October RIA Roundup: Buying vs. Renting

The RIA Roundup is a monthly real estate newsletter with the latest stories, data, and insights curated especially for rental property investors.

In this issue:

Lead Story: Buying vs. Renting

Portfolio Updates

In Other News…

Final Thoughts: Habits

Lead Story: Buying vs. Renting

It’s one of the most commonly asked questions in real estate: is it better to buy or rent your home?

There is no shortage of articles, podcasts, and online calculators designed to help people answer this question. Passionate arguments are made on both sides of the philosophical divide: those who favor buying tend to focus on peace of mind and equity-building (“rent is just flushing money down the toilet!”); the rent crowd tends to focus on simplicity, flexibility, and avoiding debt and liabilities.

The question is near and dear to me personally, because I used the proceeds from the sale of my primary residence to jumpstart my rental property investing. With this experience, I’ve often talked with my private coaching clients about a factor that is often overlooked in the buy vs. rent debate: the opportunity cost of a large down payment vs. investing that money in more productive assets, such as cash-flowing rentals or the stock market.

There are clearly a lot of ways to approach this question. Luckily, I’m not here to address every pro and con, nor to provide a single definitive answer. Rather, I’d like to keep the discussion grounded in facts, look at some data that will illuminate the current buying vs. renting dynamic in the country, and examine what it means for rental property investors.

First, let’s look at homeownership rates in general, and see how they’ve changed over time. The US Census Bureau has kept data on homeownership rates since 1965. Over the intervening ~60 years, rates of homeownership have fluctuated between a low of 63% and a high of 69%. For nearly six decades, then, it’s been true to say that about 2/3 of Americans own their home.

A closer look reveals that the peak was reached in 2005, after which time the rate declined steadily — until recently:

Rock bottom interest rates and pandemic impacts on migration patterns may explain the increase since 2016; the decline over the previous decade was often attributed to younger generations not viewing homeownership — or ownership of stuff in general — the same way older generations did. (I was always skeptical of this take; I think lower homeownership rates among recent generations was more likely due to their relatively poor financial situation — they entered the workforce during or shortly after the Great Recession, which impacted their earnings significantly, and they also face high student debt burdens and inexorably increasing health care costs.)

Anyway — we know those rock bottom interest rates are a thing of the past, and so largely are pandemic impacts on where people are choosing to live. What will that mean for the buying vs. renting decisions people are making today?

The simplest way to look at this is to compare the nominal cost of owning vs. renting the same property. If you think about it, a cash flow rental property, by definition, one that is cheaper to own than to rent (otherwise it wouldn’t cash flow). This is why cash flow investors congregate in markets where homes are cheap. But in other times and places, it would be cheaper to to rent than to own — for example, despite paying sky-high rent in New York City, I know that owning the unit I live in would be even MORE expensive once all costs are tabulated (such as mortgage, insurance, property taxes, monthly HOA, maintenance & repairs, and so on.)

Luckily, the kind folks at Coldwell Banker had the bright idea to start tracking this metric over time in 1996. If you suspect that it’s one of the toughest times ever to buy a home, trust your instincts:

Rapidly increasing home prices coupled with higher interest rates have made this the worst time to buy (vs. rent) in several decades. This has put buying out of reach for many, resulting in slowing demand on available properties. But inventory is still very limited due to the overall housing shortage and the lock-in effect caused by most homeowners having lower fixed-rate mortgages they don’t want to give up. As a result, home prices have been stable for many months despite slackening demand, and don’t seem likely to fall dramatically anytime soon.

Therefore, with the overall market somewhat frozen in place, we may face a sustained period during which renting is far cheaper than owning for most Americans.

What does this mean for rental property investors? It actually cuts both ways. On the downside, it poses a challenge because cash flow is harder to come by, something we’ve already examined closely in previous articles. But this dynamic has upsides as well: it provides price support for rental properties — rents have increased dramatically in the last few years, and are likely to remain high if buying is a relatively unaffordable option — and it may force more people into the rental market in total, lowering the risk of extended vacancies.

Portfolio Updates

With the September books closed, only one quarter remains before the end of the year. I’m currently about $5K below my projected cash flow for the year, and a number of factors may make it difficult to catch up:

Though the eviction and turn at Property #20 are finally over (this took most of the year, unfortunately), I have another ongoing eviction at one unit of my duplex (Property #18) which will become a turn in November if the eviction stays on schedule.

The tenant at Property #22 has said they will vacate at the end of October. If they follow through with that, I’ll have another turn on my hands — and because this was not a fully rehabbed property when I bought it, this first turn is likely to be pretty expensive.

The only good news is that I should be receiving the reimbursement from my PM for the eviction and turn at Property #20, as I’ve discussed previously. This should provide a nice boost that could offset some of these costs.

My September Portfolio Report dives into all the details for the most recent month, in which my cash flow was decent at ~$7,000. I’ve added the new month to my cash flow graph, and my 2023 totals:

In Other News…

Real Estate & Business, Domestic News

Fed establishes new anti-redlining rules. Bank regulators introduced new rules targeting discriminatory lending by bringing a 1977 anti-redlining law into the modern age. Shocking fact: the racial homeownership gap is larger today than it was in 1968, when redlining was legal. (I know, I couldn’t believe it either! Check out more data on the racial homeownership gap.)

Violent crime is (again) falling fast. If the barrage of media reports on crime has convinced you there’s a national crime wave afoot, time to think again. The FBI released its annual crime report, which shows that violent crime rates – after a brief uptick during the pandemic – returned to pre-pandemic levels in 2022, and will likely fall even further this year, continuing a long-term trend that started in the 1990’s. Just to take one data point: in my hometown of NYC, shooting incidents are down 27% compared to 2022, 37% compared to 2021, and 82% compared to 1993.

Retailers backtrack on claims about organized retail crime. If you follow business news, you may have noticed that claims about the impact of theft and organized retail crime have been popping up on retailers’ earning calls quite a bit. This may have been little more than convenient scapegoating. In addition to the Walgreens backing away from their previous statements, saying they had “perhaps cried too much” about the issue, other industry insiders are also calling BS on these claims, which are (conveniently for the retailers) nearly impossible to verify because retailers don’t publicly report their inventory loss, or “shrink”. The only data point we have is from an annual anonymous survey, which shows no change in the shrink rate. Plus, while instances of organized shoplifting and “smash and grab” events get a lot of media — particularly since they’re much more likely to be video-taped these days — almost all retail experts will tell you that employee theft has a much bigger impact on inventory loss than shoplifting.

House of Representatives in disarray. You’ve seen the headlines, I’m sure: a government shutdown was narrowly averted last month, but Speaker Kevin McCarthy was promptly ousted by his own party for the crime of wanting the government to run. We’ve since endured three weeks of chaos as the Republicans tried (and failed, and tried, and failed) to elect a new speaker. This week, apparently exhausted by their own dysfunction, they gave up and elected some guy from Louisiana that nobody ever heard of. Democracy at work!

NYC regains all jobs lost in the pandemic. New York City, which was hit disproportionately hard by the pandemic and the associated economic impacts, has now regained all the jobs it lost. The city had 4.7M public and private sector jobs in September, the most ever recorded. (And they’re probably not even counting that I’m a blogger now!)

Health care union strikes amid historic public support for unions. Another month, another labor strike: Kaiser Permanente union workers mounted the largest U.S. healthcare strike on record as they push for a new labor deal – but a tentative deal was quickly struck in which workers would receive a 21% pay increase over 4 years. Meanwhile, the UAW strike continues (with a tentative deal with Ford recently announced) and the SAG talks have broken down. The public overwhelmingly supports these labor actions — in fact, 71% of Americans support unions, the highest figure recorded since the 1960’s.

Trump, Menendez, and Harding face criminal liability. The Trump stuff is well-documented, of course, but the increasing pace of Trump’s co-defendants taking plea deals to cooperate with prosecutors (“flipping”, as Trump and mob bosses call it) can’t be good news for him. Not to be outdone, Democratic Senator Bob Menendez now faces charges of being an unregistered agent of the Egyptian government alongside the corruption charges already brought. And who is Harding, you might be wondering? He is the former Republican state legislator from Florida who authored the state’s infamous “don’t say gay” law. He’s now going to prison for 4 months, convicted of fraudulently obtaining $150,000 of Covid relief funds, including using fake bank statements to support his bogus filings. What a guy!

Mass shooting in Maine. A man went on a shooting spree in and around Lewiston, Maine. At the time of writing he is still at large, and the body count is still uncertain. This is the 643rd mass shooting in the United States this year (defined as an incident in which four or more people are shot). Yes, there really are that many — see the Mass Shooting Tracker, which makes clear the mind-numbing frequency of these events, but also how often the shooters and/or victims are kids. (And no, there is no conflict between this fact and the fact that violent crime is falling overall, as discussed above — both things are true. Mass shootings are a tiny sliver of overall violent crime, so even if they are becoming more common, this does not move the needle on the overall violent crime rate.)

International News, Science & Technology

Israel at war with Hamas. That’s all I will say because a) there’s plenty of news about the war, you don’t need me for this, b) it’s awful to write about, and c) it hasn’t gone great for a lot of people who have chosen to talk about the war publicly.

Paris at war with bedbugs. Paris is either facing an unprecedented infestation of bedbugs, or this is one of those viral stories that somehow got out of control, and the number of bedbugs in Paris is the same as always. I’ve got my money on Door #2.

NASA launches Psyche mission to visit a metal asteroid. The asteroid, made mostly of nickel and iron, may be the remains of the core of a protoplanet that broke apart long ago; this mission will gather data that should help confirm or reject that hypothesis.

Arts & Culture, Sports, and All the Rest

All eyes on the Sphere. U2 inaugurated the new performing venue in Las Vegas. The photos and videos from inside the show are pretty mind-blowing.

Taylor Swift movie has big debut. The theatrical version of her Eras Tour stage show was, in a remarkable turn, overshadowed by her budding romance with an NFL player. The media can’t get enough of it, making it tough to disagree with the ubiquitous takes along the lines of “I wish Taylor Swift was in love with a climate scientist.”

Final Thoughts: Habits

New Years’ resolutions are for suckers, so I’ve been getting a jump start in the last few weeks, and trying to change some habits. (October resolutions?) The main motivation for me was to get back into a gym routine. I had a good stretch last fall where I worked out most weekdays, but starting up again after the holidays was a struggle, and I’ve been sputtering ever since. I know that exercise is the best thing I can do for myself, physically and mentally, so it was time to re-commit. But how could I make that change, and stick with it?

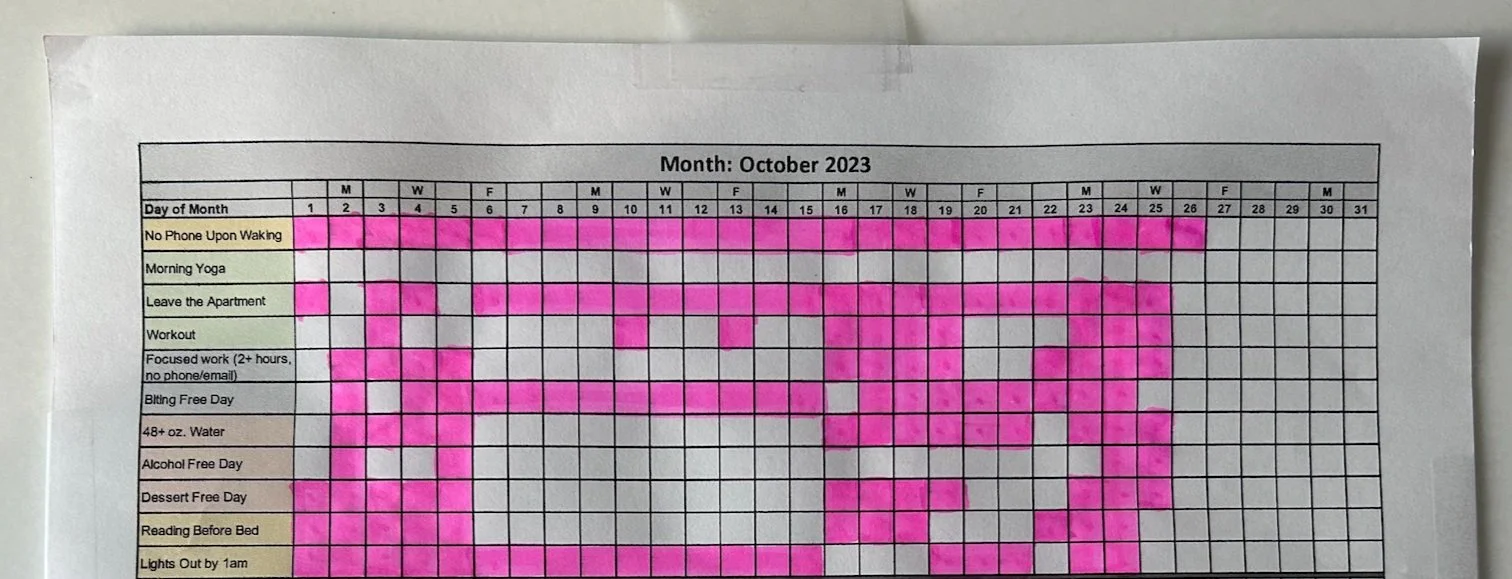

I have a useful habits hack I picked up last year from Mr. Money Mustache himself, who described a “daily habits tracker” in one of his newsletters. Here’s what mine looks like:

How it works is pretty simple. There are a few things I want to do every day (or most days), which are listed down the left-hand side; if I accomplish them, I highlight the appropriate square the next morning. At the end of the month, I get a nice visual summary of how I did. You can see the pattern of the “workout” line changed on October 16th, which was the first day of my new routine…so far, so good. The tracker provides a way to monitor myself, which is important for habit formation, but it’s also an incentive of its own — I find it quite satisfying to be able to highlight the square, which gives me more motivation to stick with the habit. (I do the highlighting each morning as my coffee is brewing — so I even have a habit for when I mark the daily habits tracker! My father would be so proud…he’s a real habits guy too, so I come by it honestly.)

I’ll be switching up a few things in November, which is one of the nice things about the tracker system — it’s flexible enough to accommodate new things and drop old ones from month to month. For example, for a long time I did a 15-minute yoga practice as part of my morning routine, but I’ve decided to drop that now that I’m committed to getting to the gym each weekday. (And I don’t want to see that empty white line on the tracker anymore!)

Unsurprisingly, the habits that people most often want to change involve finances, relationships, exercise, and diet. I’m adjusting my diet a bit as well, since my most recently annual physical turned up slightly elevated cholesterol. (Aging is a joy!) So I’m trying to emphasize fish over animal proteins, eliminate butter and most cheese, avoid fried foods, and satisfy my sweet tooth with healthier desserts, like a frozen fruit bar or oatmilk bar rather than baked goods or ice cream.

As essential as food diet is, our media diet may be just as important. How we consume media is more habitual than we think: we check the news or social media upon waking; or we scroll through social media messages at lunchtime; or we get a breaking news notification on our phone and click into it; or we watch our preferred cable news anchor each evening; and so on. Each of these things is a habit that can be changed.

Like food, too much media consumption, especially the wrong kinds, will make you sick. It’s tough to strike a balance between being aware/informed (good) and overindulging in news & commentary to the point of feeling overwhelmed by it (bad). But that balance starts with being conscious of your media consumption and the habits that may be driving it.

It’s also important to understand the dynamics of an increasingly online media landscape — the financial incentives of clickbait, algorithmic bias towards crisis and anger, how anonymity leads people to make more extreme statements, and more. Even the most reputable news organizations are not immune from these forces. (The comments section of the Washington Post and the Wall Street Journal are nearly as hyper-partisan and exhausting as anything you can find on Facebook or Twitter.) (No, I will not call it X.)

These forces can warp our perceptions of the world. It’s well-documented, for example, that people’s perception of crime and personal safety is wildly divorced from reality, and strongly influenced by media attention to high-profile crimes, politicians’ statements during election cycles, and more. A majority of Americans have thought for the last 25 years that crime is getting worse; meanwhile, the exact opposite has been true. A very similar dynamic can be observed in how we perceive the economy: most people think the economy is current struggling, which is wrong (at least by any commonly-used measure, such as the blockbuster 4.9% GDP growth reported last quarter); people also consistently say in surveys that the overall economic situation has gotten worse even if they acknowledge it has improved for them personally. This is all a result, at least to some degree, of what we put in our brains.

So how do you maintain a healthy media diet? I thought you’d never ask! Here are my 8 tips for maintaining a healthy media diet:

Establish a set time to read, watch, or listen to the news each day, including a time limit.

Know your sources — some outlets are much more reputable than others.

Recognize the difference between anecdotes & stories (a particular person in Anytown USA is struggling financially) and holistic data (overall job growth, wage growth, unemployment, etc.) Both are meaningful and important ways to convey information, but you need BOTH to understand a world as big & complex as ours.

Never lose sight of the strong financial incentives of nearly every online entity to scare you and/or make you angry. Don’t fall for it.

Turn off all notifications, alerts, and banners that create distractions on your phone throughout the day. (If that’s a bridge too far, choose only ONE reputable news source for alerts.)

Delete Twitter; use other social media only for connecting to people you know in the real world, and never for news, random takes from strangers, viral videos, or anything else.

Don’t read the comments. Ever.

One habit I’ve established in the last year that I’m most happy about is this one: no phone in bed. This ensures that I don’t look at my phone upon waking, or before going to sleep. (Instead, I now read a book for 10-15 minutes before turning out the light.) There’s almost nothing good to be found on my phone — depressing news, angry talking heads, addictive videos, toxic social media, email inboxes & messaging apps hungry for my attention — so I’ve consciously chosen never to start or end my day with any of that bullshit. I’ve been amazed at how much this one small change has improved my overall well-being.

I spend most of my time talking and writing about how rental properties are a great long-term investment. But being conscious and thoughtful about your habits — financial & spending habits, exercise habits, diet habits (both food and media) — is a great investment too.

Happy investing,

Eric

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.

Free Rental Property Analyzer

You probably know that a well-designed rental property calculator is the most important tool a real estate investor has. It allows you to quickly calculate key metrics and understand your cash returns on a target property. You can also answer questions like:

How much do your cash-on-cash returns improve if you use a mortgage vs. paying in cash?

What will your average monthly cash flow be?

How will your returns change in future years?

Those questions can be easily answered with side-by-side comparisons in the RIA Property Analyzer. I guarantee this is the best free rental property calculator out there today, and many of my readers have told me the same. It’s both powerful and very simple and intuitive to use. Check it out!