Inflation and Mortgage Rates Are Way Up. Should I Still Buy Rental Properties?

Last updated: 2023

Real estate investors are facing an environment that many of us have never encountered in our lifetimes: inflation has been running hot, and mortgage rates have risen to levels not seen for the last few decades. On top of all the general turmoil and uncertainty of the last few years — a global pandemic, a ground war in Europe, and more — it now seems as if we’ve entered a foreign and hostile financial landscape as well, and that a long era of cheap money may be ending for good.

So…it must be time to panic, right?

Nope, not yet. (Deep breaths, everyone!) Instead, I’d argue it’s time to retreat back into the warm embrace of the numbers, and let financial analysis light our way. Yes, I know that sounds nerdy — but in the end, rental property investing is all about the numbers. So rather than panic, throw in the towel, or sit nervously on the sidelines, it will pay to understand how this new environment impacts our financials, and what we can do about it.

Because the truth is that you can still make money buying rental properties today. But higher mortgage rates and higher inflation definitely change the game — so if you want to invest successfully, you need to understand how.

At the end of this article, I’ll lay out several strategies that investors can use to navigate the current environment successfully, including financing options outside of traditional mortgages. But before we get there, let’s set the factual and historical context for the discussion, starting with inflation.

Inflation

First, let’s define inflation: it’s the increase in prices of the stuff you buy (aka goods and services) over time. As prices rise, our dollars buy less, which means that inflation also has the result of decreasing the purchasing power of money. (Paula Pant over at Afford Anything has a fun, illustrated inflation explainer, if you want to go deeper on the topic.)

Most developed countries today (including the United States) use various levers in an effort to keep inflation at about 2-4% annually, which is viewed as the sweet spot for economic growth and investment. High inflation can of course be problematic, as we’ve seen this year, but deflation — in other words, negative inflation — is also very bad, because it disincentivizes investment. Think about it: if your dollars would become MORE valuable by just holding them, why bother to take any risks with investments? So a bit of inflation is good, but too much or too little can both be quite damaging.

Over time, we’ve been getting better at the task of keeping inflation in that 2-4% “Goldilocks zone”. If we look back at the history of inflation in the US over the last 100 years or so, wild swings and extreme inflation or deflation used to be quite common, but since the last period of high inflation — the oil shocks of the 1970’s — we’ve been able to keep inflation at a low simmer (chart courtesy of Macrotrends):

What is an “Inflation Hedge”?

With inflation quite low and predictable in recent decades, the idea of “hedging” against inflation’s effects became somewhat passé — until recently, of course. So let’s review: an inflation hedge is any investment that is expected to maintain its value over time, relative to inflation. For that reason, some commodities (such as gold) are often thought of as good inflation hedges.

But the undisputed king of inflation hedges is real estate. Here’s why:

The value of the underlying asset (the house) will tend to keep up with inflation

The rental potential of the property will also tend to rise with inflation, increasing cash flow over time

Using leverage (with mortgages) is very easy with real estate, which hedges against inflation in two further ways:

If inflation rises, your rate of return on invested dollars goes through the roof, because you capture all the resulting appreciation with only a fraction of the investment (i.e. your down payment); and

Inflation has the effect of “deflating” the true value of your mortgage debt — in other words, you pay off the mortgage with future dollars that are cheaper than today’s dollars, an effect that becomes increasingly pronounced as inflation increases

For these reasons, owning real estate during inflationary periods can be extremely lucrative. But mortgage rates have also gone up — won’t that cut in the other direction? Let’s take a look at mortgage rates next.

Mortgage Rates

The chart above does not show the final inflation number for 2021, nor the numbers so far in 2022 — if it did, you would see two green bars in the 6-8% range, the highest rate of inflation we’ve experienced in over 40 years. (In 2023, inflation cooled significantly.) In response to rising prices, the Federal Reserve has been doing about the only thing it can to fight back: raising interest rates. How do higher interest rates stop inflation? In theory, higher interest rates will make it more expensive for businesses and consumers to borrow money, causing them to choose to spend less. This reduction in demand should eventually lead to a reduction (or stabilization) in the price of goods.

Some people think — perhaps because of a lot of lazy reporting in the media — that these interest rate increases have a direct impact on mortgage rates. This is not quite right. (Good explainer here that underscores this point.) In fact, mortgage rates are influenced by the interest rate on 10-year Treasury notes, by normal supply & demand pressures, and perhaps most of all by — wait for it — inflation.

Which makes perfect sense, when you think about it: lending money at a 4% interest rate doesn’t do the lender much good if, in the meantime, the buying power of money is eroding at 8%. The lender is still losing ground to inflation. That’s why there is such a strong correlation between inflation and mortgage rates over time. Here is another look at inflation rates since 1970, with a view of mortgage rates over the same years directly below, which makes plain how strongly correlated these two numbers are:

Here’s another way to think about the relationship between inflation and mortgage rates. Let’s go back to the earlier example of a lender making a loan at 4% while inflation is running at 8%. That clearly isn’t a good deal for them — but that means it’s a GREAT deal for the person on the other side of the transaction, who gets to pay back the loan at 4% while the value of the underlying asset they purchased should increase at 8%. They’d make a killing.

These dynamics explain why mortgage rates are almost never lower than inflation, because there were be no incentive to lend. This graph directly compares the two metrics, and shows that mortgage rates are typically 2-4 points higher than inflation:

As you can see , there have only been a few points in the last 50 years when mortgage rates were LOWER than inflation — and one of those time is RIGHT NOW. Mortgage rates are nearly double what they were a year ago, but viewed through this inflationary lens, they are cheaper than they have ever been. In fact, any mortgage rate, no matter how high, is “cheap money” if it is lower than the rate of inflation.

So what does all this mean for rental property investors? What will higher mortgage rates do to your returns, and how should you think about that? What creative strategies can you use to reduce the cost of your debt? Let’s explore these questions using some concrete mathematical examples.

How to Succeed in Today’s Environment

To navigate this new terrain, it’s critical to understand the trade-offs introduced by higher mortgage rates, as well as the implications of higher inflation, and then use this knowledge to make investing decisions that are aligned with your long-term goals.

Let’s start by looking at a typical rental property in a cash flow market. I’m going to use the actual numbers from Property #20, which I purchased in fall 2022, to avoid having to deal in hypotheticals or averages.

I will make one change, though: I’m going to roll the cost of my initial rehab into the purchase price, to simulate what it would be like to purchase the property in its after-rehab state. I purchased the property for $93,000, and put about $10,000 into it, so let’s peg the ARV (after-rehab value) at $105,000. After the rehab was complete, I was then able to rent it for $1,095/mo.

Here are the annual expenses for the property:

Repairs & Maintenance: 1% of the purchase price ($1,050) annually.

Home Insurance: $500 annually.

Property Taxes: $1,100 annually.

Property Management: 8% of rent collected, plus a leasing fee to place a new tenant every two years equal to 50% of a month’s rent.

Vacancy: 5% (i.e. the property will be vacant, or otherwise not generating rent, 5% of the time. My portfolio has been running at only 3% vacancy the last several years, but I want to remain conservative here.)

I bought the house with cash (for reasons having to do with the 1031 exchange of which this purchase was part). Plugging all these numbers into the RIA Property Analyzer, without a mortgage, yields the following results:

(Want to use this rental property calculator yourself? You can, because I make it available as a free download!)

So the numbers look solid: I have an 8% Cap Rate, and a 7.7% Cash-on-Cash (a bit lower than cap rate due to my closing costs). But because I’m not using a mortgage, I don’t get any principal paydown, and my Total ROI of ~10% is not much higher than my CoC — indicating that the bulk of my returns on this property will be in the form of cash.

In the “good old days” of 3%-4% mortgages, getting a loan was a huge benefit with no downside whatsoever (as I discussed at length in this article on the power of mortgages.) Check out what a 4% loan (with a 25% down payment) would do to the numbers on this particular house:

Looking at these two scenarios side-by-side, the power of the mortgage is clear. First of all, it increases your cash-on-cash returns from 7.7% to 12.6%. And it brings your TOTAL ROI into the 20-25% range. AND you get pay-down of mortgage principal. AND you get to write off mortgage interest as a tax deduction. So it’s a win-win-win-win.

Today, however, mortgage rates are higher, which introduces some trade-offs. With a 7.5% mortgage, your cash-on-cash returns would actually decrease somewhat, but you’d still get many of those other long-term benefits of leverage — check out the third set of numbers for comparison:

If you were the investor in this situation, and could choose to buy in cash (Scenario 1) or get a mortgage at 7.5% (Scenario 3), what would you choose to do? There’s no right or wrong answer — it depends on what you’re optimizing for. The mortgage forces you to give up some cash-on-cash returns, so an investor with a desire to maximize CoC in the immediate term might prefer to use cash, ensuring an 8% yield on their investments rather than 6%. But the long-term benefits in equity growth (through mortgage paydown and appreciation) are still quite significant with a mortgage, so an investor willing to give up a little cash flow in exchange for long-term equity gains would still rightly choose to use a mortgage.

Therefore, in today’s world of higher mortgage rates, Tradeoff #1 is between cash flow and equity gains: using a mortgage will certainly still increase your rate of total returns on dollars invested, but less of those gains will be in the form of cash.

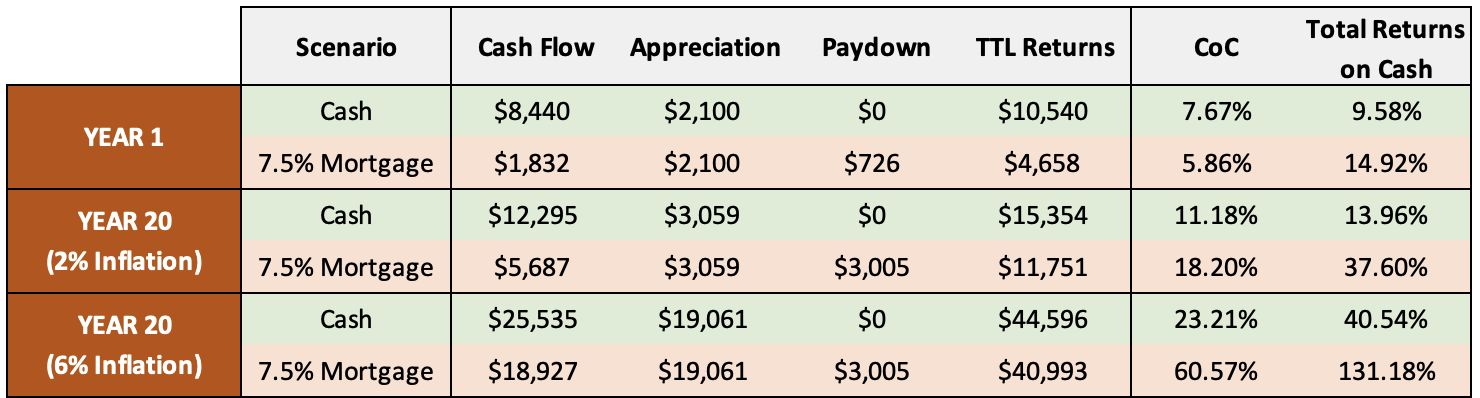

Now, let’s bring inflation into the picture, and use the Multi-Year Model of the RIA Property Analyzer to look at long-term returns in various scenarios. As a baseline, let’s look at Year 1 returns in both scenarios:

No surprises here — as we already knew, using this 7.5% mortgage decreases the rate of cash return a bit, but increases the rate of total returns. You can also see the stark difference in cash flow in pure dollars ($8,440 vs. $1,832).

Now let’s project the forecast into Year 20, assuming 2% inflation. That means we’ll assume that rent will go up 2% per year, all expenses will go up 2% per year, and the price of the home will appreciate 2% per year — but of course the mortgage payment stays the same in the leveraged scenario. Here are those same numbers with Year 20 added to the chart:

Here is where you might be surprised, because in Year 20, the cash-on-cash returns using a mortgage (18.20%) have caught up and surpassed the CoC returns of the cash purchase (11.18%). Cash-on-cash returns have increased compared to Year 1 in both scenarios because rents have gone up over time, but it increases FASTER in the leveraged scenario because those gains are off a smaller base of dollars invested, and because one piece of of your cost structure — your mortgage — never goes up. Of course, these trends only become more prevalent beyond Year 20 as you continue to roll the simulation forward.

The difference in total cash flow is still there, but it’s less pronounced now — it’s about double ($12K vs. $6K). You can also see that mortgage paydown has accelerated rapidly by Year 20 — you’re paying off over $3K in mortgage principal that year, compared to just $726 in Year 1, thanks to the loan amortization schedule wherein each successive monthly payment contains a little more principal, and a little less interest, than the previous one.

But what if inflation is much more than 2%? Let’s turn the inflation dial to 6% and see what happens to the numbers:

With a higher rate of inflation, the mortgage scenario dramatically outpaces the cash scenario by Year 20, with CoC of over 60% compared to just 23%. The difference in total cash flow isn’t even that dramatic anymore. (Of course, inflation is very unlikely to run at 6% for a sustained period as long as 20 years, but the numbers are nonetheless illustrative.)

This brings us to Tradeoff #2 of higher mortgage rates, which is short term vs. long term: using a mortgage may hurt you a bit in the short term, but the longer you hold the property, the more the mortgage helps you — and this is ESPECIALLY true in an inflationary environment.

Putting this all together, I would summarize the tradeoffs this way: if you want to optimize for cash flow AND you have a shorter investment horizon, cash is better; if you want to optimize for total returns OR you have a longer investment horizon, a mortgage is better, even at a higher interest rate. You could illustrate this in a matrix this way:

Thus, even with today’s higher mortgage rates, it still makes sense for most cash flow investors to take advantage of the long-term structural advantages of leverage. Over the long run, you are likely to make more money in total, and (counterintuitively) you are also more likely to make more in cash returns — relative to your dollars invested — by using mortgages, even if you give up a little cash flow in the short term.

Of course, this only applies in the interest rate environment at the time of writing (7-8% interest rate). If interest rates go up further, you would have to examine these tradeoffs again, and determine which strategy makes the most sense. But hopefully this discussion makes clear how to evaluate high mortgage rates and high inflation in your rental property investment decisions.

And don’t forget that you have an ace in the hole: if interest rates fall in the future, you can always re-finance to capture those benefits, reduce your monthly interest payments, and increase your cash flow.

Additional Strategies

In the above discussion, I’ve focused primarily on two scenarios: buying in cash, and financing 75% of the purchase with a conventional mortgage. But there are alternative approaches that are worth considering to counteract the impact of higher interest rates:

1. Make a larger down payment: Investors will usually put 20% or 25% down on their rental property purchases. But you always have the option to put 35% down, or 50% down — any amount you like, really. This will “split the difference” between the two scenarios discussed above, and also split the difference with respect to the financial tradeoffs.

2. Use an ARM (adjustable rate mortgage): There are certainly risks associated with an adjustable rate mortgage (as I discuss in my article on Rental Property Financing Strategies), but given that ARM rates are currently 1.5 percentage points below 30-year rates, it may be worth considering for investors who find those risks acceptable.

3. Buy down your interest rate with points: Lenders will allow you — encourage you, really — to use “points”, which means paying them money in exchange for a lower interest rate. Whether this makes sense depends on the specific numbers, but it’s usually a winning strategy for long-term investors, and that’s especially likely to be true in a higher interest rate environment.

4. Private lenders: Getting a loan from a private entity means greater flexibility and the opportunity to negotiate various aspects of the loan. There are online platforms to locate private money lenders, but you can also find one in your own network if you have good targets there (i.e. rich people). You can read more about various financing options in my article on the topic, and Chad Carson also had a useful video about private money.

5. Seller financing: Seller financing (also referred to as owner financing) is a setup whereby the seller of the property serves as the bank/lender, and offers loan terms to the buyer. So instead of applying for a conventional mortgage with a bank, you would sign a mortgage agreement directly with the seller. Again, more on that strategy in my article, or in this video (also from Chad Carson).

Conclusion

Here are your key takeaways:

Mortgage rates are higher than they’ve been in several decades.

But you can still invest successfully with leverage, especially if you’re planning to hold for the long-term, and especially given high inflation.

You may also want to consider alternate financing strategies to minimize the impact of higher interest rates.

Don’t forget — if interest rates fall, you can always re-finance.

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.

Free Rental Property Analyzer

To evaluate the impact of higher mortgage rates, you need to be able to run numbers like a pro. That’s why a well-designed rental property calculator is the most important tool an investor has. It allows you to quickly calculate key metrics and understand your cash returns on a target property. You can also answer questions like:

How much do your cash-on-cash returns improve if you use a mortgage vs. paying in cash?

What will your average monthly cash flow be?

How will your returns change in future years?

Those questions can be easily answered with side-by-side comparisons in the RIA Property Analyzer. I guarantee this is the best free rental property calculator out there today, and many of my readers have told me the same. It’s both powerful and very simple and intuitive to use. Check it out!