September RIA Roundup: The Incredible Growing Home

Lead Story: The Incredible Growing Home

When I develop a “buy box” with my private coaching clients, one of the criteria we talk about is square footage. In other words, how large should an ideal rental home be?

In many cash flow markets, the best rental neighborhoods tend to be older — built out in the mid-20th century — rather than newly developed areas. One of the striking features of those older neighborhoods is that the homes are MUCH smaller than newly built homes that we’re used to today. My clients are sometimes shocked to learn that 3-bedroom single family homes in these areas are almost never larger than 1200 square feet, and can be as small as 900 square feet. Personally, I think these small, simple homes make some of the best rental properties — my Property #17 or Property #20 are good examples. They’re now sometimes referred to as “starter homes”, but this misses the point a bit; in fact, that’s how nearly ALL homes were built at the time.

Which begs the question: when and why did homes get so big? And can that trend continue indefinitely? Let’s take a look at what the data tells us about these questions.

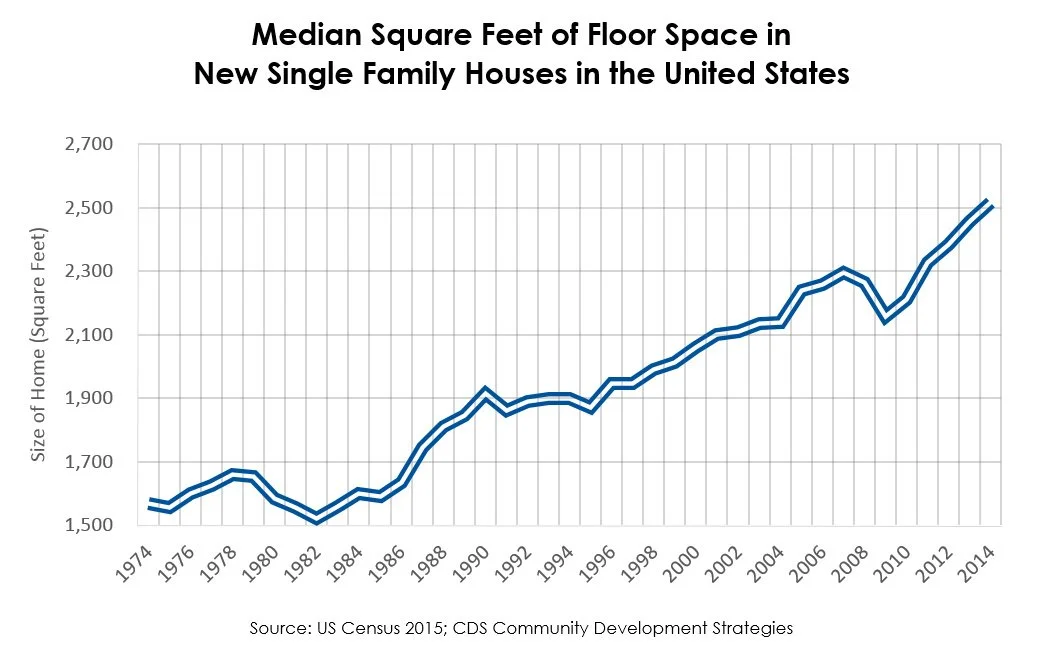

The US Census Bureau began keeping official statistics on the size of new homes in 1974, which means that many online sources and graphs only take us back to that time, and look something like this:

While homes have clearly grown rapidly since 1974, this isn’t the whole story. Other folks have done the hard work of assembling data from other sources prior to 1974, when homes were smaller still. Here’s how the history looks going back to 1920:

1920: 1,048 square feet

1930: 1,129

1940: 1,177

1950: 983

1960: 1,289

1970: 1,500

1980: 1,740

1990: 2,080

2000: 2,266

2010: 2,392

2014: 2,657

Interesting historical aside: you might be wondering about that dip in 1950, the only period in this entire history when homes got smaller. What happened there? This was due to the abundance and popularity of the Levittown house, a small, mass produced home model designed by Levitt & Sons that accounted for nearly 1 out of every 8 new homes built in 1950. Entire towns were built from the ground up using nothing but this model of house (which somehow didn’t creep out midcentury homebuyers). The homes came with white picket fences and modern appliances, but there was a catch: you had to be white to live there. Mr. Levitt refused to sell his homes to non-whites, and through the Federal Housing Authority, the US government endorsed this restriction by adding a “racial covenant” to the loan authorizations on Levittown houses. The first Black family to move into a Levittown wasn’t until 1957, when William and Daisy Myers bought a house in Levittown, PA. He was a WWII veteran, she a teacher, but they were not received warmly — instead, they were subjected to fierce intimidation, and suffered attacks on their house. But their plight attracted the attention of Martin Luther King Jr., who met with them during their four years in Levittown. This was one of many such stories across that country that inspired the push toward legislative changes that eventually made such housing discrimination illegal. (Here is an excellent medium-dive into this story, if you’re curious to read more.)

OK, back to the main thread! At the same time homes were getting larger, the number of bedrooms was also growing. The 3-bedroom home, long the mainstay of the American landscape, was slowly supplanted by the 4-bedroom home as the most common configuration for newly built homes:

The fact that homes grew larger and added bedrooms during this period was surprising in light of something else that was happening at the same time: household size was shrinking. In 1920, nearly 4.5 people lived in an average American home; today, that number is about 2.5. It’s illuminating to chart home size against household size on the same graph, which some intrepid data warrior has already seen fit to do:

That means that the space per person inside an American home has more than quadrupled since 1920, from ~240 square feet to over 1,000.

What can we attribute these trends to? The overall increase in prosperity and the trend toward suburbanization drove increases in the average home size that Americans could afford, while several other factors contributed to the decrease in household size, including the declining birth rate, the increase in single-parent households, and the aging of the population. Certainly there were other factors in play as well, but the upshot is the same: we all have a lot more personal space than we used to.

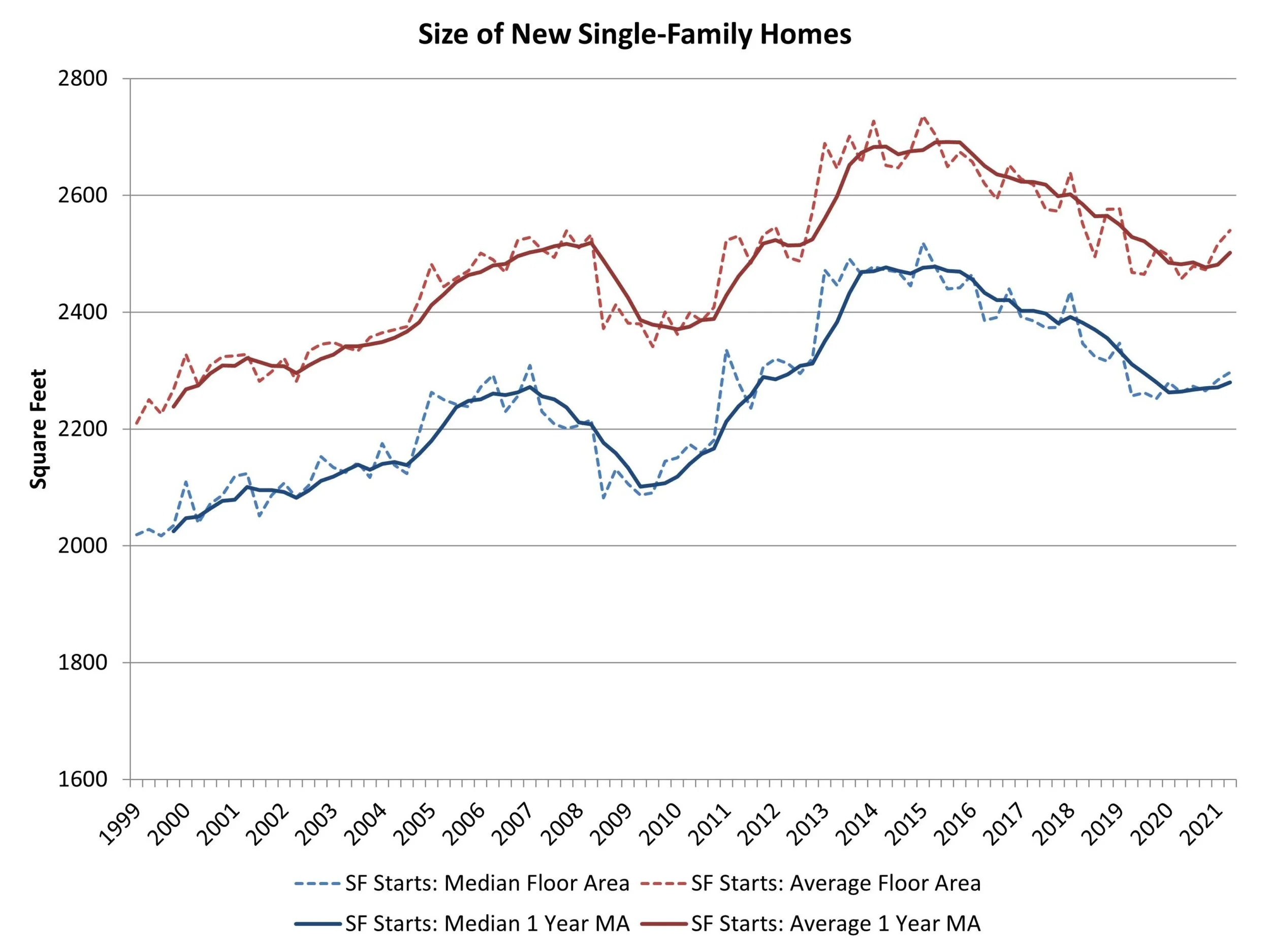

But will homes just keep getting bigger forever? Recent data suggests that this trend has stalled, if not reversed. Home size peaked in about 2016, and since then, square footage of new homes has actually FALLEN by about 10%:

Some industry watchers think the shrinking trend could continue, thanks to higher interest rates reducing the reach of homebuyers, as well as to significantly increased material and labor costs.

Perhaps there’s also a recognition that we just don’t need all that space. As someone who has lived in New York City apartments most of my life, 1000+ square feet of space just for myself would feel cavernous — but that’s what the average American enjoys today. It seems unlikely that the age of the “starter home” will return, but a bit of retrenchment seems in order. After all, who doesn’t love a quaint little cottage?

Portfolio Updates

The long eviction/bankruptcy at Property #20 has finally come to a close. I recently took repossession of the property, and approved a moderate rent-ready scope of just over $3K. I hope to have a new tenant in place in about a month. The end of this eviction also means that I’ll receive the promised reimbursement from my PM of the lost rent for the past 6 months, which will significantly soften the blow of all this. (My PM made this accommodation because they had just placed the evicted tenant a few months prior.)

But with one eviction ending, another has begun: one of my tenants in my duplex (Property #18) that has been struggling with timely payments this year has officially entered eviction proceedings. I’m hopeful that my PM can connect the tenant with rent assistance, if it’s available — but failing that, I’m keeping my fingers crossed that this one doesn’t take quite so long. The nice thing about this property is that it is still minimally cash flow positive with only one unit occupied. Also, I’ve already turned the unit in question, so the turn scope shouldn’t be too large.

You might recall that I bought Property #22 as part of my 1031 exchange last year, despite the tenant being way below market rent. The tenant has lived there for over 5 years, but was paying $825 compared to a market rent of ~$1200. They had a stellar payment record, so I was keen to retain them, but also needed a plan to get them up to market rent. I worked with my PM, who presented the plan transparently to the tenant: a $100 increase each of the next three years, and then we’d take it from there. The tenant was having none of it, and has declared they will vacate at the end of October. We’ll see if they follow through with that…there’s nothing remotely comparable they could rent at such a low price. Even if they do vacate, no big deal — it will give me the chance to bring the property up to standard and get a market rate tenant in place.

My August Portfolio Report dives into all the details for the most recent month, which showed a solid cash flow of over $8,000. I’ve added the new month to my cash flow graph, and my 2023 totals:

In Other News…

Domestic News, Business, & Real Estate

Some suburbs are combatting the housing shortage. In a previous previous Roundup, I wrote about the persistent shortage of housing in the US. Some areas, such as this town outside NYC, are trying to figure out ways to address it — and are actually making progress.

Rumors of malls’ death have been greatly exaggerated. In a separate Roundup from earlier this year, the topic was the fate of the commercial real estate sector, particularly offices who are struggling to adapt to the new realities of remote work. Another sector of commercial real estate was also once left for dead — malls. But in a surprise twist, malls are thriving of late.

Crackdown on airbnbs intensifies. NYC began to enforce tight restrictions on airbnbs, following a trend evident in many markets. The uncertain regulatory environment for short-term rentals is one reason the business is not very attractive for me personally.

Go for the OK deal in the current real estate market. Scott Trench, founder of BiggerPockets, wrote a terrific piece recently about why waiting for a “great deal” can be counterproductive. I couldn’t agree more, and often discuss the exact same concept with my clients.

Federal government in disarray. Again. Just months after the foolishness of the debt ceiling “crisis”, House Republicans are once again gumming up the works. The government will shut down on October 1st if they can’t get their act together.

Air traffic control in the spotlight for close calls. Airplanes have more near-collisions than previously known, an admission that made national headlines recently. But it’s not clear if this represents an increasing trend, since historical public data is incomplete. Also, let’s remember that US commercial aviation continues to be remarkably safe: there have been zero crash fatalities in the last 14 years, a period in which over 25 million flights took off carrying over 2 billion passengers.

Donald Trump’s legal woes continue. In this month’s installment of the former President’s legal drama, he was arrested (again), this time in Fulton County where he is accused of trying to overturn the result of the election in Georgia. (Which he certainly did — we’ve all already heard the phone call.) This time, his booking included a mug shot: he decided to go for “grumpy Grandpa”, a look that apparently appealed to his devotees who immediately slapped it on t-shirts and other merchandise. More recently, a judge ruled that Trump committed real estate fraud for years by massively inflating the value of his assets at various points in order to make deals and secure loans.

Senator Bob Menendez indicted. Apparently tired of Donald Trump gobbling up all the crime & corruption headlines, Democratic Senator Bob Menendez was indicted on federal corruption charges. Gold bars and $550,000 in cash were found in his home, which I’m sure is totally normal for a US Senator. Nothing to see here!

Medicare begins negotiating drug prices. The Biden administration unveiled a list of 10 drugs for which Medicare will negotiate drug prices directly with pharmaceutical companies. This new program was part of the 2022 Inflation Reduction Act, aimed at lowering drug prices for Americans. 85% of Americans support this effort, but of course big pharma is deploying their armies of lawyers to stop it.

Justice Department ramps us anti-trust activity. Those who think that tech companies have gotten too big and wield too much power are cheering on the federal government of late, which filed an anti-trust suit against Google several weeks ago, and followed it up with another one against Amazon a few days ago.

Labor strikes intensify. The Hollywood Writers Strike has ended, with writers achieving key concessions from studio heads. But the United Auto Workers strike has just begun, and President Biden joined striking workers on the picket line, a first for any President.

Smuckers buys Hostess. The deal cost Smuckers $5.6B, which seems like a small price to pay for the creation of jelly-filled Twinkies. Bring on the jelly-filled Twinkies!!

International News, Science & Technology

Wagner mercenary chief dies in plane crash. Yevgeny Prigozhin, the chief of the Wagner mercenary group that has done much of the fighting for Russia in Ukraine, and who staged a short-lived military coup in an attempt to unseat the Putin government, was killed when his plane crashed 30 minutes after takeoff from Moscow. Two things are immediately clear: there is a 100% chance this was an assassination, and a 100% chance that the Russian “investigation” into the crash will say it wasn’t. This isn’t the first time, of course — here is the long list of others that have died in politically-motivated killings directed by Vladimir Putin.

Tiny Caribbean country cashing in on internet domain. Anguilla is getting rich off of their .ai domain, which like many other countries they registered as a “country domain” long ago. But tech companies will pay a lot for a .ai domain these days in order to bolster their AI bona fides, and Anguilla is making the most of it.

New high speed rail line opens in Florida. Brightline completed its extension to Orlando, making it possible to travel between Miami and Orlando by train in 3.5 hours. The drive takes 4 hours, making it 14% longer and 1014% suckier.

New covid shots are now available. The latest vaccines are formulated against the current strains of covid that are currently circulating — and cases are on the rise. (And yes, you can get your flu shot and covid shot at the same time.)

Arts & Culture, Sports, and All the Rest

The Messi Effect. International soccer football star Lionel Messi has made his mark after joining Major League Soccer: MLS Season Pass had 110,000 new sign-ups on the day of Messi’s first match. Merch and tickets sales are also soaring for his club, Inter Miami. (He’s playing pretty darn well, too, lifting the fortunes of his club markedly.)

Simone Biles cruises to (another) national championship. Simone Biles won her record 8th national gymnastics championship. It was…not close.

Thirsty? France is destroying 80 million gallons of excess wine, thanks to falling demand and a glut of supply that’s making it impossible to sell the excess at a profit. Strangely, they didn’t ask me if I wanted any.

Purchase your own “happy little tree” painting for $10M. The very first painting that Bob Ross created on his television show is now for sale. Asking price? $10M. Time taken to create? 30 minutes.

Jimmy Buffett dies. The singer-songwriter will be remembered for his 1970's hits “Margaritaville” and “Cheeseburger in Paraside”, as well as the business empire he built (including Margaritaville Resorts) that was inspired by the brand of carefree island living his songs evoked.

Bob Barker dies at 99. The long-time host of The Price is Right died. He was famous for his geniality and his old-fashioned long microphone, for constantly reminding us to spay and neuter our pets, and for that fight scene with Adam Sandler in Happy Gilmore.

Final Thoughts: The Cult of Busyness

I recently flew back to NYC from Austin. I had traveled there for a golf weekend, and since I had never seen the city, I decided to stay a few extra days. I enjoyed the visit — saw some sights, found some good restaurants and excellent cocktail bars, and checked out The Lodge poker room. (Did my luck at the poker table improve since I last wrote about it? It…did not!)

But that’s not the thrust of the story. The hero of our tale is the guy I sat next to on the plane. I don’t know his name, but for the ease of storytelling, let’s call him Steve. (And a lot of guys are named Steve, so who knows?)

I had taken my window seat, and first noticed Steve when he stopped at my row to put his carry-ons in the overhead bin. He struggled to perform this task while also keeping a cell phone wedged between his shoulder and his ear, carrying on his conversation without a hitch. I was immediately fascinated by this choice. Faced with his predicament, I’d certainly say “hold on a sec”, drop my phone on the seat, get my luggage stowed, and THEN sit down and carry on the conversation.

Those were seconds that Steve could apparently not afford to lose.

Once he got seated, he kept on talking. Not loudly, but louder than I would do, and with a quite noticeable level of comfort and self-assuredness. He had the air of someone for whom things tend to go well, someone who is rarely challenged — boss energy, I’d say. He was either a big shot, or thought he was. Either way, Steve clearly had a lot to do, and a lot to say, and not nearly enough time to do and say all those very important things.

I realized pretty quickly that the topic of his call was real estate, and I briefly imagined myself striking up a conversation with him about it. Luckily, I rapidly regained control of my faculties, banished the thought, and slapped on my noice-cancelling headphones.

Once we reached altitude, Steve’s efforts to make the most of each second escalated. He got CNBC going on the seatback TV, and also pulled out his computer to do some work. I grimaced internally, knowing that multi-tasking is a myth and only hurts your productivity. (Another thing that hurst your productivity? The glacial pace of airplane “wifi”. For my own sanity, I gave up on trying to do internet-connected work on planes long ago.) Still, CNBC seems like reasonable enough background fare — easy to ignore unless you hear something that sparks your interest, right?

But then Steve did something extraordinary: he pulled out a tablet, propped it up, and fired up whatever show he was in the middle of (maybe it was Suits? Can’t remember.) So he now had three screens active AT THE SAME TIME: his show on the tablet, CNBC on the TV, all while working away on his computer. Just take a moment to picture this scene in your mind…it’s an image I will never forget. (Also, what was he listening to in his headphones? Just the audio of the show, relegating CNBC to video only? That’s the only thing that seemed plausible to me.)

Steve kept up this unholy trinity of screens for hours — nearly the entire flight.

I recognized clearly that Steve had been unwittingly dragged into the Cult of Busyness. He imagined himself to be so busy, his various tasks so important, that his only option was to half-listen to his show without watching it, while half-watching CNBC on mute, all while trying to work on his computer with a barely-functioning internet connection. He no doubt congratulated himself on a wildly productive flight; to me, this setup looked like a torture machine.

We attach a bizarre cultural value to being overly busy: we tend to equate busyness with success, while assuming that un-busy people are lazy or dumb. Inside that framework, it’s tempting to overfill every crevice of time (or failing that, to at least create the appearance of busyness) as a way to meet external expectations or create psychological comfort for ourselves. But most of the time, busyness just means running faster on the hamster wheel, as Steve so perfectly demonstrated.

True success is being able to step off the hamster wheel entirely. To make thoughtful choices about how you spend your time. To pursue meaningful projects, but also leisure. To be present in the moment; to slow down; to focus and achieve flow; to enjoy sights, sounds, smells, flavors, experiences, and other people as deeply as possible.

At bottom, that’s what my journey with rental properties is all about. It’s not about the properties, it’s about what the properties enabled and unlocked in my life. It’s about finding a way to pack more stuff that matters into life, not just more stuff. I don’t want to be busy — instead, I want to find and create meaning, which is much harder.

Sounds like a worthwhile project, though, doesn’t it?

Once I exited the plane, I noticed Steve off to the side, back on his phone, chatting away again. (Lots to get caught up on after the flight!) Then, halfway to baggage claim, he bombed past me at a DEAD SPRINT, rollerbag out front, weaving and dodging his way through an obstacle course of other travelers. I’d never seen anyone run that fast in an airport, including latecomers running TO their flights to catch them.

It must be exhausting to be Steve, I thought. I chuckled, and continued toward baggage claim at a leisurely medium pace.

Happy investing,

Eric

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.

Free Rental Property Analyzer

You probably know that a well-designed rental property calculator is the most important tool a real estate investor has. It allows you to quickly calculate key metrics and understand your cash returns on a target property. You can also answer questions like:

How much do your cash-on-cash returns improve if you use a mortgage vs. paying in cash?

What will your average monthly cash flow be?

How will your returns change in future years?

Those questions can be easily answered with side-by-side comparisons in the RIA Property Analyzer. I guarantee this is the best free rental property calculator out there today, and many of my readers have told me the same. It’s both powerful and very simple and intuitive to use. Check it out!