January RIA Roundup: 2023 Year in Review

The RIA Roundup is a monthly real estate newsletter with the latest stories, data, and insights curated especially for rental property investors.

In this issue:

Lead Story: 2023 Year in Review

Portfolio Updates

In Other News…

Final Thoughts: Artifice

Lead Story: 2023 Year in Review

Well, 2023 was quite a year! (Yes, I know it’s almost February — but I only do one of these a month, and it’s not like I have a team of writers on staff. It’s just me down here at RIA Global Headquarters, typing away furiously at my keyboard…)

Fill in the blank: “2023 was the year of ___”. What popped into your mind?

For insight into this question, I went back to review all of 2023’s RIA Roundups. To me, there were SEVEN key themes that drove the biggest news of the year. Let’s look at each of them in turn, looking back at how 2023 will be remembered, and also forward at how these themes are likely to develop in 2024.

So: 2023 was the year of…

1. The Real Estate Freeze

For several years leading into 2023, the residential real estate market was on fire. It seemed like everyone was buying, nobody was selling, and the feeding frenzy fueled several years of strong double-digit prices increases. That all ended in 2023, but the housing market didn’t crash. Instead, it just froze in place.

As I wrote about in August, this was largely due to the “mortgage lock in effect”, thanks to most homeowners having very low rates on their loans:

As interest rates rose, demand flagged. But most owners wanted to hold on to their existing low fixed rate mortgages, disincentivizing moves or upsizing, and leading to the lowest level of new home listings in decades. The result was a housing market on ice: low demand, low inventory, and persistently high prices. The combination of high prices and high interest rates meant that buyers were facing the most unaffordable market in recent memory.

2024 Outlook: The Fed will likely cut rates, mortgage rates will probably fall, and that may lead to a thaw in the market wherein buyers will be able to better afford homes and sellers will be more willing to list. But whether we see a slight thaw or full melt remains to be seen.

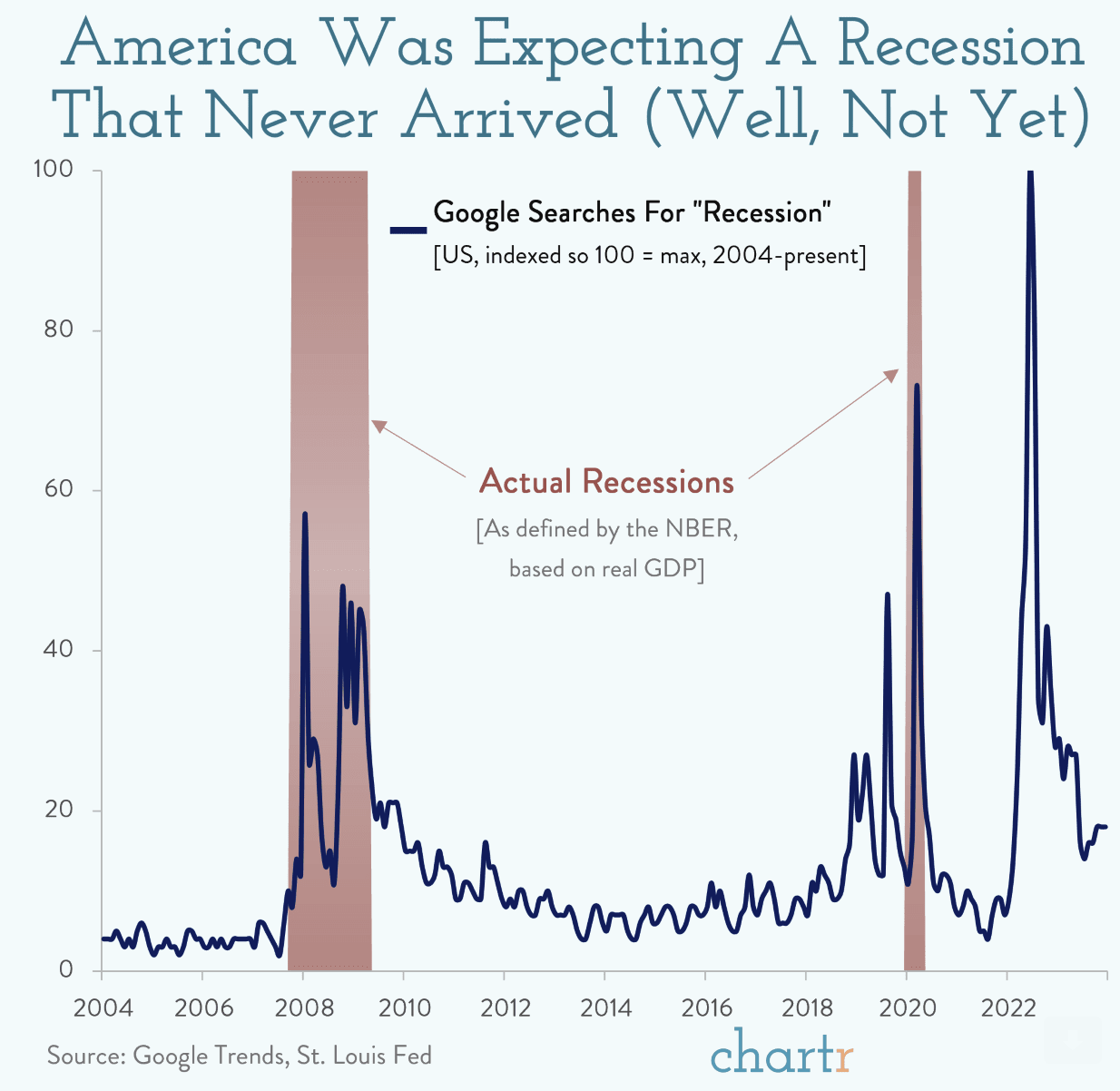

2. The “Looming” Recession

Back in May, the lead story of the Roundup was about the recession that was just around the corner. Sounds scary, until you realize it had been just around the corner for nearly two years. We kept looking for a recession, economists agreed one was likely…and yet it never seemed to arrive.

Well, we’re still waiting:

Not only has there not been a recession, the economic data is suggesting more strongly than ever that we’ll achieve a “soft landing” — in other words, we’ll get inflation under control with interest rate increases WITHOUT causing a recession. As I argued last month, inflation is largely tamed already, with additional future reductions already baked in as a result of how rent costs (which have been flat for a while now) are calculated in the CPI. Meanwhile, hiring continues to be robust (2.7 million new jobs created last year), consumer spending is resilient, and GDP grew at a more-than-healthy 3.1% last year. In fact, 2023 was a surprisingly strong economic year, despite the dour forecasts of a recession.

2024 Outlook: A soft landing seems more likely, but who knows? There will eventually be a recession — there always is — and if 2023 proved anything, it’s that nobody knows when that will be.

3. Artificial Intelligence

2023 was the year that AI truly arrived (only 22 years after the Spielberg flick by the same name!) ChatGPT became the fastest-growing consumer product in history, but also became rapidly integrated into real-world business processes of all types. Unlike crypto, NFTs, Web 3.0, or other fads-of the-moment, we actually started to USE these tools to do things. This isn’t a flash in the pan; this one is the real deal.

And it’s not just text-based AI’s like ChatGPT that show promise. Suddenly, the practical applications of AI seem endless — and deep-pocketed investors everywhere have heard the siren song, pumping record amounts of capital into generative AI startups:

The biggest companies in the world have begun to jockey for position as well, including the well-publicized fiasco involving the firing and rapid re-hiring of OpenAI’s CEO Sam Altman this past fall, in which Microsoft was the power (and money) behind the throne.

If you feel like AI is moving too far, too fast, you’re not alone. Lawmakers and regulators across the globe have taken notice, drafting (and in some cases passing) legislation meant to protect individuals, artists, writers, news organizations, and others from the potential ravages of the technology. In other cases, AI companies may face legal challenges from those stakeholders, who allege that AI companies are in effect stealing their work to build the massive training databases required to make an AI “intelligent” in the first place. The recent spat of explicit, AI-generated photos of Taylor Swift dramatically underscores the need for regulations and protections.

2024 Outlook: More of the same. Expect new products, new applications & use cases, and old fears — legitimate ones like the impact of AI on workers and artists, and (mostly) silly ones about the existential threat of a digital super-intelligence.

4. The Labor Resurgence

2023 was noteworthy not just because of how many large labor strikes there were — and there were a LOT, including UPS, Kaiser Permanente, the “big three” auto companies, Hollywood writers and actors, Las Vegas casino workers, and more — but because of how successful they were in achieving their goals through collective bargaining. A new generation of labor leaders employed new tactics, framing their strikes as a way to reassert the power of workers in the face of corporate greed — not a tough message to sell in an age of eye-popping income inequality and record corporate profits.

Still, the numbers of striking workers wasn’t huge by historical standards — nearly five times this level of work stoppages was the norm mid-century, a time when union membership was much higher. Just 10% of workers are unionized today, a rate that has been dropping steadily for decades, and still is.

2024 Outlook: It would be surprising if 2023’s rate of striking workers continued into 2024, since there just aren’t that many workers in unions. But the huge successes that unions achieved for their workers in 2023 might convince more Americans to consider unionization — to that point, public support for unions stands at ~70%, the highest since the mid-1960s.

5. The “Magic Pill”

For decades, public health experts have watched the ever-increasing rates of obesity across the world with alarm. Obesity is a significant risk factor for all sorts of diseases and ailments, and years of concerted messaging to “eat right and exercise regularly” was clearly not working. Naturally, many wondered if there would be a day when a “magic pill” could cure obesity. In 2023, that day seemed to arrive out of the clear blue sky, thanks to a class of drugs that was not developed to treat obesity at all.

Those drugs are known as GLP-1 agonists, of which Ozempic and Wegovy are the best-known brands. Originally developed to treat diabetes, trials of these drugs showed that people often lost weight as well. Last year, the dam broke as clinicians and patients realized we might have already stumbled on that magic weight loss drug.

Suddenly, these drugs seemed to be everywhere in the news. Celebrities, including Oprah, talked about them. More people wanted them, whether they had diabetes or not.

But they’re not a miracle drug, experts warn — many people experience serious gastro-intestinal side effects, and other side effects are still being understood. Also, for now it’s a “magic injection”, not a pill, though that’s likely to change in the years to come as the promise of an oral version of these medications is too lucrative for drug companies to ignore.

2024 Outlook: Drug companies will double down on investments in these drugs — both R&D and marketing — and uptake will likely increase. The drugs’ limitations and risks may come into clearer focus as well.

6. The Climate Tipping Point

The globe has been warming slowly for many decades. But 2023 was the year it started warming FAST, baffling climate scientists, blowing past worst-case scenarios, and raising fears that we had past a tipping point.

2023 was officially the hottest year on record — by a LOT.

Historic heat waves roiled multiple continents all year, including weeks of unprecedented summer heat that baked Europe. (I was there, and I can attest is was really damn hot.) But it wasn’t just the heat: the frequency and character of wildfires, tropical storms, and heavy rainfall events are all changing before our eyes. We’ve known about climate change for over half a century, but the era of climate change impacts is upon us — and that chart is only moving in one direction, so things will certainly get worse before they get better (if they ever do).

2024 Outlook: It might be another record-breaker, if the strong El Nino continues. The case for action against climate change will only get stronger, but global emissions will likely continue to rise unabated.

7. The Back-to-Normal

The pandemic started for most of us around March 2020. Though it’s by no means “over” — preliminary counts show that covid killed more than 70,000 Americans last year — the acute risk of the virus materially subsided in 2023. And so the pandemic faded, mercifully, into the background.

The pandemic’s impacts were foundational and far-reaching. It hit our economies, our psyches, and our sense of security; it disrupted supply chains, schooling, and travel. It brought our health care system, and our doctors and nurses, to the brink. We may never wash our hands or view crowded indoor spaces the same way again.

And yet, 2023 felt like the year many things got back to normal. The Roundup has touched on many of these topics throughout the year:

Companies have increasingly asked (demanded) that their workers come back to the office at least three days per week, though they still face some resistance from workers on that

Travel is booming, as people make up for lost time

Fractured supply chains have largely healed

Pandemic-related economic impacts, including inflation, have eased

With Barbie and Oppenheimer, we had hit blockbuster movies this year (that we actually went to theaters to see!)

Getting a covid shot is no longer an Instagram-worthy event, you just get it with your flu shot

Violent crime, which spiked during the pandemic, is falling rapidly across the country

Consumer sentiment is rising

Outlook for 2024: In big and small ways, we’ve all gotten back to the business of living and put the pandemic — an event that was no less than an earthquake beneath our modern civilization — in the rear-view mirror. All of this should (fingers crossed!) continue to slowly improve in the year to come, which is something to be grateful for.

Portfolio Updates

As promised in last month’s newsletter, I recently published my Annual Report for 2023, which dives into all the financial results and metrics for my 25-property portfolio last year. Here are some of the highlights:

My net cash flow was $103,842

Maintenance & repair costs were $42,093, a bit above expectations

Occupancy was 97.4%

Rents increased by 4.6% on average

I turned four properties, unfortunately including two evictions

Here’s a dashboard with some of those key results, and others:

Price appreciation slowed markedly this year, but this was not surprising given the huge increases in the two years prior. Occupancy and rent increases continued to be strong, while cash flow — the most important metric of all — exceeded expectations.

There were a few areas of concern in this analysis, indicated by the yellow lights. First, maintenance costs were a bit high, but close enough not to warrant any further adjustments to my cost models. Hopefully they’ll be a little lower this year.

Turns continued to be less frequent than anticipated, but more costly. The low frequency is terrific, and I hope it continues; the high cost will just be a fact of life for me until I get through the “first turns” on all my properties — but there’s only a few more of those left, so I’m hopeful that my average turn costs will come down in the coming years.

Finally, turn duration was a little longer than I’d like. The culprit here is that tenant placement into vacant properties was a little slower than I’m used to, thanks to the rental market cooling off a bit in 2023. This suggests that I should consider somewhat lower asking rents in vacant properties, in the hopes of attracting more prospective tenants and getting those vacancies filled faster.

As part of my year-end number crunching, I also updated my individual Property Spotlight articles with annual numbers on individual properties. If you’ve ever wanted to see how an individual property performs over a multi-year period, check out the Annual Updates section at the bottom of each of those articles.

In February, I’ll return to my normal discussion of monthly goings-on in my portfolio. Until then, here are the updated cash flow graphs including all months in 2023:

And now this!

This month’s Roundup is sponsored by Stessa.

Stessa is the industry-leading financial app for rental property investors, and I recommend it to all my clients. Stessa makes it easy to track rent and expenses, run reports, and much more — it even connects directly to financial accounts and property management systems so you can import all your transactions seamlessly.

Especially as we head into tax season, a good accounting system is a must for rental property investors who want to claim all their deductions without all the paperwork.

Learn more about Stessa here.

In Other News…

Real Estate & Business, Domestic News

Office real estate fallout continues. While many companies have mandated return-to-office three days per week, very few are going to a full five days per week, so demand for office space continues to lag supply. It’s even starting to hit premier A-class buildings that had, until recently, fared relatively well. (This topic was the lead story of an earlier Roundup this year.)

Microsoft becomes world’s most valuable company — again. The software giant overtook Apple as the world’s most valuable company, with a valuation ~$2.9 trillion. The same thing happened in 2021, only for Apple to surge ahead again.

Primary season gets underway. The long-anticipated Biden-Trump rematch seems inevitable, as Trump wins the first two contests in Iowa and New Hampshire.

International News, Science & Technology

India becomes most populous country. China fell to #2 in the rankings, though both countries still have enormous populations of about 1.4 billion people. India’s population growth has slowed, and is expected to peak sometime after 2060 at ~1.7 billion. Meanwhile, China’s population has already peaked, and has now fallen for the second straight year. (And yes, the world population will also peak at some point, at which point we’ll enter a new phase in our civilization: depopulation.)

Tensions rise in the Middle East. While there are hopes for a negotiated pause to the Israel-Gaza war to allow for the return of hostages, conflicts are flaring in the wider region. Three US service-members were killed in Jordan in a drone attack apparently launched from Syria by Iran-affiliated militia groups. President Biden has promised a response.

Arts & Culture, Sports, and All the Rest

One trillion cicadas set to emerge. In a rare “dual emergence”, the cycles of two large cicada broods will line up this year: the 13-year cycle of the Great Southern Brood and the 17-year cycle of the Northern Illinois brood both hit in 2024, the first time this has happened since 1803. Over one TRILLION cicadas are expected to emerge across the Midwest and South…which sounds like more than we need, frankly.

Amateur wins PGA Tour event. Nick Dunlap, a college sophomore at the University of Alabama, beat a deep field of people who play golf for a living at the PGA’s “The American Express”. (Dumb name for a tournament.) He’s the first amateur to win an event in 33 years, when Phil Mickelson did it in 1991. Dunlap doesn’t get the $1.5m prize money, but he does earn a PGA tour card for 2 years, should he choose to leave Alabama and go pro. (He announced less than a week after his victory that he would do so — no surprise there.)

Chiefs and 49ers make the Super Bowl. Yeah, pretty sure Taylor Swift will be there — so if you’re weary of the T-Swift cutaways while you’re watching football, buckle up!

Final Thoughts: Artifice

So many things seem fake these days. (And I don’t mean the news, which unfortunately is nearly all real.) I mean viral stories and online memes. I mean the weird no-name brands that are taking over online marketplaces. (Get your HAZKWUMG joggers, only $29.99!) I mean tech CEOs who breathlessly tout the next big thing, bending facts beyond recognition in the name of hype. (Everyone will live in the metaverse!) I mean regular people, at least as they often choose to represent themselves online, photos airbrushed and lifestyles over-curated. And now, with the advent of AI, we need be suspicious of every image we see, article we read, or voice message we hear, all of which could easily be fake.

It seems we’re diving headlong into a future chock full of forgers, fakers, con artists, copycats, scammers, and dishonest influencers.

But the worst of them all: the online gurus.

Online gurus are pretty easy to spot. They’re really successful, and want you to know it. (“Here’s the Lamborghini I just bought!”) They talk fast, but without saying anything too specific. They make big promises. (“Earn $10,000 per month from you laptop!”) And of course, they’re willing to share their secret with you, so that you can also become rich and successful — if only you’d come to their workshop or conference, buy their online course, or sign up for their program. The specific business involved doesn’t really matter, and it runs the gamut — it could be dropshipping, affiliate marketing, social media marketing, property flipping, wholesaling, etc. Whatever it is, they promise it’ll be really easy, and you’ll make a ton of money, just sign up here with your credit card. (It’s gotta be legit, right? I mean, look at that Lambo!)

These gurus are con artists. They’re all style, no substance. They are pure artifice, made digitally manifest through their buzzy videos, their myriad social media channels, and of course their ubiquitous, tiresome, predictable (and yet somehow mesmerizing) YouTube ads.

I speak with several dozen aspiring investors each month in free initial consultations. These are fascinating conversations, since I meet people from all kinds of backgrounds. I’m able to get a sense of what information and guidance they’ve already encountered from other sources about rental property investing. Sometimes they’ve found content from Chad Carson or Paula Pant, or read books by Brandon Turner. These are good sources. But just as often, they’ve stumbled upon an online guru making big promises. Just in the last month, I’ve spoken to three people who had found, and even signed on with, the same guru — a guy who is promising investors 50% cash-on-cash returns in his program. (I won’t mention his name — he can do his own marketing.)

If you’ve read any of my blog or have any investing savvy, you’ll know that this is a seriously dishonest promise. I watched some of this guy’s videos, and he fits the classic mold of an online guru: long on excitement, short on specifics, overly expensive watch, the whole deal. I found him not remotely credible. (Also, he’s 22 years old.)

One of the things I always tell my clients is this: “I am not a guru.” By this I mean that I will not pretend to have any “secrets” about rental property investing. (There are no secrets.) I will not lure you in with a trail of cheap breadcrumbs just to surprise you with a high-priced workshop at the end. I will tell the truth, from the beginning, about what I do, what I offer, and what rental property investing is really like. I am an experienced investor, perhaps even an expert in my lane — but I am NOT a guru.

In fact, I’m the anti-guru, and that’s by design. I try to do things differently, and avoid even a whiff of artifice. I write deeply-researched and carefully written content, and care deeply about its accuracy and usefulness. I back up my claims with data and evidence. I transparently publish the results of my own rental portfolio, the good and the bad. I’m clear about the coaching service I offer, and what it costs — no surprises, no bait & switch.

In short, I try to be a breath of the world’s coolest, freshest air in an industry that otherwise emits a rather dank odor. (“Industry” here can be real estate or online coaching — either one works fine.)

Sometimes in my initial consultations, prospects reflect this back to me. “You content is SO useful, I’ve gotten a ton of value from it.” “I know there are plenty of scammers out there, but you seem like an honest, real, trustworthy source.” “Your blog articles are way different from anything else I’ve found.” This is my brand, the anti-guru, coming through loud and clear when people encounter me online — and this tells me I must be doing something right. My approach with active coaching clients is informed by the same set of values.

The same thing can be said, then, about my content and my coaching style: it isn’t sexy, it’s not flashy, it’s not clickable, it’s not viral, it’s hot hyped — but it’s honest, and it’s useful. It’s REAL.

In an increasingly artificial world, that counts for a lot. At least I hope it does.

Happy investing,

Eric

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.

Free Rental Property Analyzer

You probably know that a well-designed rental property calculator is the most important tool a real estate investor has. It allows you to quickly calculate key metrics and understand your cash returns on a target property. You can also answer questions like:

How much do your cash-on-cash returns improve if you use a mortgage vs. paying in cash?

What will your average monthly cash flow be?

How will your returns change in future years?

Those questions can be easily answered with side-by-side comparisons in the RIA Property Analyzer. I guarantee this is the best free rental property calculator out there today, and many of my readers have told me the same. It’s both powerful and very simple and intuitive to use. Check it out!