December RIA Roundup: How Far Will Mortgage Rates Fall?

The RIA Roundup is a monthly real estate newsletter with the latest stories, data, and insights curated especially for rental property investors.

In this issue:

Lead Story: How Far Will Mortgage Rates Fall?

Portfolio Updates

In Other News…

Final Thoughts: Home for the Holidays

Lead Story: How Far Will Mortgage Rates Fall?

For a while there, it seemed like mortgage rates would just keep going up forever.

It turns out forever is longer than we thought. Mortgage rates have fallen every week for the past 8 weeks, from a high of 7.79% in the Freddie Mac survey to the most recent reading of 6.67%. Here’s the history over the past two years:

Obviously, we’re still quite a bit higher than the 3-4% rates we got used to over the past decade, but rates are falling fast. The real question, though, is where will rates go from here?

I’m normally EXTREMELY cautious about making predictions, as I know well that forecasting is a notoriously fickle business. But in some cases, there is enough external data to make an informed guess and feel reasonably confident about it.

Luckily, this is one of those times. Absent some world-shattering exogenous event (which of course can happen at any time), I think the following assumptions are pretty reasonable — but just as a hedge, I’ve put my confidence level next to each prediction:

Mortgage rates have peaked, and the 7.79% figure will not be exceeded in the next two years. (95% confidence)

Mortgage rates will keep falling, and will be lower in 6 months than they are today. (80% confidence)

Mortgage rates will fall below 6% by the end of 2024. (70% confidence)

Mortgage rates will fall below 5% by the end of 2024. (50% confidence)

Why would I make these predictions and subject myself to public ridicule if I’m wrong? Because there are two very good reasons to believe in the continuation of the current downward trajectory in mortgage rates. Let’s examine both of those reasons.

Reason #1: Inflation has been tamed

Rising consumer prices has been one of the main economic stories of the post-pandemic era. I’ve even written about it in this newsletter (most notably in my October 2022 analysis that predicted — correctly, as it turned out — that inflation had peaked.)

Despite the media’s focus on this issue, and the breathless anticipation of each Federal Reserve meeting and any spoken utterances of Fed Chair Jerome Powell, the truth is that it’s been pretty clear for a long time that inflation would continue easing. And it has:

But that’s not the whole story. In fact, this graph obscures a reality that keen observers (and real estate folks) have been pointing out since this past summer: once you strip out shelter costs from the CPI, inflation has essentially been running at ~1% for the past 18 months.

That can’t be right, you’re thinking. Prices have been going crazy! Well…nope, not since mid-2022. It has just taken the media, and many financial commentators, some extra time to give up on the Inflation Apocalypse storyline. (Anything for clicks, right?)

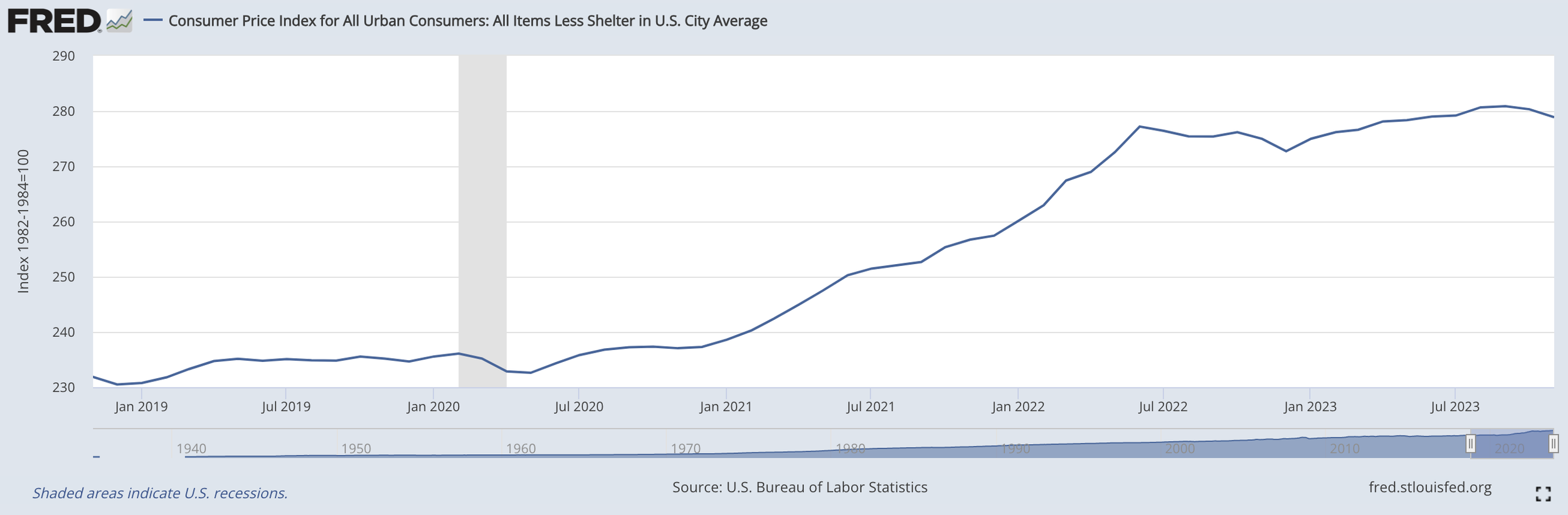

Jay Parsons produced this great analysis in August, explaining that shelter costs (i.e. rent) are a big part of the CPI measurement, but because of they way rents are measured, there is a ~12-month lag between when rents change and when those changes are reflected in the CPI. In other words, rents have been flat for a while now, but the CPI is still counting them as increasing. This effect is dramatic: here’s what the CPI graph looks like when shelter costs are stripped out:

That’s down to almost 0%! And because of the lag in when rents are reflected in the CPI, it was clear in August that this trend would continue, because data on asking rents from 12 months prior indicated that shelter costs were flat or slowly falling. Sure enough, more recent data on CPI Less Shelter confirms this. The following chart is in nominal terms (rather than percentage changes); you can once again see non-shelter prices flattening dramatically in mid-2022, and the small dip at the end means that non-shelter prices have actually been FALLING in nominal terms over the past few months:

Meanwhile, consumer sentiment is rising, and consumer inflation expectations are back in line with historical averages.

Long story short: inflation is tamed.

But what does inflation have to do with mortgage rates? Well, it turns out that inflation and mortgage rates are highly correlated (for reasons I won’t dive into here) with a 6-12 month lag. So when you see inflation falling, you can expect to see mortgage rates falling within the next year. And in fact, that’s exactly what we’re now seeing: inflation peaked in October 2022, and mortgage rates peaked in October 2023. Understanding this historical relationship, and peeking at the inflation charts above, it’s a pretty good bet that mortgage rates will continue to fall as we move into the first half of 2024.

Reason #2: The Fed knows all this

I’m not telling you anything so far that the Fed doesn’t know quite well. That’s why, in their most recent statements, they have not only suggested that there will be no further rate increases, but that they anticipate three rate CUTS in 2024. With inflation very much under control, they will begin to unwind their previous rate increases in an effort to keep the gears of the economy well-greased, with companies hiring, investors investing, and growth…growing.

While the Fed rate doesn’t directly impact mortgage rates, it does have an indirect effect by impacting the yield on 10-year Treasury bills. You can read more about those relationships here if you’d like, but the bottom line is that rate cuts from the Fed will put some additional downward pressure on mortgage rates.

What does this all mean for rental investors? Mostly it’s good news:

GOOD: Lower mortgage rates mean higher total ROI and cash-on-cash returns for new properties

GOOD: Lower borrowing costs once again make rentals the clear leader over types of investment (i.e. stocks)

GOOD: If mortgage rates fall enough, it could present the opportunity to refinance higher interest rate loans

MIXED: Dropping rates are likely to “unfreeze” the market to some extent, which might heat up competition for homes…but that would also create upward price pressure, which is good for existing portfolios.

Portfolio Updates

I had three different properties vacant in the month of November:

Property #20 was vacant as we looked for a new resident following an eviction and turn. As of December 5th, a new resident has moved in, so this property will be back to occupied in next month’s report.

Property #18 also had a recent eviction and turn in one unit of this duplex. The rent-ready work was completed in November, and the unit is currently being marketed for rent. We were getting good traction on this listing, but some prospective tenants reported that the carpet on the stairs (the only place where I have carpet in this property) had a bad odor, so we just replaced that. I hope to have a new resident in place by January.

Property #22’s tenant vacated at the end of October. My PM completed a large turn, and got a new tenant in place by November 20th, which was the most efficient turn I have ever seen in my portfolio. Even better, the new tenant is paying $1200 vs. the previous tenant paying $825, so the numbers for this property look very good moving forward. This exactly follows the plan I had when I purchased the property earlier this year — I knew I’d have a relatively expensive first turn, but that I’d be able to charge more in rent if the existing tenant chose to leave.

My November Portfolio Report dives into all the details for the most recent month. As expected, I fell back into the red for the year vs. my cash flow projections, and will likely end the year there — but it’s still mighty close.

My 2024 Annual Report is coming!

Don’t forget that in January, you can look forward to a new Annual Portfolio Report! I’ll also make annual updates to the stats for each of my individual property articles in my Property Spotlights section.

And now this!

This month’s Roundup is sponsored by Stessa.

Stessa is the industry-leading financial app for rental property investors, and I recommend it to all my clients. Stessa makes it easy to track rent and expenses, run reports, and much more — it even connects directly to financial accounts and property management systems so you can import all your transactions seamlessly.

Especially as we head into tax season, a good accounting system is a must for rental property investors who want to claim all their deductions without all the paperwork.

Learn more about Stessa here.

In Other News…

Real Estate & Business, Domestic News

Homebuilders get back in gear. With mortgage rates falling, the pace of homebuilding surged in November.

White House announces new funding for trains. The Biden administration announced $8.2 billion in new funding for high speed rail and other train projects nationwide. The 2021 bipartisan infrastructure law is providing the money for these projects.

Tesla delivers its first Cybertrucks. The electric vehicles, which look futuristic only if you grew up in the 1980’s, have been marred by production delays and were supposed to be delivered in 2021. Nearly 3 years late, not so bad!

Self driving cars hit some roadbumps. In other Tesla news, the company recalled 2M vehicles (which is nearly all of them) over safety concerns around the autopilot feature. Separately, the GM-owned self-driving company Cruise is laying off 24% of its workforce after it was forced to pull its vehicles from the road following an October incident in which a pedestrian was struck. Facts worth remembering here: every day in America there are ~15,000 car accidents, and over 100 people are killed. (Every. Single. Day.)

Trevor Milton sentenced to four years in prison. The founder of the electric truck company Nikola will join fellow startup fraudster Elizabeth Holmes in prison. He made a habit of lying about the company’s technology, including an infamous video that purported to show a truck in operation when in fact it was just rolling down a hill with no driver in it. Turns out there IS a line between “hype” and fraud when it comes to startups…and both Holmes and Nikola crossed it.

George Santos expelled from Congress. In a historic bipartisan vote, the New York Republican and noted fabulist was expelled following a jaw-dropping report from the Ethics Committee, which detailed (among other things) how he used campaign funds to pay for luxury goods, Botox, and porn. He’s since been busying making Cameo videos, presumably to continue funding those same passions.

Kevin McCarthy to leave Congress. The former Speaker of the House, after being ousted by his own party for relying on Democratic votes to keep the government running, says he will leave Congress at the end of the year. He plans to make money by selling Washington access to space and AI companies; he has been friendly with Elon Musk for a decade. Meanwhile, former Speaker Nancy Pelosi continues to serve in Congress.

Tuberville gives up hold on military promotions. Senator Tommy Tuberville, Republican of Alabama, has been single-handedly holding up hundreds of military promotions for months in protest of the military’s policy to reimburse travel costs to servicemembers seeking abortion car. The blockade left many important leadership positions unfilled. After facing significant pressure from his Senate colleagues, including fellow Republicans, has has finally given up.

Mint is shutting down. Breathe easy, Ryan Reynolds fans — I’m not talking about Mint Mobile. This is just plain Mint, the long-popular budgeting and personal finance app. It is owned by Intuit, which is shutting it down and rolling some of its features into Credit Karma (which is…not useful.) Committed Minters like me have been spending weeks looking for a viable replacement…I’ve finally settled on Monarch Money, and we’ll see how it goes.

International News, Science & Technology

This month in AI. Sports Illustrated took a big hit after it was discovered that they had published articles by imaginary AI-generated writers. Fully AI-generated singer-songwriter Anna Indiana released her first song, and literally everyone hated it. (Also, using a name clearly modeled on “Hannah Montana” seems pretty lazy for an AI with nothing better to do. And Veronica Vermont was right there!) Even the Pope is getting in on the AI game: he cited the existential threat of AI while calling for a global treaty on the technology.

Historic climate deal reached. After some controversy, the COP28 climate summit ended with an agreement between 200 nations to transition away from fossil fuels and achieve net zero emissions by 2050. Not a moment too soon, because 2023 was the hottest year ever recorded by a wide margin.

Ukraine on the path to EU membership. The EU has agreed to begin “accession” conversations with Ukraine and Moldova, both of which are campaigning to join the union.

Volcano erupts in Iceland. The country is used to eruptions, but this appears to be the largest one since the 1970’s. The government evacuated a town of 3,000 people about a month ago, citing significant risk of an eruption in that area…which is exactly what happened. Good call, science!

Arts & Culture, Sports, and All the Rest

Charlie Munger dies at 99. The friend and six-decade confidante of Warren Buffett, Munger helped shape the Berkshire Hathaway investing philosophy of buying stable, profitable businesses for the long term.

Henry Kissinger dies at 100. The influential diplomat, whose name became almost synonymous with US foreign policy, leaves a legacy that is both consequential and controversial.

Sandra Day O’Connor dies at 93. The first woman on the Supreme Court, O’Connor was nominated to the bench by Ronald Reagan and served from 1981 to 2006. Pairing a centrist’s pragmatism with a formidable personal presence, she shaped the court for decades and was among the most powerful women in the country.

Shohei Ohtani signs record contract with the Dodgers. The Japan-born baseball player will receive $700 million over 10 years, the largest ever MLB contract. Ohtani may be worth it: he both hits AND pitches at an elite level, something no player in baseball’s modern era has ever done. In another unusual move, $680 million of that $700 million will be paid AFTER the 10 years of the contract…luckily, Ohtani makes $50 million per year in endorsements, so he should still be able to make rent.

Everyone at Yale is getting A’s. Unlike price inflation, grade inflation at Yale (and many other colleges) isn’t slowing down at all. A recent report showed that 80% of grades awarded at the college were A’s or A-‘s.

Have yourself a merry little Christmas, it may be your last. The modern holiday classic, first sung by Judy Garland in the 1944 musical Meet Me in St. Louis, has a fascinating origin story: the lyrics didn’t start out as sweet and nostalgic as the ones you know.

Final Thoughts: Home for the Holidays

In last December’s Roundup, I wrote about respite, and the simple joys of being away in the woods for a few days to rest, read, think, write, and be alone. That trip forged a strong association in my brain between December and the idea of cozying up with a good book and a hot cup of tea, with a view out my window like this one:

So when December rolled around, I was drawn once again to the woods. This was the view through my cozy little cabin, where I spent four nights reconnnecting with myself and with nature. I think it’ll be an annual tradition now — it’s truly one of my favorite things in the world. (The company that runs these cabins is called Getaway. They don’t pay me for marketing, but they probably should, given that I rave about them to anyone who’ll listen.)

I’ll also partake in another December tradition this month: heading home for the holidays. For me, that means driving an hour to the New York City suburbs and spending a few days in the house where I grew up with my parents and my brother’s family. I’m 44 years old, and I still go to my parents’ place for Christmas. This is either perfectly charming or kinda sad, depending on your perspective — or maybe somewhere in between, like “quaint”.

But really, where else would I go? These are my people. That’s the point of the holidays, isn’t it? Not the gifts, decorations, or rituals, but what they stand for: family, comfort, connection.

It has been five years since I left my corporate job and re-engineered by work life. As I’ve written about extensively, this change brought deep rewards and lasting satisfaction. Financial independence and working for myself is just so much better than waking to an alarm, heading to the office, and navigating corporate politics and unpredictable bosses. I try to remember this every day and not become numb to it. I feel like I’ve now achieved a really good balance between work and play, able to pursue my passions and recreations while still being challenged and energized by my work building a website and coaching business. In other words, I like where I’m at.

Still, the successful re-engineering of my work life has led me to think about how to re-engineer my personal life in similar ways. To me, that means deepening connections with the small group of people I love the most: my spouse, family, and close friends. Maintaining my holiday traditions is of course part of that, but I’m also committed to creating other experiences with those people — taking memorable couples trips, organizing a small reunion of my close college friends, and just being the one who’s always saying “let’s get together, what dates work for you?”

I’m very much an introvert. (It’s not everyone who would enjoy five days of solitude in the Catskills.) And yet, these close relationships are still the most meaningful things in my life. If the point of my journey to financial independence through rental properties was to have the freedom to focus on what matters, then I’d better get busy.

It’s not just me, of course — this time of year is a trigger for many people to reflect on what (and who) is most important to them. The pages of newspapers and magazines are full of other writers participating in this annual holiday tradition. (Here’s one of this year’s best: my husband’s friend Richard Morgan penned this lovely piece about his 93-year-old grandmother, and why he’s going to see her for Christmas. Read it without crying, I dare you.)

It also turns out that deep interpersonal relationships are hugely beneficial to health, happiness, and longevity. There have been numerous academic studies on this topic, but for a great overview, I’d recommend this video from Derek Muller on the Veritasium YouTube channel. (Yes, there are YouTube creators who create absolutely amazing content, and he is one of them.) In fact, loneliness — the subjective feeling of disconnectedness from others — may be as unhealthy as better-known ravages like smoking or sedentary lifestyle.

So wherever you’re headed for the holidays, I hope you’re able to connect with loved ones and strengthen those bonds. It’s what matters most in the end — plus, you’ll be doing something healthy to offset all the holiday food and drink. So go ahead, have another eggnog!

Happy investing,

Eric

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.

Free Rental Property Analyzer

You probably know that a well-designed rental property calculator is the most important tool a real estate investor has. It allows you to quickly calculate key metrics and understand your cash returns on a target property. You can also answer questions like:

How much do your cash-on-cash returns improve if you use a mortgage vs. paying in cash?

What will your average monthly cash flow be?

How will your returns change in future years?

Those questions can be easily answered with side-by-side comparisons in the RIA Property Analyzer. I guarantee this is the best free rental property calculator out there today, and many of my readers have told me the same. It’s both powerful and very simple and intuitive to use. Check it out!