May RIA Roundup: The Recession That Never Comes

The RIA Roundup is a monthly real estate newsletter with the latest stories, data, and insights curated especially for rental property investors.

In this issue:

Lead Story: The Recession That Never Comes

Portfolio Updates

In Other News…

Final Thoughts: Epidemic

Lead Story: The Recession That Never Comes

No doubt you’ve heard there’s a recession coming. It seems everyone is expecting one, and it’s been all over the news. Nobody knows exactly when, but they’re very sure it’s coming. Experts have weighed in on CNBC; ordinary people on the street have been stopped and interviewed. Everyone seems to agree a recession is just around the corner. Not yet, but soon. Could be any time now.

Of course, I’m gently mocking the herd mentality that tends to develop on such topics thanks to the way our media works. But here’s the truly strange thing about the paragraph above: I could have written it two full years ago, and it would have been just as true. It’s fair to say the media — even outside of the financial media — has been somewhat obsessed with this topic. We’ve been breathlessly anticipating a recession for years now.

But is there anything to this? Well, the theories about the causes of the looming recession have shifted over time. In 2021, the concern was that the various forms of covid stimulus (stimulus payments, expanded unemployment benefits, PPE loans, emergency rental assistance, and more) were winding down, and that this would cause widespread economic hardship which would reduce consumer spending and cause a recession. That never happened — in fact, consumer spending has remained remarkably strong since the initial shock of the pandemic in early 2020 (which caused a brief but severe recession that officially lasted only two months, the shortest in US history):

Monthly Change in US Consumer Spending (vs. the previous month)

There was also concern that the expiration of these relief programs would cause a huge wave of evictions. That also never materialized — in fact, eviction rates stayed ~50% below historical averages throughout all of 2021, and didn’t approach pre-pandemic averages until the end of 2022.

It seems the basic reason these early recession concerns fell flat is that the economy had healed so much, so quickly — people still had more money in their pockets than normal due to covid relief policies, and they were spending it, which fueled rapid job and wage growth. This virtuous economic cycle was more than strong enough to withstand the expiration of covid relief programs. In short: these programs were an enormous success, and worked exactly as they were intended to work.

But wait — maybe they worked TOO well! The economy was so hot that we experienced elevated rates of inflation for the first time in four decades, and soon there was a new recessionary fear: in response to high inflation, the Fed would sharply increase interest rates, which would throw a wet blanket on the economy, slow business investment and job growth, and cause a recession. (If you’re a regular reader, you know that inflation isn’t a new topic — last fall, I wrote at length about inflation and its impact on real estate investors, and predicted (correctly, as it turned out) that inflation had already peaked.)

The Fed did, in fact, raise interest rates at the fastest rate in history, moving from 0% to over 5% in just over a year:

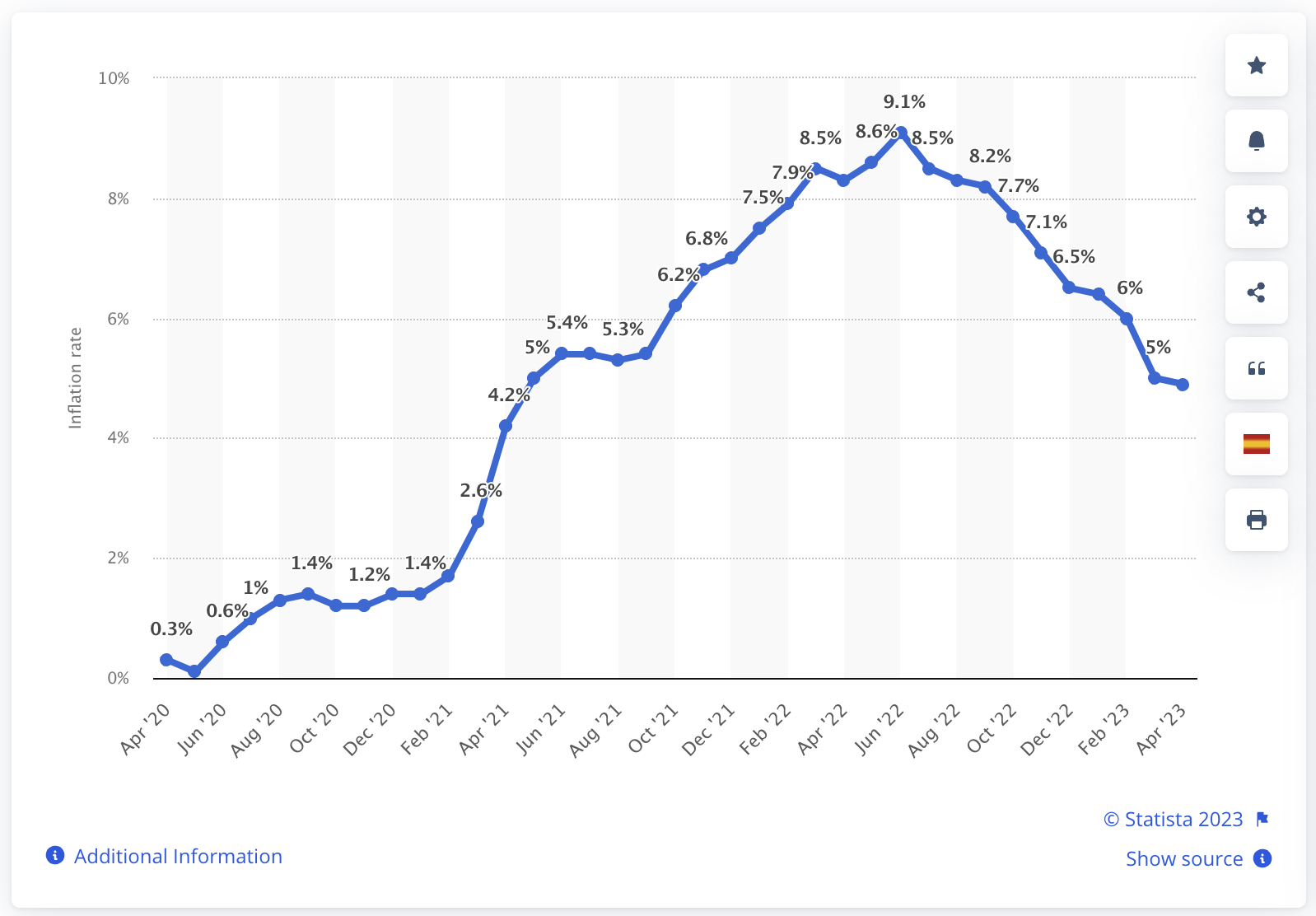

The Fed’s actions are achieving the intended result with respect to inflation. (Or, at least, inflation has come down — assigning singular credit to the Fed’s interest rate increases is a bit complicated, given that other simultaneous factors likely played a significant role, such as the untangling and reorganization of global supply chains in the wake of the covid shock.) Whatever the precise causes, inflation has come down: in the last reading, prices were rising at an annual pace of 4.9%, which is down from a peak of over 9%, and is much lower than our counterparts in the UK and Europe, where inflation is still running over 8% on average:

Monthly 12-month inflation rate in the United States from April 2020 to April 2023

But has this caused a recession? Not by any measure we know of. As noted above, consumer spending is robust; manufacturing is booming; corporate profits are at record highs; wage growth is strong; and the economy has continued to add jobs at a robust rate, bringing the unemployment rate to 3.4%, the lowest figure in more than 50 years:

Still, overall economic growth has slowed a bit, registering just 1.1% GDP growth in the last quarter. You know what that means…a recession must be just around the corner!

Jokes aside, a recession is certainly coming…eventually. We’ve experienced recessions at an average rate of one every ~6-7 years since 1945. There will be another recession at some point. But predicting when that will occur is a notoriously tricky business — even economists are very, very bad at predicting recessions.

So next time you read an article that tries to convince you a recession is coming, best not to worry too much about it. A recession will eventually come, but the person who wrote the article — just like the guy who wrote THIS article! — has no reliable way of knowing when.

Portfolio Updates

Since the last Roundup, I published my April portfolio report. April cash flow was nearly $7,000 but fell short of my pro forma:

In last month’s newsletter, I mentioned some tenant payment issues. I provided an update on those in the April portfolio report, but here’s the skinny: one tenant did pay April rent, but still appears to be struggling to catch up; the other tenant failed to pay rent, and was evicted. The eviction proceeded faster than any I’ve done before, and I should have possession of that house in just a few more weeks. Also, because this was a newly-placed tenant at one of my new homes (Property #20), my PM has also agreed to reimburse me for the lost rent, which is a nice accommodation.

I’m currently ~$3K behind my cash flow projection for 2023, but I should be in a strong enough position in the next few months to make that up. (I’m tempting fate by even putting that in writing, I suppose…)

In Other News…

Domestic News, Business, & Real Estate

Hot real estate markets cool, but boring markets stay boring. A recent BiggerPockets analysis of market trends reinforces “bifurcation” between hot and boring markets that I wrote about in last month’s Roundup. Remember: when it comes to investing, boring is sexy.

Institution investors are pulling out of real estate. In the first two months of 2022, institution investors purchased 90% fewer homes than in the same period a year ago. Fine by me — more for the rest of us!

More ethics scandals rile the Supreme Court. It was already bad, but things only got worse for the Supreme Court in the last month, as new reporting revealed that Clarence Thomas’ billionaire benefactor (in addition to paying for lavish yacht vacations, private jet trips, and purchasing Thomas’s mother’s home and letting her live there rent free) ALSO paid the private school tuition for Thomas’s great nephew, whom Thomas raised from childhood. But I’m sure they’re just, you know, good friends — I mean, doesn’t everyone have a good friend who takes them on private jets, pays for their vacations, sends their kids to private school, and lets their mother live rent free in his house? Yeah, me neither.

Covid emergency ends, and so does Title 42. Title 42, which gave expanded authority to the government (first under Trump, and continuing under Biden) to expel migrants who arrive at the southern border, ended when the government declared the covid emergency over. This was replaced by new rules the Biden administration put into place, which in some ways are more punitive to migrants who attempt to enter the country illegally. (These rules are being challenged in court by the ACLU, who claim that they illegally restrict access to asylum.) Perhaps on account of these new rules, the surge of migrants that was feared after the expiration of Title 42 largely failed to materialize.

States reach historic water use agreement with White House. Several western states reached a historic agreement over water use from the Colorado River. Years of drought and increasing water usage have severely depleted the river and its huge reservoirs, Lake Mead and Lake Powell, raising fears that the West may not have enough water in the future if no action is taken.

New York congressman indicted on 13 federal charges. Freshman Republican George Santos was indicted by federal prosecutors on charges related to the breathtaking web of lies he spun during his run for Congress. Until he’s convicted, though, he will remain in Congress. (He will also remain a laughingstock.)

Donald Trump found liable for sexual assault. The former president was found liable in civil court for the 1996 sexual assault of E. Jean Carroll, and was ordered to pay $5M for battery and defamation. He was undeterred, apparently, because he went right on defaming her on CNN the very next day. So Carroll sued him again. (She can do this ALL day.)

Ron DeSantis launches presidential campaign…sort of. The launch was to take place on Twitter with Elon Musk, but it was profoundly (and hilariously) botched due to near-fatal technical issues. Maybe Musk should rehire some of those people he fired if he wants Twitter to, you know, actually function?

Surgeon General issues stark warning about social media. In a 19-page report, the country’s “top doc” stated that use of social media poses a “profound risk of harm to the mental health and well-being of children and adolescents.” Sounds about right — except he left out adults.

International News, Science & Technology

Britain crowned a new king. The coronation of King Charles III made international headlines, and also spawned some truly excellent internet memes.

AI tools frequently just make stuff up. This is because the “large language models” that undergird the tools’ ability to generate text and respond to questions is “designed to be persuasive, not true”. Yikes! So they’re basically just digital sociopaths — totally confident and charmingly persuasive even when they’re lying to you. For this and many other reasons, even the people creating these tools seem to be increasingly freaked out by them: over 1000 technologists have called for a moratorium on research and development of AI tools, and many of the industry leaders are asking governments to regulate them.

In other alarming AI news, a fake image (briefly) crashed the stock market. An AI-generated image of the Pentagon burning went viral, with real-world consequences: the stock market experienced a sharp midday drop, but then recovered once everyone realized the image was fake. Seems like this kind of this is only going to get worse as the technology proliferates, and bad actors imagine new ways to use it for nefarious purposes. (And by “bad actors”, I’m of course not talking about, say, Nicolas Cage.)

Imagine a future with no passwords. Tired of forgetting passwords and dealing with 2-factor authentication? Google made a major move into a password-less future, which (we’re told) will be both more convenient and more secure.

Miscellany

Tina Turner, “Queen of Rock ‘n Roll”, dies at 83. Simply the Best.

The IRS wants to make filing your taxes easier (and cheaper). As part of the infusion of money provisioned to the IRS in the Inflation Reduction Act, the agency is aiming to build direct e-file capabilities, which would allow you to file your taxes for free directly on an IRS website. In a shocking twist, Turbo Tax is against it.

Meetings and emails continue to drive office workers crazy. Microsoft data shows that average workers now spend two full days every week on emails or in meetings. Yet 62% of people report being happy with their jobs, the highest level reported in decades. So…I guess those other three days must be really good?

Got milk? Not if it’s chocolate. Chocolate milk may come off school lunch menus, since it has lots of added sugar. Not sure about this one — I was a big fan of chocolate milk as a kid, and I turned out alright.

Final Thoughts: Epidemic

This month, I’m going to resist the overwhelming urge to rail against the debt ceiling lunacy that has been going on between Congress and the White House. I said all I needed to say about it way back in January’s Roundup, when it was already clear that this “crisis” would come. A default would be disastrous for real estate investors, of course, but that seems unlikely: as of the time of writing (Saturday May 27th), some sort of deal seems likely to pass in the nick of time, which is what a lot of people expected all along. Regardless of what’s in the deal, I think the episode has been a failure, since we’ve once again lent credence to the idea that it’s acceptable to use the full faith and credit of the U.S. government as a bargaining chip in the legislative process — and it’s not. It’s economic hostage-taking, and we should not be rewarding or appeasing any political party who employs such tactics.

Instead, I want to be an optimist (for once!) and reflect on another development that caught my attention in the last month, which struck me as unequivocally good news: there has been a sharp drop in HIV infections in our country. The Centers for Disease Control said recently that an estimated 32,100 people were infected with HIV in 2021, a 12% drop from 2017. The drop among 13-24 year-olds was even steeper, at 33%.

The sharp decline is being driven by increased access to health care among at-risk populations, especially gay and bisexual men. Two types of interventions are making a big impact. First, anti-viral drugs are available that are cheaper, more effective, and easier to take than ever before. When taken properly, these drugs suppress HIV so successfully that the virus is undetectable in lab tests — which is great for the health of that individual, but also makes it impossible to transmit the virus to others. Second, for those who are not infected but are at risk, the drug PrEP (pre-exposure prophylaxis) became available in 2012, and is nearly 100% effective at preventing a person from becoming infected. Uptake of PrEP continues to increase — the CDC says that prescriptions for PrEP among 16-24 year-olds more than doubled since 2017.

This is a powerful one-two punch: for an increasing segment of HIV+ individuals, it is impossible for them to transmit the virus; and for an increasing segment of the at-risk population, it is impossible for them to get infected. It’s not surprising, then, that we’re seeing steep declines in infection rates. The change is so notable, in fact, that Dr. Kenneth Freedberg, director of the Medical Practice Evaluation Center at Massachusetts General Hospital in Boston, said this: “We’re in a place where we can see the end of the HIV epidemic in the U.S.”

That’s a remarkable statement, especially when we remember how terrifying the disease was when it was discovered in the early 1980’s. HIV was incurable and largely untreatable, and would inevitably progress into AIDS, which not only was lethal in all cases, but intensely painful and acutely dehumazing. The disease left a trail of destruction and trauma in its wake, most especially in the community of gay and bisexual men.

Government’s initial response to the epidemic was dismissive, and reinforced stigmas against gay people that were widespread at the time. It took years of advocacy before any definitive action was taken. (One Anthony Fauci was an early target of AIDS activist organizations, but he eventually became one of their most important allies in government.) NBA star Magic Johnson revealed his HIV+ status in 1991, retired from basketball, and became a vocal public advocate for AIDS research — and was a living example that the disease could affect straight and gay people alike.

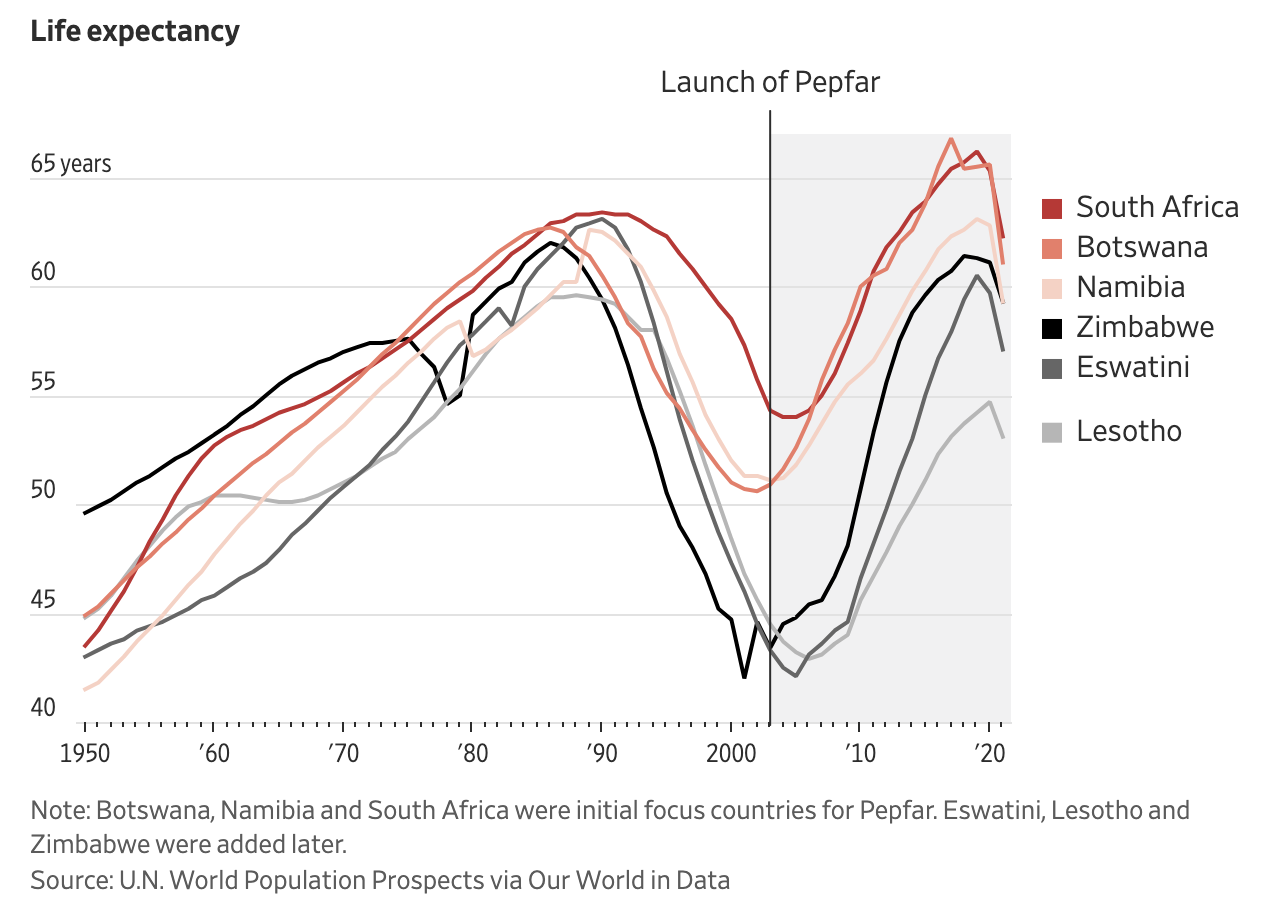

Progress was slow, but in time, testing, education and awareness campaigns, and the development of drugs made an impact. Most critically, it became possible for HIV to be managed as a chronic condition, such that HIV+ people could expect normal lifespans. The drugs got better and better, and then came PrEP to prevent infection among HIV- people — and now it seems a terrifying scourge has been completely defanged. (Progress in southern Africa, where the disease was significantly more devastating and widespread, has been just as remarkable — this graph of life expectancy in five African nations tells the story best:)

In the backdrop of this 40-year history, and just as important to the public health success story that the HIV epidemic has become, was the gradual de-stigmatization of gay people. Gay people became more visible in the media, and in everyday life as they increasingly chose to “come out of the closet” and live openly. Public acceptance and support for gay people, and later gay marriage, shifted with remarkable speed. This meant that over time, at-risk people were increasingly likely to get tested, know their status, and seek out available treatments — all of which were critical in the fight to contain the spread of the virus. (It also makes recent efforts by some individuals and state governments to RE-stigmatize that population — particularly transgender people — that much more troubling.)

As a result of all these factors coming together, we can now imagine an end to the HIV epidemic. Which feels miraculous, but of course isn’t — it’s just the net result of countless incremental steps forward by advocates, governments, researchers, and drug companies over a decades-long fight.

The covid epidemic is in a similar place — still with us, but fading in importance. The evolutionary trajectory of the virus means that it is now much more transmissible, but much less virulent, than the original strain in 2019. Those evolutionary pressures may be unavoidable for some viruses — it seems likely that the other coronaviruses that circulate widely in the human population and cause common colds are themselves evolutionary remnants of previous epidemics. Here too, though, there is a remarkable public health victory: thanks in no small part to the Trump administration’s Operation Warp Speed, safe and effective vaccines were developed in record time, and saved tens of millions of lives around the world. (This is arguably the most important and unequivocal success of the Trump administration, which is why it’s ironic that some segment of his supporters remain highly skeptical of the vaccines, despite unassailable evidence that they are safe and effective. Looking forward to getting my updated booster in the fall!)

I’m a person who finds data and evidence very persuasive. Perhaps that’s why I’m drawn to cash flow rental investing, since so much of it rests of data, modeling, and measurement. But outside of investing, I’m intrigued and amazed by human society’s capacity for ingenuity, creativity, and progress — how we’re able to imagine solutions to problems, test them, observe the results, and continuously improve them over time. (We have the capacity for lots of bad stuff, too, obviously, which is what makes humans especially fascinating and frustrating.) But for progress to take place, it’s important that we recognize and support the people, processes, and institutions that we know WORK. Public health initiatives, just like other forms of public policy and government interventions, can be powerfully effective if we support the process of learning what works vs. what doesn’t work, in a continuing and iterative way.

That process often requires public investment…which, perhaps inevitably, brings me back to the debt ceiling fight. One proposal that has reportedly been discussed in these (ill-advised) negotiations is clawing back unspent funds from covid relief legislation. That is probably quite reasonable in many cases, given the current state of the epidemic — but the White House is fighting to preserve two specific pieces that Republicans want to cut: $5B to fund the development of next-generation coronavirus vaccines (that could potentially provide protection against ALL coronaviruses), and $1B for an initiative to offer free covid vaccines to Americans who lack health insurance.

We know that type of investment WORKS, and can save lives. Whatever deal is struck, let’s hope that funding survives.

Happy investing,

Eric

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.

Free Rental Property Analyzer

You probably know that a well-designed rental property calculator is the most important tool a real estate investor has. It allows you to quickly calculate key metrics and understand your cash returns on a target property. You can also answer questions like:

How much do your cash-on-cash returns improve if you use a mortgage vs. paying in cash?

What will your average monthly cash flow be?

How will your returns change in future years?

Those questions can be easily answered with side-by-side comparisons in the RIA Property Analyzer. I guarantee this is the best free rental property calculator out there today, and many of my readers have told me the same. It’s both powerful and very simple and intuitive to use. Check it out!