Why the 50-year mortgage might actually be great for investors

There has been much buzz and speculation in real estate circles over the last month since FHFA Director Bill Pulte announced that the administration is working on a 50-year mortgage option to help lower homebuyers’ mortgage payments.

Will the 50-year mortgage actually happen? Hard to know. Mr. Pulte also created waves earlier this year by announcing that Fannie Mae & Freddie Mac would exit the government conservatorship under which they have operated since the financial crisis of 2008 — but that’s now apparently off the table. (The same guy is also under investigation for his handling of mortgage documents that were used to create criminal referrals against political enemies of the Trump administration — so we’ll see how that turns out!)

But if the 50-year mortgage DID happen, would it be good for homeowners? What about for investors?

Much of what has been published on this topic so far has (rightly) focused on homeowners — and apparently, a lot of people really hate the idea. Most commentators have been dismissive of the 50-year mortgage, and they have generally made the same three points over and over (so much so that I’m legit curious if talking points were distributed in advance):

the monthly payment would not be that much lower;

the total interest payments over the life of the loan would be much higher; and

the owner would build equity in the home much slower.

True enough on all counts, though if the slightly lower payment allows a family to afford and live in their preferred home for many decades, it might still be a win for them.

Here’s the real rub, though: all those point would be equally true in comparing a 30-year mortgage to a 15-year mortgage. So why aren’t these critics equally dismissive of a 30-year mortgage in favor of a 15-year mortgage? They seem strangely silent on this question. These critiques therefore strike me as true but mostly irrelevant; they’re a kind of misdirection. The also reflects a strong “status quo bias”, whereby current conditions are deemed to be normal or natural — inevitable, even — while new proposals are met with fierce skepticism.

(Quick aside: I’ve honestly been surprised at how dumb the public commentary has been so far…I’ve been smacking my forehead for weeks! Many prominent people have made straight-faced arguments that a 50-year mortgage is a terrible idea, basically a bank scam that would rob you of generational wealth, etc., while at the same time tacitly asserting that a 30-year mortgage is perfectly fine, and none of those things at all. Like…WHAT? How ‘bout some actual financial analysis, people?! Sheesh.)

I guess that’s where I come in: let’s take a deep financial dive on this topic, and learn what its true implications would be. For our purposes, I want to focus on this topic through an investor’s lens. Access to mortgages (fixed-rate, fully-amortized, low-risk) is one of the key advantages that real estate investors have vs. other asset classes, a fact I’ve written about extensively before — such as in this article, one of the first ones I ever published. But if we had access to 15-year, 30-year, AND 50-year options, which should we choose, and why?

To explore this question, I’m going to use the current figures for one of my existing properties (Property #20), and imagine that I was an investor looking to buy this property today. Let’s run the numbers and see how different mortgage terms impact our returns — but before we get too deep, we should review a few mortgage basics that will be very important in this analysis.

Mortgage Basics

A longer mortgage term obviously means that you’ll have more total mortgage payments. Taking smaller bites of the loan repayment means that you’ll have lower monthly payments, even if your total interest paid over the life of the loan is higher.

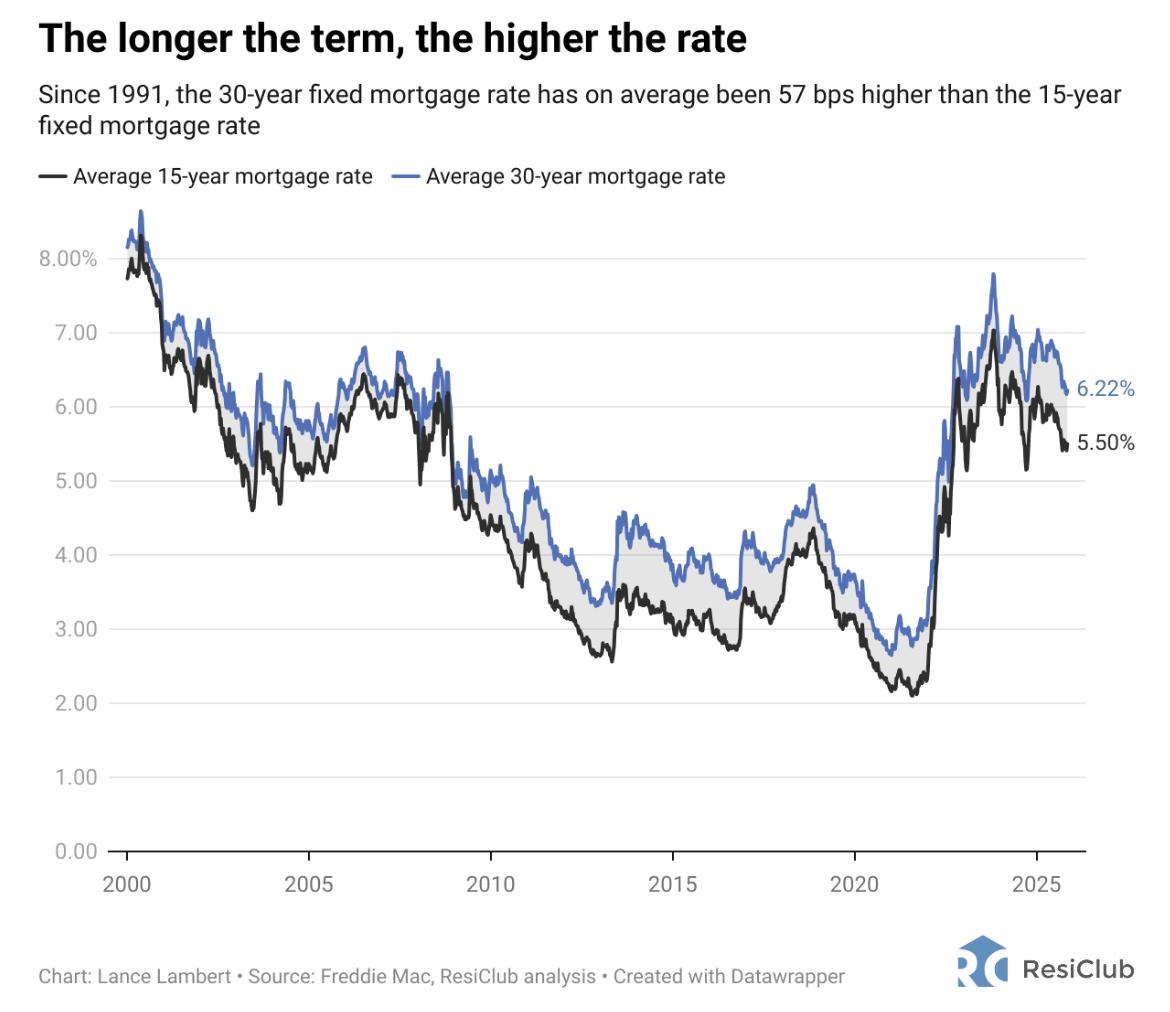

There is a countervailing force, though: loans with longer terms have higher interest rates, due to the uncertainty/risk associated with predicting financial conditions, inflation, etc., over the longer term. In fact, the spread between the rates for 15 and 30-year mortgages has consistently been at least half a point:

While we don’t know exactly what the rates would be on 50-year loans, it’s reasonable to expect them to be higher. A few independent estimates have already been published, suggesting a ~40 basis point premium over a 30-year mortgage. Therefore, for this analysis, I will use the following interest rates:

15-year: 5.625% (current as of the time of writing)

30-year: 6.25% (current as of the time of writing)

50-year: 6.625% (based on best current projections)

The other important thing to remember about mortgages is how they are amortized over time — specifically, though your mortgage payment never changes, the PORTION of your payment that goes to repaying the loan principal starts out very small, and increases at an accelerating rate over the life of the loan. In other words, your early payments are mostly interest, whereas your final payments are mostly principal. This impacts the timing of your home equity growth due to principal paydown: it’s minimal at first, and increases the longer you hold the loan.

And of course, the longer your loan term, the longer it takes to reach those more lucrative final payments that are mostly principal.

Just to illustrate this quickly: in the specific examples I’m about to dive into, here are the payments for each loan type in the first month, and in 5 year increments after that:

(Loan size = $92,000)

Notice that with the 50-year mortgage, your payment after 30 years is still ~70% interest. You might look at this and think, “Why would I ever get the 50-year mortgage, I’m getting screwed!” Though…if you look at the 30-year vs. the 15-year mortgage, you might say precisely the same thing about the 30-year mortgage, where your payments are still 60%+ interest at the 15-year mark — the same time that the 15-year loan is fully repaid.

But were’ missing something here. The other major factor we haven’t examined is the difference in TOTAL mortgage payments in the three scenarios: the longer mortgages have lower total payments, which means more cash flow is left over. So we need to zoom out, and look at the complete financials of the investment when each of these three loans is applied.

50-year mortgages vs. 30-year vs. 15-year

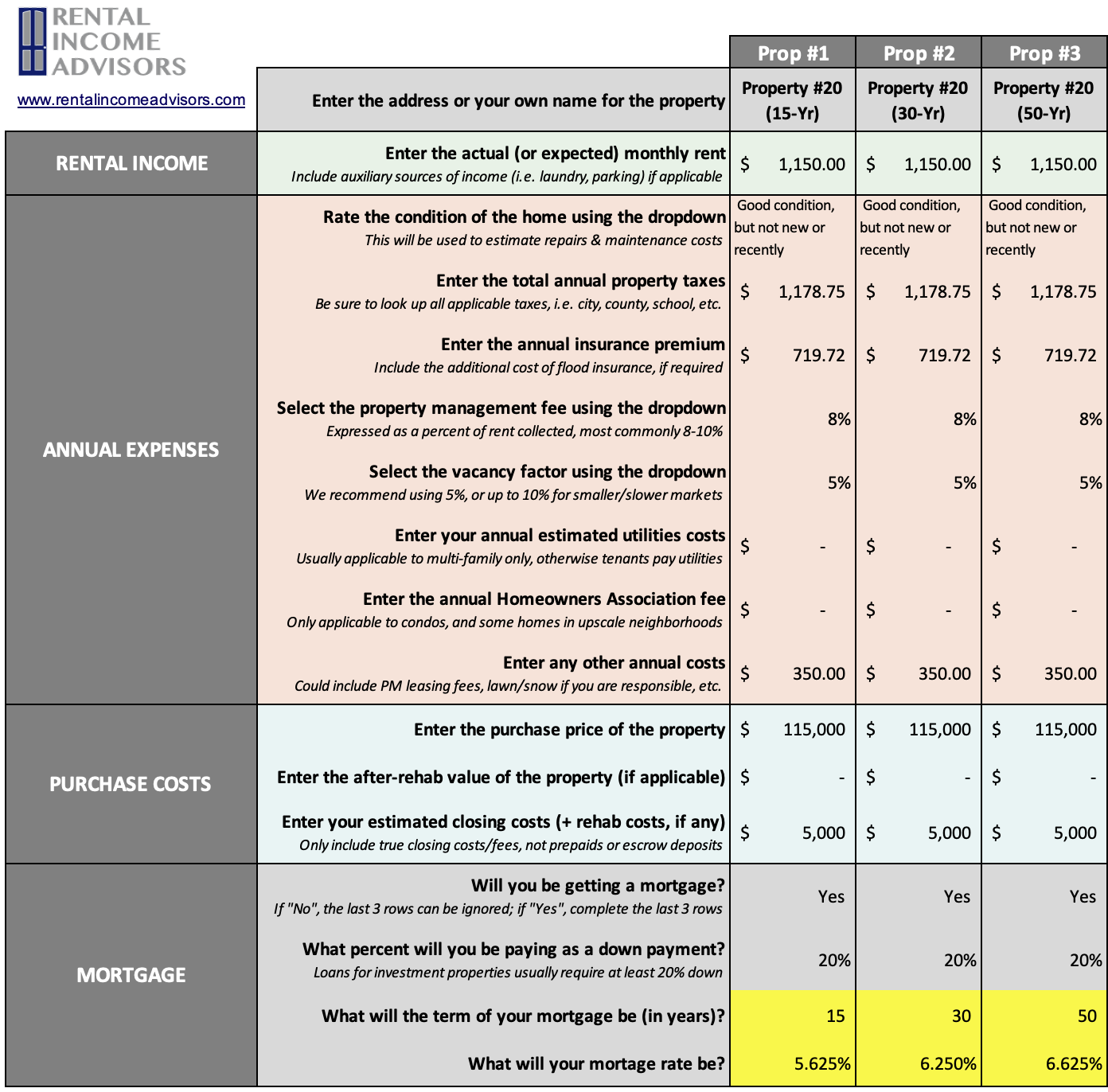

As I mentioned earlier, I’m going to use one of my actual properties to illustrate this example. It’s this house, which I bought in 2022 — but we’ll be modeling this is if we’re purchasing it today. Here are the true, current facts and figures about this house that I’ll use in this example:

Current Value/Purchase Price: $115,000

Closing Costs: $5,000

Market Rent: $1,150/mo. (the current tenant actually pays $1,165)

Property Taxes: $1,178/yr.

Insurance: $719/yr.

Maintenance Budget: $96/mo.

Management: 8% of rent

Vacancy Allowance: 5%

Other Costs: $350/yr (covering PM leasing & renewal fees)

20% down payment in each scenario

When I set up all these inputs in the RIA Property Analyzer, it looks like this:

(Want to use this Analyzer? You can! I make it available as a free download, and over 4,000 investors are already using it.)

I’ve set up three scenarios, one for each loan, so we can easily compare them side-by-side. The only inputs that differ in these scenarios are highlighted above: the term of the mortgage and the interest rate.

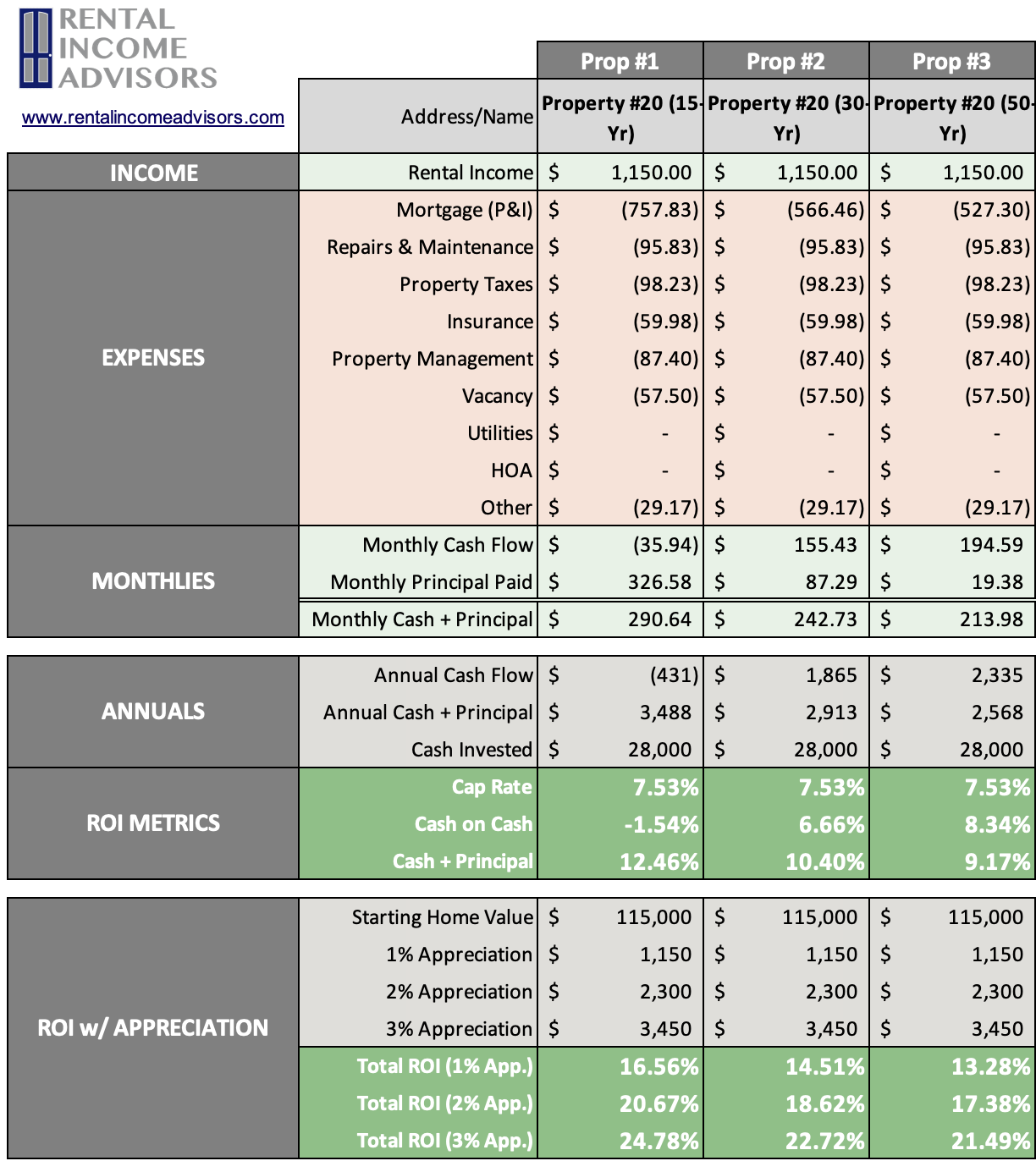

Clicking over to the results of these inputs, here’s what we see:

These metrics represent our Year 1 pro-forma for each scenario. A few important things to point out:

With a 15-year mortgage: this is a cash-flow negative deal where we expect to lose over $400 each year. (Not so keen on the 15-year mortgage anymore, right?) But we pay off a lot of principal each month, starting at $326 in the first month.

With a 30-year mortgage: we expect $150/mo. in cash flow, which is a 6.66% rate of return on our $28,000 invested. Our first loan payment includes $87 of principal.

With a 50-year mortgage: our cash flow is even better at nearly $200/mo, which brings our cash-on-cash up to 8.34%. But we pay off just a paltry $19 of loan principal with our first payment.

Take a look at the “Cash + Principal” rows, which sum up the expected cash flow and the principal paydown. The 15-year mortgage actually looks best here, with total Cash + Principal of $3,488 per year, vs. $2,913 and $2,568 for the 30-year and 50-year, respectively. That’s why the Total ROI figures at the bottom are highest for the 15-year mortgage.

So that means the 15-year mortgage is the best investment, right? RIGHT?

Well…not so fast.

50-year mortgages and the power of cash flow

My analyzer also includes a handy-dandy Multi-Year Model (MYM), which projects the initial pro forma into the future so we can visualize long-term trends for each scenario. There’s a LOT of numbers and graphs in the MYM, and I don’t want to get TOO deep in the weeds. (Wait, is it already too late for that? Don’t panic, stay with me!)

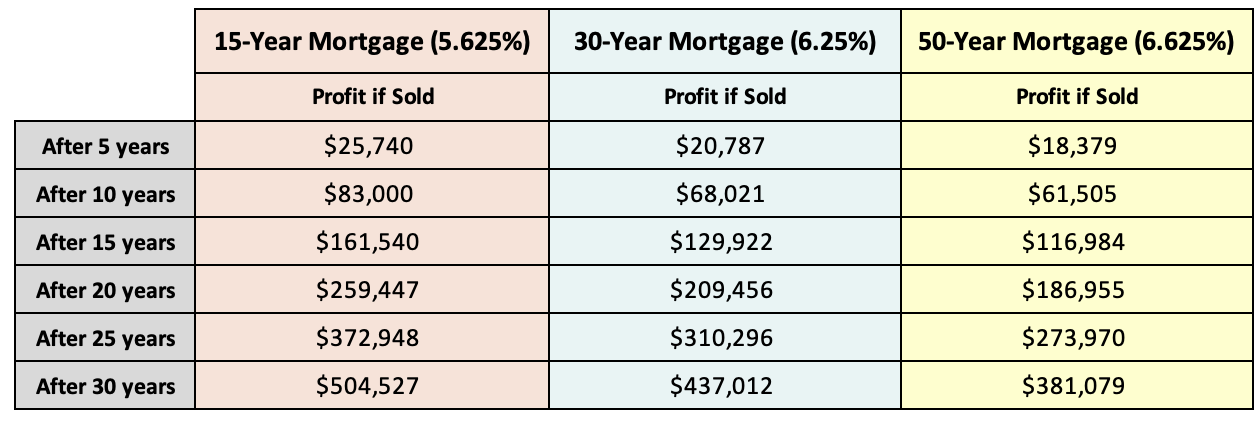

One of the figures that is calculated in the MYM is “Profit if Sold”. To arrive at this number, the analyzer adds up all the cumulative returns (cash flow + appreciation + mortgage paydown) through each given year in the model, and then subtracts out selling costs (i.e. broker commissions) and our initial cash investment. So which loan term gives us the most profit?

Assumptions: 3% annual expense growth; 3% annual rent growth; 3% annual appreciation

Again, the 15-year mortgage looks best here — not surprising, given the figures we saw in the previous section.

The cumulative cash flow in each scenario is baked into the final “Profit if Sold” calculation. But so far, we have ignored a hyper-critical question: what would we actually DO with any cash flow the property produces? We most likely wouldn’t just stuff it under our mattress for decades — but in fact, that’s exactly what the model assumes we will do.

In reality, we are much more likely to reinvest the cash flow, which has significant long-term financial implications and will change these numbers quite a lot. (I encountered a very similar situation in the long-term modeling I did for my Stocks vs. Rental Properties article, in which it was critical to model the reinvestment of rental property cash flow in order to accurately compare it to stock investing.)

Of course, we might also simply USE the cash flow, i.e. to buy groceries, take vacations, replace W2 income to create work freedom, etc. That wouldn’t have any financial value in our model, but of course it would have immeasurable life value.

Anyway, let’s look at what these total returns would look like assuming that annual cash flow is re-invested at a 10% rate of return, not adjusted for inflation (these are typical average returns for long-term stock market investing):

The changes here are actually quite fascinating. In the reinvestment scenarios, the longer mortgage terms quickly close the gap with the 15-year mortgage, and have pulled ahead once we reach the 15th year of the investment. The 50-year scenario finally pulls ahead of the 30-year scenario once we reach the 30th year of the model (and continues to grow its lead from there, btw.)

Over long investment horizons, then, the 15-year mortgage goes from being the best option to the worst option once reinvestment of cash flow is incorporated into the model. That’s because the cash flow is so skinny in the early years of the 15-year scenario; with the longer mortgages, even a few thousand dollars per year in cash flow in the early years has a chance to snowball over time.

This perfectly illustrates why cash flow is so important in rental investing. You’re going to do one of two very powerful things if your properties are producing cash: either reinvest the cash (i.e. in stocks, or in additional rental properties), or use the cash to live, creating freedom & flexibility in your life.

It should be noted that all of these scenarios are all pretty close together, in the grand scheme of things. They all provide exceptional long-term returns, and in each of them we see the power of mortgages to increase long-term wealth-building.

But still, cash is king. In thinking about my own investing, the difference between these loan options couldn’t be more stark. I own 25 rental properties that produce $100K+ in annual cash flow, money that allowed me to quit my corporate job in retail 7 years ago (and start a blog!) But had I used 15-year mortgages, I’d be producing vastly less cash flow, and I’d therefore still be working my office job. Even worse, I’d still have 8 more years to wait before I could expect any significant jump in cash flow, when my first mortgages would be paid off in full. Sounds awful!

I’m therefore very grateful that I had the option to use 30-year loans instead, and create meaningful cash flow right out of the gates. And if 50-year mortgages were available, I would strongly consider those as well, for the same reasons: it would allow me to keep even more cash flow, which I could then re-invest or spend.

Conclusion

We don’t know whether or not the government will facilitate the creation of 50-year mortgages. But if this happens, investors would have good reason to strongly consider this for their rental property financing.

While it’s true that the 50-year mortgage will come with higher rates, and more total interest paid over the life of the loan, it allows for greater monthly cash flow — and this is critically important. If the cash flow is re-invested, this may produce the greatest total returns in the long-term. If the cash flow is spent, the benefit to lifestyle can be priceless (as it was in my particular case.)

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.