What the FIRE Movement Gets Wrong About Rental Properties

Last updated: 2023

The movement known as FIRE – a wonderfully catchy acronym for Financial Independence Retire Early – has been having a moment recently. Just a few years ago, it was a loosely assembled rag-tag team of bloggers and their adherents, who preached the gospel of ultra-frugality as a means to achieve financial independence at a young age and exit the rat race. (Presumably with an emphatic mic drop.)

But of late, it has achieved a much broader audience through popular podcasts and books, and has received plenty of attention – and some derision – from mainstream media that has covered it. Even Suze Orman, one of the best-known personalities in the world of personal finance, famously linked herself to the FIRE movement — though only by being harshly and publicly critical of it. Still, this is evidence of the growing influence and relevance of the movement. (I mean, she was actually a guest on a FIRE podcast when she did it, so…)

Now, don’t let the title of this article fool you: I am well-versed in the FIRE canon, and I’m a big fan. I found some of those podcasts and blogs just at the moment I was running out of patience with my corporate career, and they provided both the knowledge and inspiration I needed to quit my job at age 38. (If you’re curious, some of my personal favorites are the Afford Anything blog & podcast, the Our Next Life blog, and the ChooseFI podcast.)

The FIRE movement gets a lot of things right, in my opinion: the rejection of mainstream consumerism and “keeping up with the Joneses”; the idea that your spending should be aligned with your values; the view that nobody can time the market, and total stock and bond index funds are all you really need in your investment portfolio. And of course, their one BIG idea: that a life well-lived is not likely to be one in which you labor for decades in a job you hate.

But one of the central tenets of this financial quasi-religion is misleading, or at least woefully incomplete, and is due for a close re-examination. It’s commonly known as “the 4% rule”, and it prevents many FIRE adherents from reaching what would otherwise be an obvious conclusion: if you want to retire early, cash-flowing rental properties are the best way to get there.

What is the 4% Rule?

The 4% rule grew out the “Trinity study”, an influential 1998 paper written by three finance professors at Trinity University. The study backtested a variety of hypothetical retirement portfolios against historical market returns to determine what a “safe withdrawal rate” would be – that is, the amount that could be withdrawn from a portfolio each year with the safe assumption that the money would never run out.

Their conclusion? A conservative safe withdrawal rate is 4%.

That is to say: regardless of whether you have stocks, bonds, or a mixture of the two, if you retire and withdraw 4% of your principal each year to cover your expenses, you are almost certain to live comfortably through your retirement and never run out of money. (To be a bit more precise, you would withdraw 4% your first year, and then that initial amount adjusted for inflation in each subsequent year, regardless of your portfolio balance in those later years.)

Disciples of the FIRE movement love the 4% rule, partly because it decouples the idea of retirement from reaching a specific age. Using the 4% rule, you can retire at ANY age if you have enough money invested to support your expenses.

How much money would you need to save? The answer depends on your expenses — on how much income you need to support your lifestyle. To get to a point where 4% of your investment portfolio covers your costs, you’d need to save up 25 times your annual expenses. So if you spend $40K per year, you’d need 25 x $40K = $1M invested.

When I did this math for myself years ago, the news wasn’t good. I realized that I spent nearly $100K per year, which I couldn’t significantly reduce unless I left New York City. Which I wasn’t able to do anytime soon. Which meant I’d need $2.5M invested in order to retire. Which meant I had a LONG way to go.

Which meant…something had to give. I knew I couldn’t keep doing my office job for the years (or likely decades!) it would take to build up a nest egg like that, so I looked desperately for a way around this rule.

After all, I told myself — rules are meant to be broken, right?

Paper Assets vs. Real Estate

By making the 4% rule gospel, the FIRE movement has developed a myopic focus on paper assets (stocks & bonds) as a means to achieving financial freedom. (To be fair, this is not true across the board, but it’s true enough that I’m comfortable making the generalization.)

And because 4% isn’t really very much, FIRE disciples think a lot about reducing expenses. Why? Because if you can cut your expenses from, say, $80K/year to $40K/year, you can reduce your required investments from $2M to $1M, and therefore be able to retire a lot sooner. That’s why a lot of people associate the FIRE movement with ultra-frugality – for example, living in super-affordable areas, pinching pennies on everything from cars to food to cable TV, and so on.

But all of this ignores another major asset class that can also produce cash to pay the bills, and is readily available to the average investor: rental real estate.

And it turns out that rental properties absolutely CRUSH the 4% rule. Let me talk about how.

The Magic Money Machine

First, let’s reframe the 4% rule and broaden its applications. At its core, what the rule really says is that in order to retire (or at least have the freedom to quit your job if you want to), you need to have assets that produce income in excess of your expenses. Let’s refer to those assets – be they stocks, bonds, real estate, business ownership, or whatever – as “The Magic Money Machine”.

The Magic Money Machine is real. The only thing it does is make more money. And it’s available for purchase. You can buy it anywhere, anytime. And you can buy as much or as many as you want. Instead of buying, say, a new car or TV or couch, you can instead use that money to buy a machine that makes MORE MONEY. Once your machine is big enough that it makes more money than you spend, you win the game and you can quit your job. (Or get a lower-paying one you like better. Or start a blog!)

Quick aside: I’m not a marketing expert but I really think it would be easier to convince people to invest if we stopped calling them investments, and started calling them “Magic Money Machines”. I mean, who wouldn’t want one of those?!?

Anyway – since a picture is worth a thousand words, and because I have to use my rapidly atrophying Powerpoint skills for SOMETHING, here are the four stages of this journey from working person to wealthy owner of a Magic Money Machine, in simple diagrams:

Stage 1: Getting By

In Stage 1, you have a job that pays you enough to support your lifestyle — but that’s it.

Stage 2: Wealth-Building

In Stage 2, either by cutting expenses, increasing your income, or both, you now earn enough to support your lifestyle while ALSO saving for your Magic Money Machine — in other words, you begin investing and building wealth.

Stage 3: Financial Freedom

In stage 3, you’ve reached financial independence because your Magic Money Machine makes enough money all by itself to support your lifestyle. Notice there is no “Job”, or trading time for money, in this stage.

Stage 4: Massive Wealth-Building

In the final stage, your Magic Money Machine makes MORE money than you need, with the excess being reinvested back into the machine to make it ever larger and more powerful.

At this point you’re probably saying “Gee, I wish I had a handy 1-pager with those four stages of wealth-building, so I can download it, print and post it on my wall, and share it on social media!” Your wish is my command:

So let’s return to the main question: if you’re looking to get to Stage 3 (Financial Freedom), how much does that Magic Money Machine cost? Well, it turns out there are different models of Magic Money Machines available. As we’ve already discussed, if you buy the “stocks & bonds” model, it will cost 25 times your annual expenses.

Which ain’t cheap. But what if there were a less expensive Magic Money Machine out there?

How Many Rental Properties Do I Need to Retire?

How expensive would a “rental properties” Magic Money Machine be? Let’s look at some examples to find out – and for the purpose of these examples let’s say you needed $60K per year to cover your expenses. (Recall that using the 4% rule, you’d need to have $1.5M invested in order to retire and safely draw $60K per year.)

For rental properties, the metric that comes into play here is cash-on-cash returns, which takes your net cash flow (your income after all expenses are paid) and divides it by the amount of cash you’ve invested. In essence, it’s a measure of how much NEW cash your invested cash makes each year.

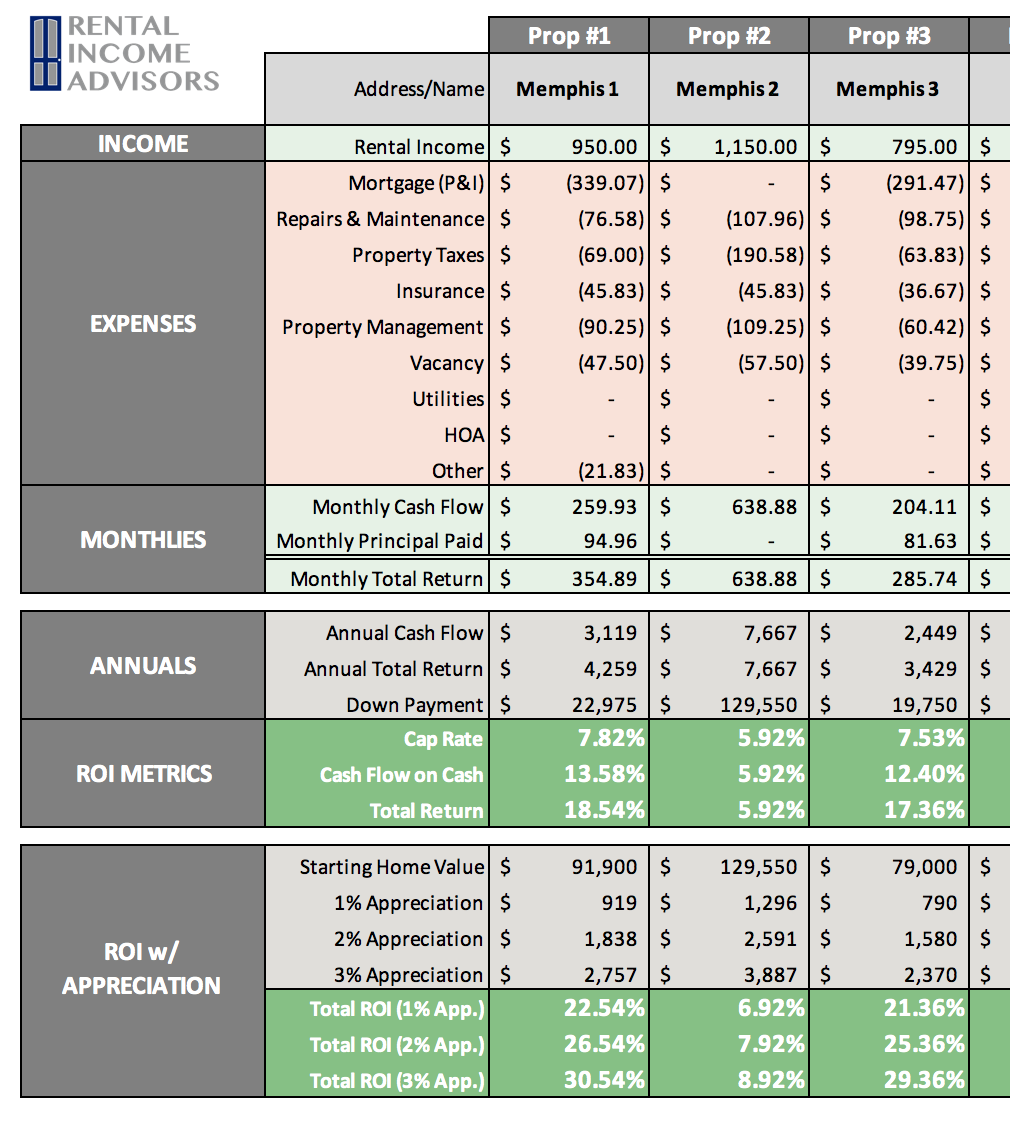

The average property in my 16-unit Memphis portfolio earns ~10% cash-on-cash returns. That means every $10K I invest produces $1K in annual cash flow. (These are actual numbers that hold up under scrutiny – I publish my actual portfolio performance each month that validates the financial models I use.)

From there, the math is pretty easy: to produce $60K in annual cash flow, I would need to invest $600K in rental properties like the ones in my portfolio. That’s still a lot of cash, but it’s a lot LESS than the $1.5 million you’d need using the 4% rule.

And even better returns are possible. This little house I own has a 14% Cash-on-cash return, one of the better ones in my portfolio. If you could achieve 14% cash-on-cash, then you’d only need ~$430K to produce your $60K per year of income!

My most recent acquisition is a duplex with some outstanding financials – it will produce nearly 20% cash-on-cash. If you could get this consistently, you’d only need $300K invested in order to retire with $60K per year in income. (To be fair, achieving those kinds of returns is rare, particularly as mortgage rates rise from their historical lows; for further reading, I wrote an article about how to navigate higher interest rates.)

As you’ve probably already realized, the formula here is simple: take the annual income you need to earn, and divide by the cash-on-cash returns you can achieve. The result is how much you need to invest in rental properties in order to achieve that income.

This formula is really just a broader application of the 4% rule that works with ANY income-producing asset – and it all boils down to the cash-on-cash returns you can achieve:

Formula Using the 4% Rule:

Formula Applied to Rental Properties:

By now it should be clear: as long as you can get reasonably strong cash returns, rental properties are a far cheaper way to buy the Magic Money Machine you need for retirement, whether you’re looking to retire early or at a more traditional age.

It’s not even close, in fact. Think about it: would you rather wait to save up $1.5M in investments, or be able to retire when you get to $600K? The difference could mean many additional years – even decades – of a “work optional” lifestyle that you can fill with passion projects, family time, leisure activities, or whatever else brings you joy and satisfaction.

What does this math really mean for YOU specifically? Well, here’s a breakdown of how much money you’d need to invest in order to achieve various levels of monthly income:

You want to download that one too, right? I knew it!

How many rental properties do these numbers equate to? A typical property in a cash flow market requires ~$30-35K invested on average. So every $100K invested is about 3 properties. If you’re looking at the chart and thinking a portfolio of that size will be too much work, worry not: a professional PM will take care of all the day-to-day stuff for you, making it possible for even a large portfolio to be nearly completely passive for the owner. (I know this is true, because it’s what I do now: my 25-unit portfolio requires no more than 1-2 hours per month of my attention.)

Based on what we’ve covered so far, it’s already an open-and-shut case that rental properties crush the 4% rule. But believe it or not, it gets even better.

But Wait, There’s More!

Using rental properties for your Magic Money Machine comes with a few other built-in advantages.

First, whereas the withdrawals from investment accounts reduce the principal (aka the amount you have invested), the cash flow from rental properties does nothing to your principal (aka home equity). All the income from rental properties is essentially a dividend. Whatever amount you have invested stays there, and continues to appreciate with the value of the home.

Further, your equity increases even more over time if you have a mortgage, because you’re gradually paying down the mortgage balance. You also get bigger benefits from home price appreciation when you have a mortgage, as I discussed in detail here.

Finally, there are tax advantages. Unless you have a Roth account, withdrawals from your investment or retirement accounts will be taxed as ordinary income. By contrast, the income from your rental properties will be taxed at a much lower rate – perhaps not taxed at all – because of the enormous tax advantages given to real estate investments, primarily deductions and depreciation.

One quick caveat before I wrap up: retirement accounts (401k, IRA, Roth IRA) are still excellent tax-advantaged vehicles for saving and investing. During my working career, I always maxed out my annual 401k contributions, and don’t regret doing so. The approach I advocate is to max out those contributions, and use whatever is left to buy rental properties. But each investor must make their own decision about how to prioritize their investments between paper assets, real estate, cash, and other asset classes.

Conclusion

The FIRE movement is gaining a lot of traction, and it offers very useful insights and perspectives on personal finance and life optimization.

However, the 4% rule has received too much focus, leading to an over-emphasis on stock & bond investing vs. rental properties, which offer the potential for much greater cash returns (along with other benefits.)

To retire comfortably, you need a “Magic Money Machine” big enough to cover your expenses – and rental properties are by FAR the fastest way to achieve this.

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

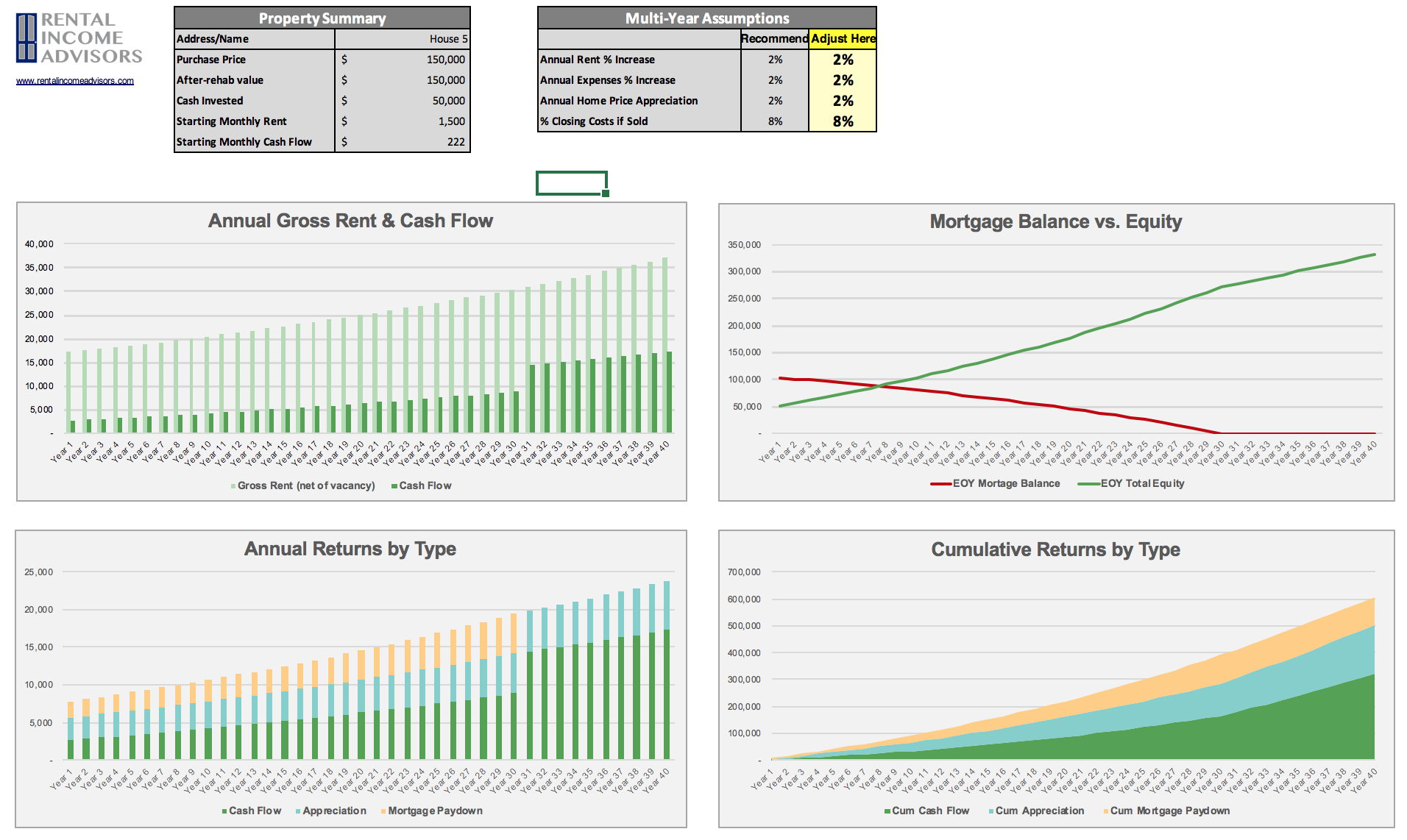

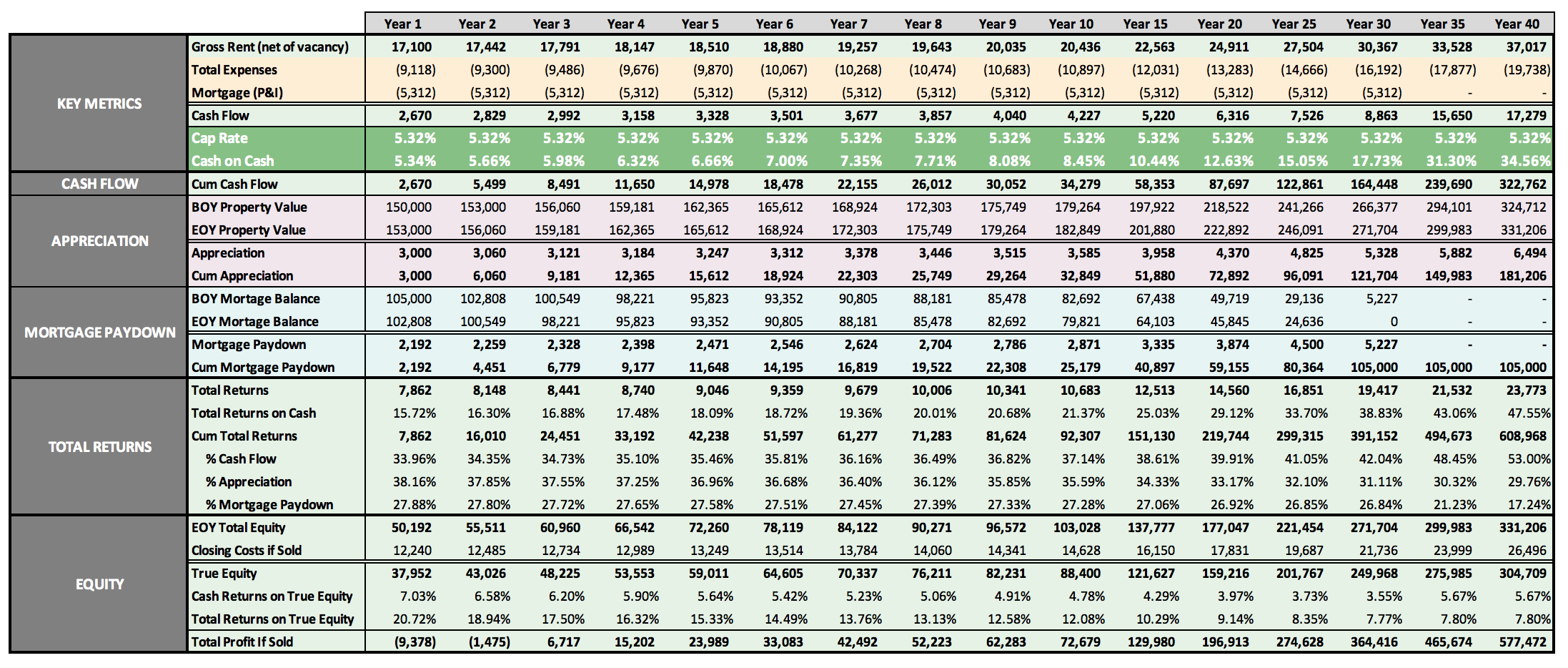

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.

RIA Property Analyzer

Need help running the numbers on your own properties? Get the FREE RIA Property Analyzer. I guarantee this is the most intuitive, elegant, and powerful free tool you’ll find to run the financials on rental properties.

OR