No, This is Not Another Housing Bubble

Last updated: 2023

Note: this analysis represents a point in time (mid-2021, specifically), and as a result I am not planning to go back to the article to update it with more recent stats. But so far, my conclusion that there was not an asset bubble in real estate has held up very well.

Many of my coaching clients are currently in the process of starting or scaling their own rental property portfolios. They’re encountering a red-hot, highly competitive market that’s making things tough: quality properties are selling within 24 hours, often with multiple cash offers above asking price. And this isn’t just in one market — it’s the same story in every cash flow market where I’m working with clients.

This guy’s take on the current market is hilarious, and pretty spot-on:

For many people, the current buying frenzy is reminiscent of the housing market of 2006-2008, which of course burst spectacularly and led to the global financial crisis. It feels the same today, so this must be another bubble, right?

Plenty of online commentators and prognosticators think there IS a bubble. They mock the “this time is different” crowd who point to numerous ways this market does NOT look like 2008.

But here’s the thing: the “this time is different” crowd is making some good points.

To be clear, I’m not in the predictions business. I tend to side with Yogi Berra, who wryly observed that “it’s tough to make predictions, especially about the future.” My approach is to trust my numbers and my long-term investing strategy, and not worry much about where home prices are headed or trying to time the market.

But in this case, the state of the market is causing some rental property investors to wonder whether it’s better to wait, stay on the sidelines, and enter the market when there is less competition. So the topic of “Housing Bubble 2.0” is now impossible for me to avoid. I’ve been forced to look carefully at this question, and formulate an opinion on the risks of a housing market crash.

The available data leads me to believe strongly that this is NOT a bubble, and that investors who choose to wait it out will not be rewarded.

Here’s an outline of what I’ll discuss in this article:

First, I’ll present data that will establish the facts about the current real estate market. (Yes, it’s very hot.)

Then, I’ll review several possible underlying causes that may help to explain why competition and prices are increasing.

Finally, I’ll examine numerous potential catalysts for a crash, and how likely we are to see each of them in the near future.

Let’s get into it!

1 Current Snapshot of the Real Estate Market

There’s no doubt about it: the U.S. real estate market is on fire. Here is the data to prove it.

More Homes are Selling

Above is a chart of the seasonally-adjusted annual rate of existing home sales (in millions) for the last 5 years. The impacts of the pandemic are very clear: home sales plunged in March 2020 as the pandemic hit, and then surged in the second half of 2020. They have fallen back somewhat in early 2021, though the rate still exceeds the pre-pandemic averages — and the pullback can be partly explained by the fact that there are simply so few homes available for sale.

Fewer Homes are Available for Sale

This chart shows the number of existing homes that are available for sale each month for the last 5 years. In early 2021, the inventory of homes for sale fell to an all-time low of about one million. This is being caused by more than just increased sales eating up inventory; there have also been fewer homes being listed, which may be the result of homeowners not wanting to have buyers come through their house during a pandemic, or not wanting to go through a move themselves. The uncertainty of the pandemic has caused many people to stay put when they might otherwise have moved.

A little quick math shows that at the current rate of sale, the existing supply of homes would be exhausted in about 2 months, which is also an all-time low. Homes are also selling faster: the median number of days a home sits on the market has fallen from 29 days a year ago to just 18 days today.

Home Prices are Rising

Low supply and high demand can only mean one thing: upward price pressure. And that’s exactly what the data show. This chart of the median price of existing home sales shows prices increasing strongly in the second half of 2020, and spiking again in early 2021.

So the facts are clear: more people are buying homes, fewer homes are for sale, and that is causing prices to rise. But WHY is that happening? What are the underlying root causes of these trend changes? Is it just the pandemic, or are other factors in play? Will pandemic affects subside later this year as the majority of people are vaccinated, or will some of those changes be long-term? Let’s explore these questions.

2 What Explains the Hot Real Estate Market?

Understanding the underlying forces that drive a large, complex market like housing is notoriously difficult. But let’s take a look at some of the factors currently in play that may help to explain the current market — both short-term, pandemic-related factors, as well as longer-term trends that are beginning to mature.

Pandemic-Related Demand Shifts on Housing

When the pandemic hit, many people naturally wanted more space to spread out. This caused an abrupt softening of demand — from both renters and owners — in dense urban centers, and corresponding strong demand in suburban areas. Some of those urbanites were looking for temporary homes or second homes outside the city, while for others the pandemic was the impetus to make a permanent move they had already been contemplating.

This urban vs. suburban dynamic played out in major metro areas all over the country. In New York City where I live, the market fell off a cliff in March 2020; buyer and renter activity was reduced to a trickle, and both home prices and rents began to fall — and they’re still falling. Despite the strong housing market nationally, New York City still has a glut of inventory and prices that are more than 5% lower than a year ago. Meanwhile, the surrounding suburbs have been booming, with prices UP 10-20% since last year.

But in the last few months, activity in the city has picked up dramatically as buyers take advantage of lower prices, and return to the city in anticipation of the end of pandemic restrictions. This may signal that some of these pandemic-induced demand shifts will be temporary — but I suspect not all. Some people, particularly if they have the ability to work from home, will keep their additional space outside the city, or choose to relocate permanently.

Long-Term Demand Shifts on Housing

There are also long-term trends that reinforce this same shift in demand away from the most densely populated (and most expensive) cities:

Work-From-Home: this trend was already growing before the pandemic, but a whole new world of possibilities has now opened up, for both companies and workers. Some workers will now have the opportunity to live wherever they want; others will have a flexible schedule with reduced time in the office, making a longer commute from the suburbs easier to justify.

Affordability: it’s no secret that the cost of living — and housing in particular — has exploded in places like New York City and San Francisco in the last several decades. This has created market pressure for people to move to other places, where much more of the housing stock is single-family homes, rather than multi-unit structures.

The Rise of Secondary Markets: there are other reasons beyond affordability to move to some of those markets. In the last decade, places like Nashville, Austin, Phoenix, Atlanta, Columbus, and others have become much more attractive to those craving the urban lifestyle that big cities offer. The experiences — cultural, social, culinary, etc. — that used to be the exclusive province of premier cities are now available in many secondary markets, also reducing the gravitational pull of those large cities.

If these long-term trends continue — and we have every reason to believe they will — they will continue to produce additional demand on single-family homes all over the country. (It will be interesting to watch the release of more detailed 2020 Census data later this year, which may provide more evidence for these shifts.)

Supply Shortage of Homes

After the housing crash a decade ago, homebuilders became much more cautious about building homes. In fact, for many years after the last crisis, new homes were built at the slowest rate since records were kept. Only recently has the rate of new home construction rebounded to historical averages. This chart shows home starts (in millions) going back to the 1950s:

Even though the pace has picked up recently, there is still an overwhelming consensus that we need to build more homes to bring the market back into balance, given how few homes have been built in the last 15 years. Rising prices for lumber and other raw materials may make this even more difficult in the short run.

Low Mortgage Rates

Interest rates have been at historic lows for many years. They ticked up a bit earlier this year, but 30-year mortgage rates are still below 3%. This seems normal to us now, but remember that before 2010, mortgage rates had never been below 5%:

The Fed has indicated its commitment to keep interest rates low for the foreseeable future, even as the economy picks up steam, which should help to keep mortgage rates low as well. Low mortgage rates support home prices, because they increase the buying power of purchasers, and make a greater range of properties attractive to investors. (In fact, from an investor standpoint, low mortgage interest rates are one of the things that makes rental property investing such a slam dunk at the moment, even when compared to stocks.)

Demographic Factors

You’ve probably heard plenty about the millennial generation: they’re digital, they’re idealistic, they’re getting married later, and so on. There are also a LOT of them — check it out:

Notice the high peak in the yellow section of the visual. From a demographic standpoint, a large group of Americans is now entering their prime home-buying years, which will buoy demand for houses for the next decade. (You may have also heard that millennials support the sharing economy, and aren’t buying homes at the rates their parents did. That’s true enough — 42% of millennials own homes, compared to 48% of baby boomers when they were the same age — but demand from millennials is increasing fast.)

Increased Demand for Rental Homes as Investments

Just as important as any factor listed above is the continued increase in demand for rental property investments. Investors of all stripes have realized that there is money to be made in single-family homes, including less expensive starter homes in secondary and tertiary markets all over the country, and technology is giving them greater access than ever before to this sector.

There are a number of related trends that are driving this:

Remote Investing: technology has made it easier to purchase and manage properties from afar. Online platforms for buying and selling (such as Roofstock), as well as new and better software for landlords and property managers, has made remote rental property investing a much more viable option than ever before, causing a continued influx of investors into lower cost, high cash-flow markets. (Naturally, I’ve participated in this trend, and wrote about it in my article on Out of State Rental Properties.)

Institutional Investment in Rental Homes: institutional investors have also gotten the memo about rental homes. Hedge funds, endowment managers, corporations, and governments have gotten in the game, and begun to buy up rental homes for their high yields and stable long-term prices. While the vast majority of rental investors are still small landlords, this is changing fast.

Short-Term Rentals (AirBNB): while long-term rentals still dominate, many investors have taken advantage of another new technology — namely, AirBNB — to make money with short-term rentals. And this is no longer just about renting out an extra room; increasingly, investors are buying houses, fixing them up, and running them as full-time AirBNBs. As NYU Professor Scott Galloway illustrates in one of his many excellent blog posts, AirBNB is huge, growing, and not going anywhere.

3 What Could Cause a Housing Crash?

So far, I’ve demonstrated that housing is indeed very hot, and that there may be sound underlying reasons for that. But couldn’t a crash still happen? Let’s look at some potential catalysts for a housing crash, and see how likely those things actually are.

Soft Demand: People Stop Wanting to Buy Houses

People will always need a place to live, and homeownership rates have been remarkably stable over time. So this doesn’t seem likely, especially given all the millennials who will be looking to put down roots as they get older. If prices keep increasing, that will eventually suppress demand, but that would cause prices to plateau, not crash.

Overbuilding

If we build too many houses, supply could outstrip demand, causing prices to fall. But as discussed above, there is still a significant UNDERsupply of housing across the country, which in the best-case scenario will take many years to correct.

Foreclosures

Housing supply could also increase due to foreclosures, which could have the same effect as overbuilding. This was part of the story in 2008, when foreclosures increased dramatically due to less-qualified buyers getting access to easy mortgages. (Or, more accurately, being duped into them by unscrupulous lenders who could repackage those loans into garbage financial products in order to externalize the risk, while ratings agencies and government regulators were either complicit or asleep at the switch. Btw, if you’ve never watched The Big Short, I highly recommend it.)

Some have argued that moratoriums on foreclosures during the pandemic means that there is a tidal wave of foreclosures coming once the pandemic ends. This just isn’t borne out by the facts, though — mortgage delinquencies, a precursor to foreclosures, ticked up only slightly last year, and are already headed back down:

Also, keep in mind that the covid-19 recession hit low income people (generally renters) much harder than wealthier folks (generally homeowners). So there is really no evidence to suggest a wave of foreclosures in the near future.

Economic Shock

What if there is another, deeper recession? Or a resurgence of the pandemic? Or inflation rises? Or there’s an asteroid impact?

(Some good news on that last one: we’re watching asteroids very closely, and despite what you’ve seen in the movies, the chance of a major impact in the next few centuries is breathtakingly low. Phew!)

But it’s nonetheless true that economic shocks from any number of sources are always possible — and if we wait long enough, they’re absolutely certain. Predicting them, however, is a tricky business. If you’re worried about them, it may be worth noting that we’re still in the middle of a historic pandemic and economic shock, and housing has done just fine. In fact, real property is a great asset to hold to hedge against both unforeseen economic shocks and inflation — historically, housing tends to do pretty well during recessions. Thus, staying out of real estate investing out of fear of an unknowable future doesn’t make a lot of sense.

Higher Interest Rates

If interest rates were to materially increase, this would certainly depress housing prices by lowering the effective purchasing power of buyers. But will interest rates rise? Hard to say — but as already discussed above, it doesn’t seem imminent based on the currently monetary policy of the Federal Reserve. (Note: of course they did go up. In a separate article, I discuss the impact of those higher rates on rental investors.)

Tighter Lending Standards

When mortgages are easy to get, this is good for housing (at least in the short term — see 2005-2007); when mortgages are tough to get, this is bad for housing, because fewer people can qualify to buy a home.

So is today’s housing demand being artificially buttressed by easy money? Not at all. Here’s a look at the Mortgage Credit Availability Index, designed to measure how tight or loose lending standards are:

This shows that lending standards have remained reasonably tight since the Great Recession. In fact, the response of lenders to the pandemic was to TIGHTEN lending standards — you can see the pronounced dip at the right side of the graph. In other words, banks actually retrenched during the pandemic, meaning that the current surge in the housing market is happening in spite of tighter lender standards, not because of looser ones. (If you’ve recently applied for a mortgage, you know this first-hand!) If anything, the coming years may see a loosening of lending standards back to pre-pandemic levels, which would produce further upward pressure on home prices.

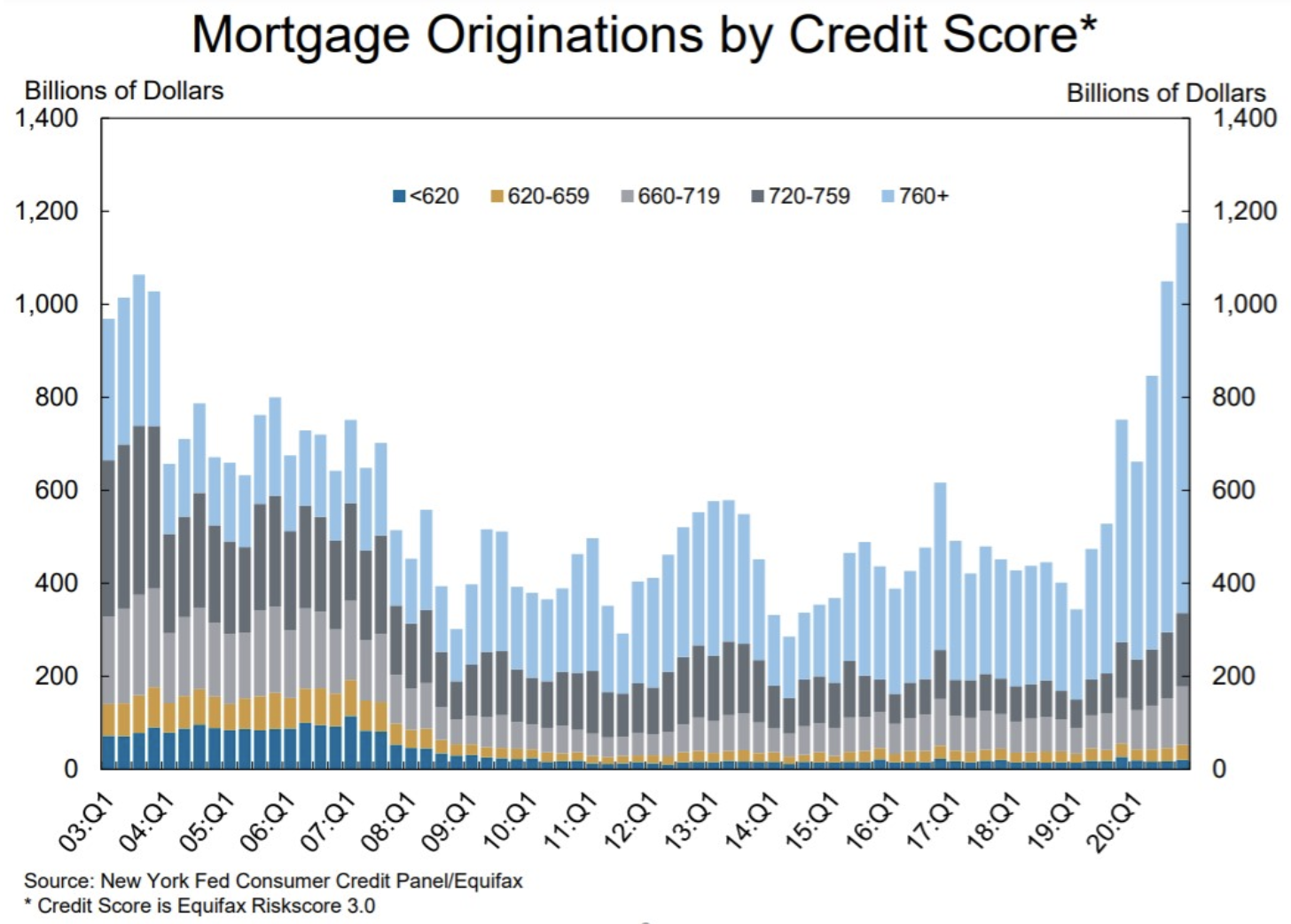

You can also see evidence for tighter lending standards in the credit-worthiness of borrowers. Low interest rates have driven mortgage originations to record levels, but most of that increase has come from borrowers with excellent credit, not because of banks lending money to those with poor credit:

Conclusion

Here are the key takeaways based on all available facts and data about the current housing market:

You’re not imagining it — the market is very hot right now.

More houses are selling, with less time on the market

Inventory is historically low

Prices are rising

There are a number of sound explanations for this.

Pandemic impacts

Long-term demand shifts

Housing supply shortage

Low interest rates

Millennial home-buying

Demand for rental homes as investments, from remote investors, institutional investors, and AirBNB

None of the possible triggers for a housing crash seems very likely.

Soft demand

Overbuilding

Foreclosures

Economic shock

Higher interest rates

Tighter lending standards

This is very likely NOT a bubble. Therefore, trying to wait it out is not likely to be a winning strategy for investors.

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.

Free Rental Property Analyzer

Now that you know there’s no bubble, you may be itching to get into the rental property game! If so, you should know that a well-designed rental property calculator is the most important tool an investors has. It allows you to quickly calculate key metrics and understand your cash returns on a target property. You can also answer questions like:

How much do your cash-on-cash returns improve if you use a mortgage vs. paying in cash?

What will your average monthly cash flow be?

How will your returns change in future years?

Those questions can be easily answered with side-by-side comparisons in the RIA Property Analyzer. I guarantee this is the best free rental property calculator out there today, and many of my readers have told me the same. It’s both powerful and very simple and intuitive to use. Check it out!