The Benefits (and Risks) of Turnkey Rental Properties

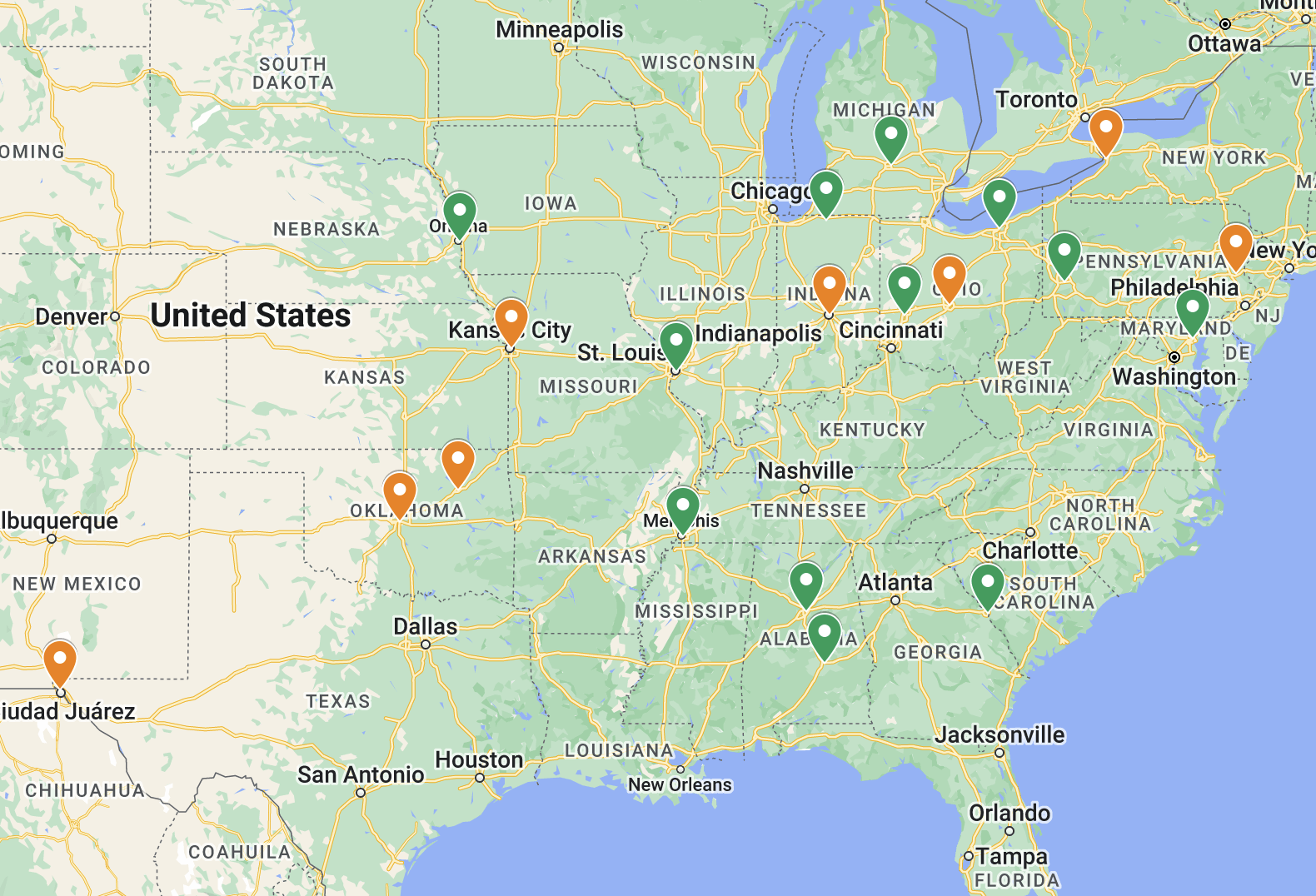

Turnkey rental properties are an increasingly popular way for investors – particularly out-of-state investors – to get into the real estate game in lower-priced markets predominantly in the West, Midwest, and South. In fact, I’m one of those out-of-state investors myself – of my 16 properties in Memphis, four of them were turnkeys.

In this article, I’ll provide an overview of the turnkey model, examine the purported benefits of turnkey investing, and share my personal experience (and data!) from my portfolio to see if turnkey properties actually live up to the hype.

What Is a Turnkey Property?

A turnkey property is one that has been recently renovated and is being marketed for sale to investors, usually with a tenant already in place. A turnkey provider is a business that finds properties (usually in very bad shape), buys them, completely renovates them, places a tenant, and then looks to re-sell the property to an investor for a profit. In essence, they’re very much like a house flipper, but instead of selling to an owner-occupant, they sell to an investor. Some turnkey providers will also do the property management for you after you buy the house.

What does a turnkey renovation entail? Usually it means replacing all the home’s major systems, and installing new (but not high-end) finishes that are focused on functionality and durability. Specifically, you can usually expect a turnkey property to have:

New roof

New HVAC system

New furnace and hot water heater

Updated plumbing and electrical, as needed

New or refurbished kitchen, including cabinets, countertops, and flooring

New or refurbished bathrooms, including vanities, toilets, tubs, and surrounds

New flooring throughout, typically LVP (luxury vinyl plank flooring), but sometimes carpeting in bedrooms

New light fixtures

Fresh interior paint in neutral color, with doors and trim white

Full cleaning after completion of renovation

Exterior paint and/or landscaping, as needed

When all that work is completed, it should look something like this – here is one of my turnkey properties that I bought in early 2019:

The primary benefits of buying a turnkey property should be clear: you’re getting a newly renovated property with all the big-ticket items replaced, which should mean lower maintenance expenses and fewer surprises in the first 5-10 years; and you’re getting that home with a tenant already in place so you can cash flow from Day 1.

Sounds great, right? So why would you NOT buy turnkey properties? Well, there are a few oft-cited reasons – so let me address those first before I discuss the benefits in more detail.

Critiques of the Turnkey Model

You generally hear two central criticisms of the turnkey model: first, that the homes are too expensive and there are no below-market deals to be found; and second, that turnkey providers themselves may not deliver what they say they will.

“You’ll Overpay”

Some investors don’t like the turnkey model because there are no “deals” to be had – that is, you’re always going to pay retail (market value) for the home. In fact, you may pay a bit more than a typical home in the neighborhood on account of it being newly renovated. And many turnkey providers won’t discount at all – you can make a full-price offer or nothing.

Investors who avoid turnkeys for this reason prefer to create value in their real estate investments by finding discounted prices, usually on distressed properties, pouncing on those deals, and getting the properties back into shape. Then they’ll either sell those properties (“fix and flip” model) or rent them out (“fix and rent” model). There’s certainly money to be made this way – after all, we know that the turnkey providers themselves make money doing this.

But this is definitely NOT a passive way to invest in real estate. It’s a completely different animal vs. the “buy and hold” model that I prefer, and it takes a lot of work. To be successful, you have to know how to find great deals in the competitive marketplace of distressed/foreclosed properties, and you have to know how to renovate properties quickly, correctly, and at the right cost. Many investors don’t have the time, expertise, or desire to try their hand at this, and would prefer a more passive (and less risky) approach.

So will you pay full price for turnkey properties? Yes. And it’s true that you’re funding the turnkey provider’s profit by doing so. But this isn’t a problem if you’re an investor looking for passive income; instead, it’s the price you pay for the convenience and security of the turnkey model, which sets you up perfectly to reap the amazing long-term rewards of buy & hold rentals.

“They’ll Underdeliver”

It’s easy to find horror stories online about turnkey providers. They did shoddy work that didn’t hold up; they failed to disclose issues with the house; they took way too long to complete the renovation; their pro-forma was inaccurate/overly optimistic about the ROI; they placed a bad tenant; and so on.

But this isn’t terribly surprising, when you think about it. After all, you can find similar horror stories about all sorts of companies and service providers – hotels, airlines, cable companies, contractors, plumbers, dry cleaners, hair colorists, and so on ad infinitum. (Also, landlords!)

This doesn’t mean those business models are inherently flawed. It just means you have to do your due diligence and find a good one. Turnkey providers are no different. I’ll offer some tips at the end for how to properly vet turnkey providers and avoid becoming a horror story yourself.

But now, on to the benefits of turnkey!

The Benefits of Turnkey Investing

Turnkey providers make several claims, explicitly or implicitly, about the benefits of their properties to you, the investor. Specifically, they will promise:

Rental property investing made easy. They do the upfront work for you by finding, purchasing, and renovating homes that will make good long-term rentals.

Cash flow from day 1. With no rehab needed, and a quality tenant already in place, the positive cash flow starts right away.

Lower maintenance expenses. A full rehab means fewer of those pesky repairs in the first few years, which saves you both money and headaches.

No CapEx surprises. All the major CapEx items (roof, HVAC, etc.) will be brand new, so you won’t have to worry about replacing those for many years.

Higher rent potential. A sparkling new home is easier to rent, and should fetch a higher price than an average comparable property in the area.

Less hassle to manage. Because turnkey rentals should be “smooth sailing” for many years, it’s less hassle for the owner – and perfect if the owner doesn’t have a lot of time to devote to their rentals.

Let’s examine each of these six claims in detail, and see how well they hold up. Whenever possible, I’ll bring in data from my own portfolio to illuminate the discussion.

Turnkey Claim #1:

Rental Property Investing Made Easy

This is true, almost by definition – turnkey providers DO, in fact, perform most the upfront work for you, and deliver you a rent-ready property. While this comes at a cost, it is nonetheless a great model for part-time, passive, and/or out-of-state investors.

However, you must still do your due diligence to be sure the neighborhood and property support your investment goals and strategy. For example, if you’ve decided against C-neighborhoods, don’t buy in a C-neighborhood just because you found a cute turnkey property.

There is some additional peace of mind if the turnkey provider also does property management. This provides greater incentive for them to buy homes that will make good long-term rentals – after all, they don’t want to create a property management headache for themselves.

As for my four turnkey properties, they were in good investment neighborhoods, came out looking great, and have cash-flowed better than expected. They truly were very easy.

I rate this first claim as TRUE.

Turnkey Claim #2:

Cash Flow From Day 1

While turnkey providers often point to this benefit, there are a few important things to note. First, not every turnkey provider will promise to place a tenant before closing. Some will, but others will push to go ahead with closing after the rehab is complete, even if a tenant has not yet been signed. In that case, you’re not truly cash flowing from the starting gates.

Second, the opportunity to “cash flow from day 1” is by no means limited to turnkey properties. There are many occupied rental properties being offered for sale at any given time, both on MLS and off-market. You can “cash flow from day 1” just as easily by purchasing any of these properties.

I rate this claim as PARTLY TRUE.

Turnkey Claim #3:

Lower Maintenance Expenses

This is the first claim I can examine with actual numbers from my portfolio. (I always love it when there is actual data to look at!)

I went back and pulled both Maintenance & Repair costs, as well as CapEx, on each of my properties since I purchased them. Here are the numbers for the “regular” (non-turnkey) properties, alongside those for turnkey properties:

Expenses for NON-TURNKEY Properties

Expenses for TURNKEY Properties

As you can see, the turnkey properties generally fared much better, and were less expensive to maintain. Here are the overall totals and averages by property type:

Based on these numbers, this claim holds up well. My turnkey properties have needed an average of $20 per month per property in repairs, while all my other properties have required $87 per month per property. That’s a big difference – on an annualized basis, my turnkey properties have saved me over $800/year in expenses as compared to my other properties.

I’ll be very interested to come back to this analysis in the years to come, to see how well this holds up over time. I’m pretty confident that it will, at least for the first 5-7 years.

I rate this claim as TRUE.

Turnkey Claim #4:

No CapEx Surprises

As we’ve already seen, this has been true as well for my portfolio: while two of my non-turnkey properties have had major CapEx in the first 1-2 years (a new water heater for $1,125 in one case, and a new HVAC for $2,615 in another), none of my turnkey properties have required any CapEx.

I rate this claim as TRUE (so far).

Turnkey Claim #5:

Higher Rent Potential

Anecdotally, I would argue that my turnkey properties have been easier to rent than my other properties (though I’ve had very little trouble renting any of them.) I’d also say that the turnkey properties get a premium rent because they’re more desirable to renters.

But I always prefer if there’s a way to avoid argument-by-anecdote, and instead use actual data. So I decided to compare each property’s current rent against the Rentometer estimate. (Rentometer is an online automated rent estimator – you can get full rental comp reports powered by Rentometer in the Free Tools section of my site. Rentcast is another great online rent estimation tool, with some great additional features.)

While Rentometer estimates aren’t perfect, this method still provides a single algorithmic benchmark against which to compare. If turnkey properties really do fetch higher rents, then we’d expect the rents on those properties to compare more favorably against Rentometer than the non-turnkey properties.

Here’s what I found:

Rent for NON-TURNKEY Properties

Rents for TURNKEY Properties

While you can certainly see a bit of “noise” in the data – again, I would never take the Rentometer/Rentcast estimate as gospel – the pattern I expected to see is nonetheless quite apparent. It appears as if the turnkey properties ARE fetching a premium rent: on average, my turnkey rentals exceed the Rentometer estimate by 12%, while all my other properties fall 1% short of the Rentometer estimate.

An additional 12% might not sound like a lot, but it’s actually pretty huge — that’s an additional ~$120 in monthly rent per property, or nearly $1,500 per year per property! While this is a small sample size for this kind of analysis, the numbers definitely point in the right direction.

I rate this claim as LIKELY TRUE.

Turnkey Claim #6:

Less Hassle to Manage

I’ve discussed before how important a good property manager is to the success of your rental business. My property manager absorbs the brunt of the work when there is an issue to deal with, so I don’t personally experience many “hassles”, no matter what happens.

Still, I never like to see maintenance expenses come through, and it’s pretty stressful to have a vacant property that isn’t renting. So, when I consider that these turnkey properties have experienced very few repair issues, and have been easy to rent (at premium prices), I’d say it’s still true for me that my turnkeys have been easier to manage than my other properties.

I rate this claim as TRUE.

Conclusion

Turnkey rental properties are very popular among certain types of investor. The model has both proponents and detractors; it makes many promises and receives some common critiques.

How does it all stack up in the end? Here’s a summary of each of the points I’ve discussed:

Based on all this, is turnkey right for you? If you’re not intent on shopping for below-market deals, and you’re looking for an easy path to the long-term benefits of buy & hold rental properties, then turnkey may be a good option for you. My experience, and the data from my portfolio, shows that the turnkey model largely DOES live up to its promises. (At least so far — in a year or two, I plan to update this article with more data and see if that conclusion holds.)

But you definitely have to vet your provider thoroughly. As promised, to close this article here are a few quick tips on how to do this:

Use the Google machine. See if you can find online reviews of the turnkey provider. You can also ask about them in online forums, such as BiggerPockets. Additionally, there are facebook groups devoted to turnkey investing, such as Turnkey Rental Properties, where you can ask for other investors’ feedback on, or experiences with, a specific provider. While online reviews/comments tend to skew toward negative experiences, if you find too many concerning comments, tread carefully.

Ask for references. Ask the turnkey provider for several references of investors who have recently purchased from them. Call those investors to find out what their experience was like. If you find any red flags, or the provider fails to provide references, you should probably keep looking.

Double-check their pro-formas. Is the financial pro-forma accurate? Did they estimate rent conservatively, and include all expenses? If not, be very careful — a fudged pro-forma is a huge red flag.

Watch their prices. While you shouldn’t be afraid to pay full price for a turnkey property, some providers do attempt to charge a HUGE premium (30% or more) over the median home price in the neighborhood. That’s an attempt to pad their profits on the backs of unwitting out-of-state investors. It may be reasonable to pay a 10%-15% premium over an average home in the area, but be skeptical of anything more than that.

Ask about warranties/guarantees. A quality turnkey provider should be willing to back up their work with a guarantee – i.e. they will pay for any issues in the first year (at least) that were part of their rehab scope of work.

Understand their tenant policy. Not all turnkey providers will guarantee to have a tenant placed by the time you close.

Look for providers who do their own property management. This creates a built-in incentive for them to purchase properties that will make good rentals, and to not skimp on the rehab.

Consider a turnkey agent/marketer. This is a person who connects investors to turnkey providers in multiple markets. They may have an informed perspective on which providers are the most reliable and trustworthy.

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.