Monthly Portfolio Report: January 2024

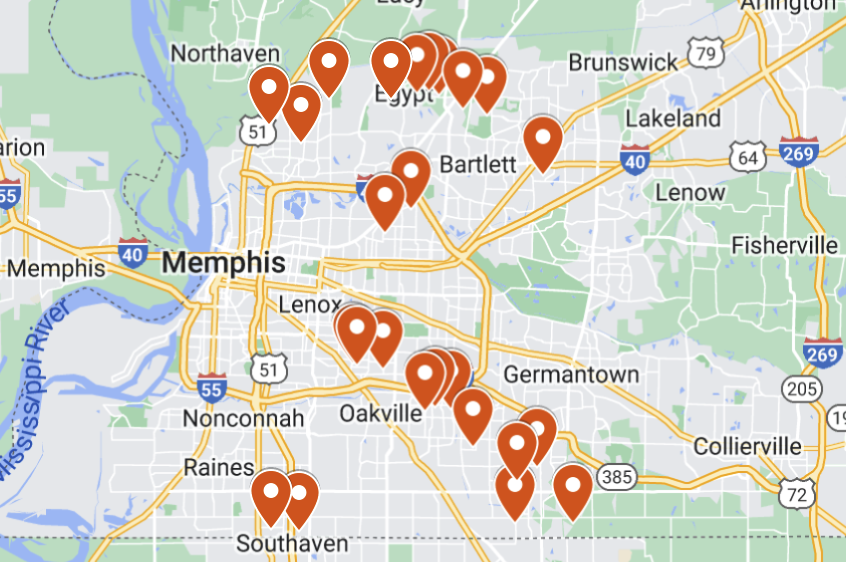

One of my goals with Rental Income Advisors is to be as transparent and data-driven as possible with my readers and my coaching clients. I think the best way to build confidence in a new investor is to actually show the numbers, to prove that rental property investing really does work as advertised.

For those reasons, I publish a monthly report on my portfolio’s performance. I hope that this chronological history paints a clear picture of what it’s like to be a remote landlord. It’s also a great exercise for me to be sure I’m staying plugged in to all my numbers.

Here is the update for January 2024. You can also check out all my previous monthly reports and annual reports.

Property Overview

I still had one vacant property in January, following several turns at the end of last year. But that vacancy (one side of my duplex, Property #18) has been filled, and the new tenant is in place as of February. The new rent is $895 per month, vs. $830 per month that the old tenant was paying.

Still, I won’t be fully occupied in February, because the tenant at Property #13 vacated at the end of their lease on January 31st. That turn scope of work is underway, and I’ll discuss it in a bit more detail next month.

Rental Income

As mentioned in last month’s report, one of my properties paid me double rent in December due to an accounting error, which bolstered my collections rate that month. As expected, I gave that back this month, since I was paid out nothing in January.

Separately, the tenant at Property #23 continues to struggle to make rent, and they are currently under eviction proceedings. They’ve made a few partial payments recently, so I’m still hopeful they’ll be able to right the ship. If not, I’ll have an upcoming turn at this property. That’s all pretty disappointing, given that this was a turnkey property I bought within the last 18 months.

Expenses

This screenshot comes from RentalHero, the online accounting tool I use for my portfolio.

Here are the details around my expenses this month:

Maintenance & Repairs: An unusually quiet month, with just a few small repairs.

Property Management: My PM fees were a bit higher than normal this month because I was charged a leasing fee for my newly placed tenant at Property #18.

Utilities: I paid the full utility bill for the period of vacancy at Property #18. It covered a few months, but was still quite high, which I’m checking into with my PM.

Tenant Chargeback: The negative expense here indicates that a tenant has paid my PM for a previous piece of work that was deemed to be the tenant’s responsibility. When that happens, I get reimbursed.

The Bottom Line

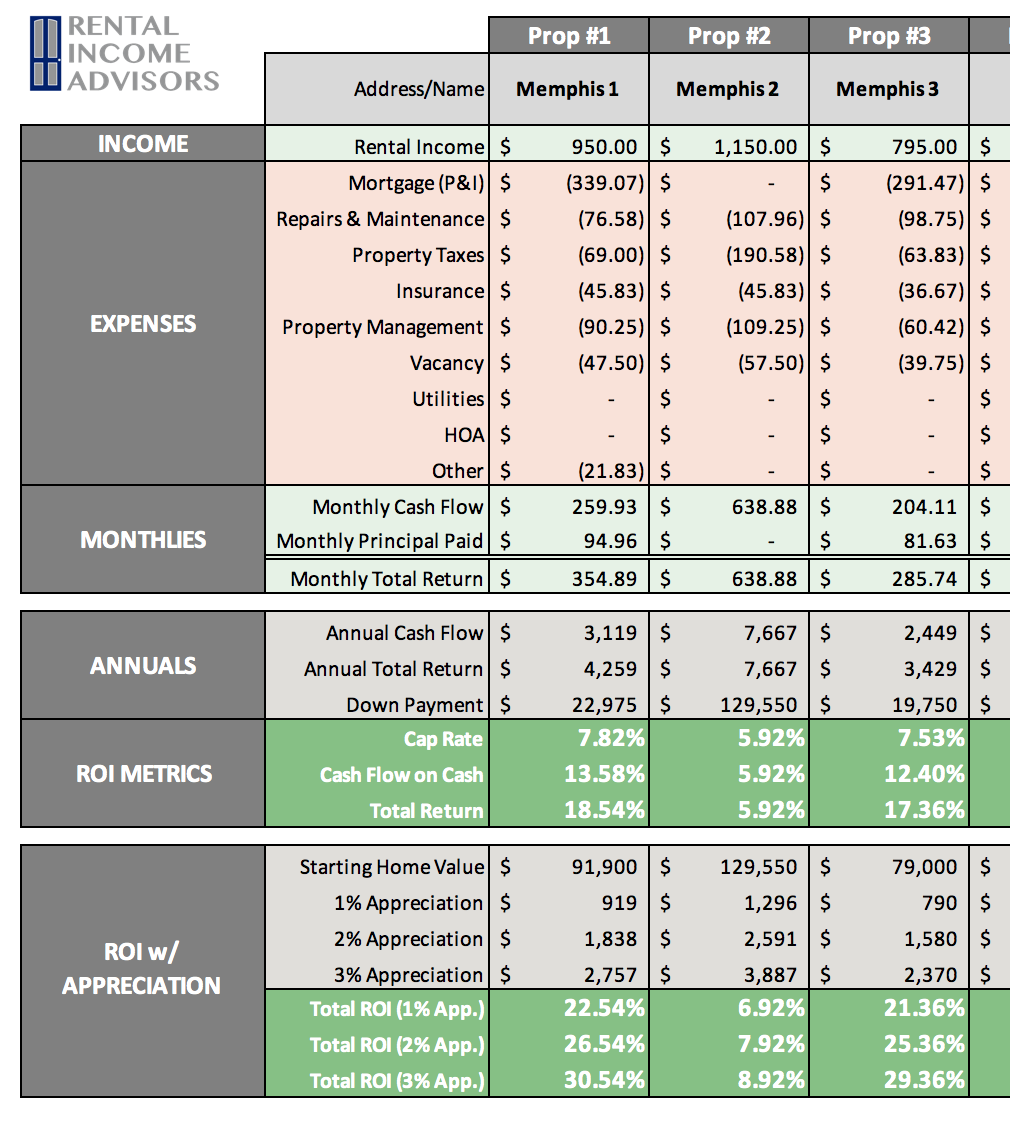

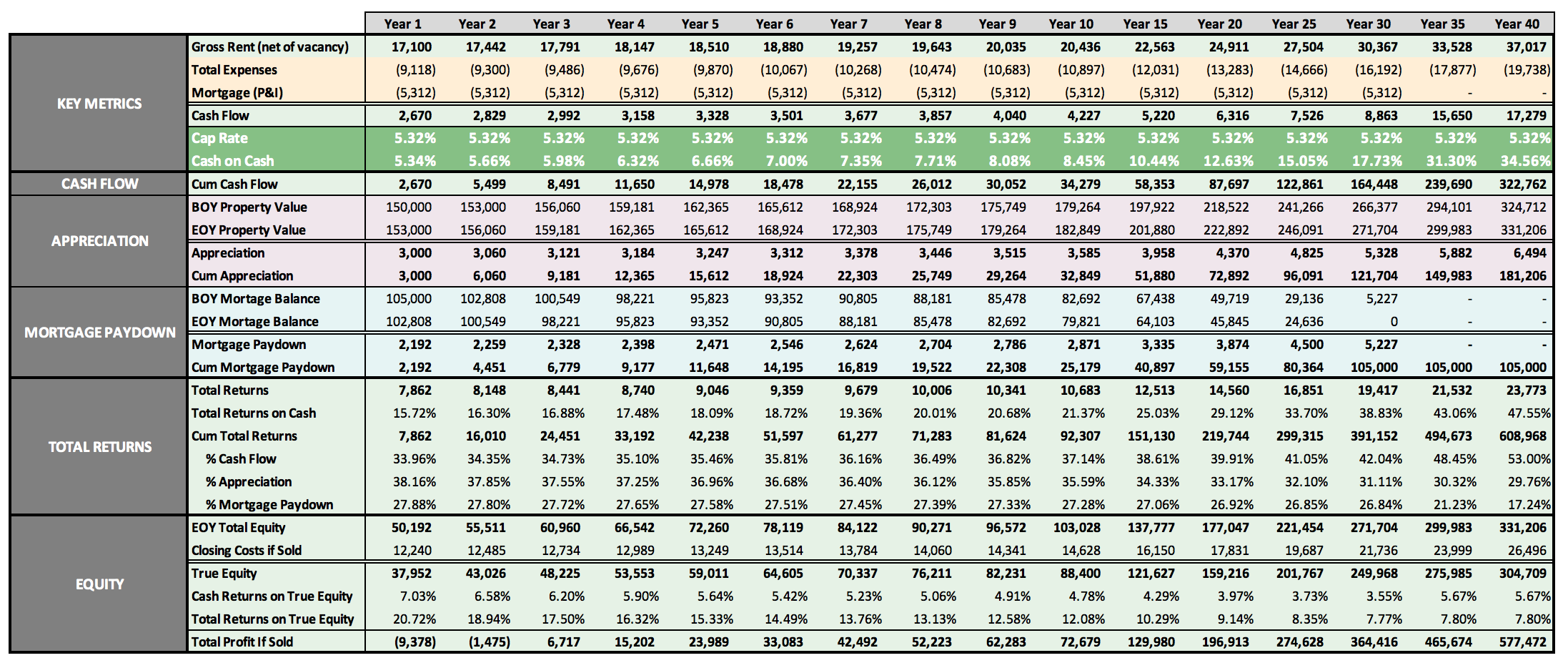

My financial model currently projects my Memphis portfolio to generate $8,863 of positive cash flow in an average month. This month, my cash flow was $10,648, nearly $2K above my projected average. Very low maintenance costs this month more than offset the collections shortfall.

Finally, here’s the running tally and graph I update each month. The dotted blue line indicates my projected average monthly cash flow for my portfolio in each given month. It’s a very solid start to 2024 — though I know February will be the opposite when the turn costs at Property #13 are scheduled to book:

Free Rental Property Analyzer

Need help running the numbers on rental properties? Want to be more confident in your financial projections?

Check out the FREE RIA Property Analyzer. I guarantee this is the most intuitive, elegant, and powerful free tool you’ll find to run the financials on rental properties. I still use it every day, and so do all my coaching clients.

OR

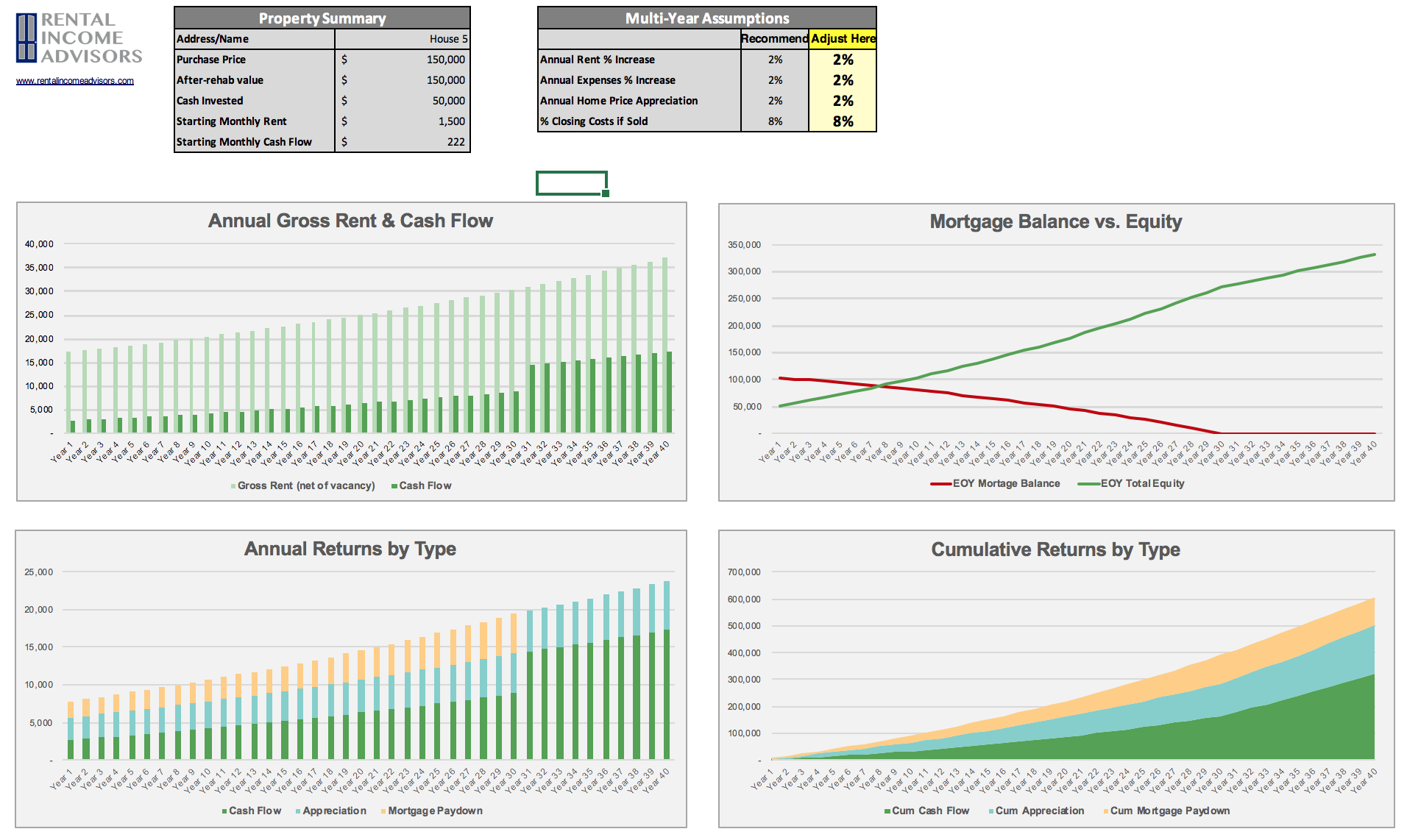

Here’s what the Property Analyzer looks like:

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.