How to Choose the Best Rental Property Markets

There are hundreds of metro areas across the country where investors own and rent homes. Choosing your market(s) is among the most consequential decisions you’ll make as a rental property investor.

But it can be confusing. Just Google “best markets for real estate”, and you’ll see what I mean. There are countless lists published on this topic, all of which use their own (usually opaque) criteria for ranking markets. It’s no wonder so many investors don’t know where to start.

In this article, I’ll attempt to cut through the noise, and lay out the most important factors to consider as you select an investment market.

But first, here are a few things you should NOT consider. Many new investors are misled into believing these things matter – but they don’t:

Historical price appreciation. Remember that you’re not in this for appreciation. (If you are, you’re reading the wrong blog!) And in any case, past appreciation is no guarantee of future appreciation. Cash flow is the cake, appreciation is the icing – and no amount of icing can save a bad cake.

Where YOU would want to live. You’re buying investments, not a future home. You don’t have to live there. (In fact, you don’t even have to GO there.) Don’t make the mistake of thinking that only “hip” places where you’d want to live will make good investments – it just ain’t so.

Local market knowledge. Many new investors are more comfortable investing in markets they know well. But they overestimate the value of this knowledge, and underestimate how much they’re giving up by only considering markets in their backyards. The fact is this: you can get to know ANY market well in just a few weeks – days, if you’re very focused and talk to the right people – so your current familiarity with a given market should not be a factor in your decision.

So what DOES matter when choosing an investment market? I’ll break the discussion into three groups of factors: Financial; Demographic; and the cleverly-named “Other”.

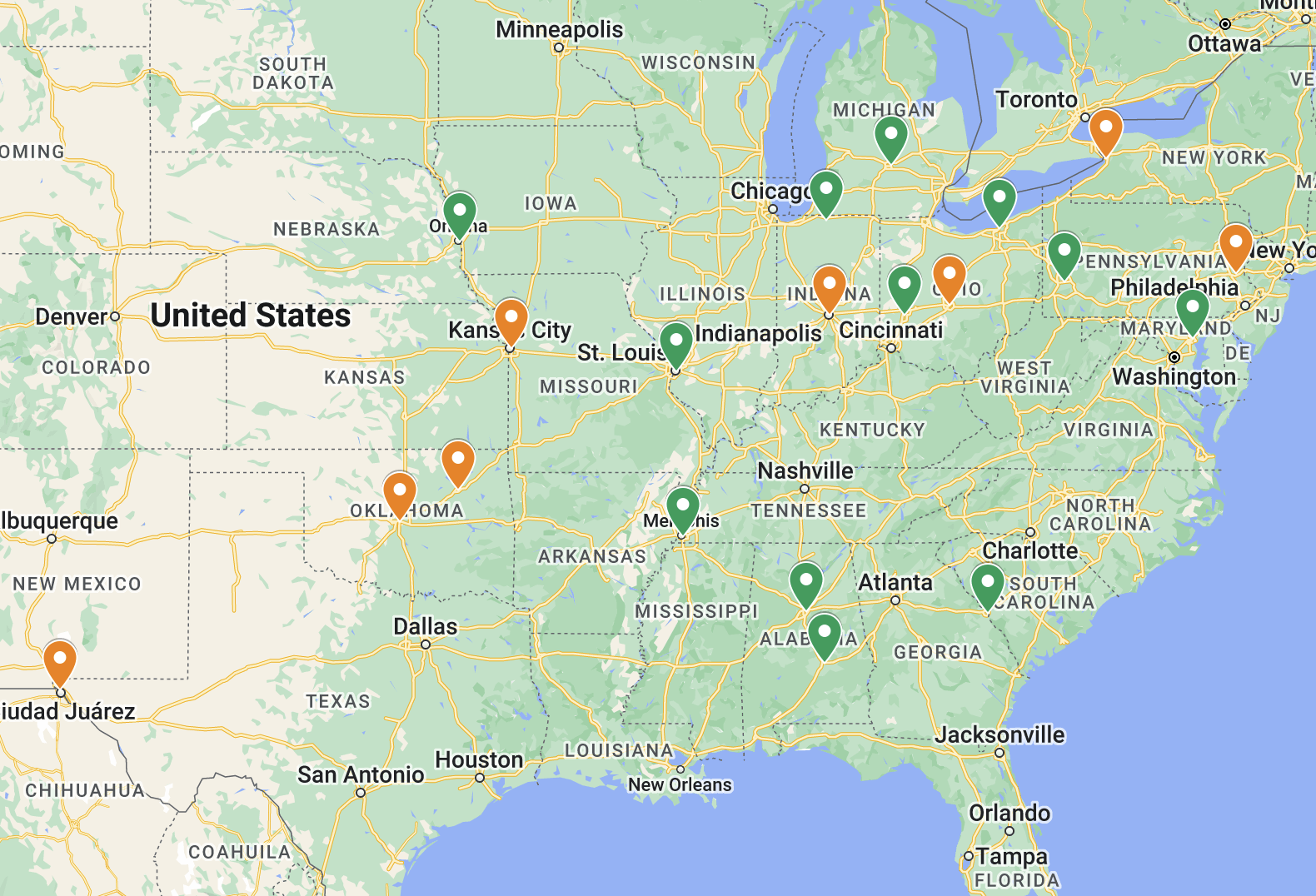

At the end, I’ll combine all these factors to evaluate and compare 10 popular markets for rental property investors: Jacksonville FL; Greensboro NC; Memphis TN; Kansas City MO; Dayton OH; Indianapolis IN; Birmingham AL; Detroit MI; Oklahoma City OK; and Austin TX.

Which market will come out on top? Place your bets now! (You can also check out my article on the 12 Best Cash Flow Markets.)

1 Financial Factors for Rental Property Markets

Price-to-Rent Ratio

This metric uses average home value and average annual rent as a way to gauge the relative affordability of owning versus renting. Markets with low home prices relative to rent are of course more attractive for rental property investing.

I’m listing Price-to-Rent Ratio first because it’s THE most important factor in the success of your rental properties. If the numbers don’t work in a given market, nothing else matters; if the numbers work well, much else can be forgiven.

Let’s take an easy example of the math. If an average home in a given market costs $120,000, and average monthly rent in that market is $1,000, then the price-to-rent ratio is $120,000 divided by the annual rent of $12,000, which yields 10. (Savvy readers may notice that this calculation uses the same two numbers as “the 1% rule” that suggests investors focus on properties where monthly rent is at least 1% of the home price. Following the 1% rule means you’re looking for a price-to-rent ratio of 8.33 or lower.)

A few caveats here. First, understand that these averages for a total metro area provide directional guidance only. There are, of course, neighborhoods in every city that will deviate significantly from the averages, and strong cash-flow deals can be found in all markets. But the overall price-to-rent ratio nonetheless tells you whether those good, cash-flowing properties will be easy or hard to find in a given market, and it’s a reasonable way to compare one market with another.

Also, beware of varying data methodologies when you look up these numbers. In particular, the numbers for a city may be quite different than those for the larger metro area of that city. I prefer to use metro area data for all markets, which ensures an apples-to-apples comparison in light of the varying ways that official city boundaries are drawn.

Where can you find this data on home prices and rental rates? As with so much else these days, the answer is simple: Google it. Nearly every number you want is published online somewhere. But here are a few of the best resources for price-to-rent ratio:

This article summarizes price-to-rent in a range of markets, and seems to be updated periodically

For even more data on a range of markets, I especially love the dynamic chart toward the bottom of this article

For data-savvy Excel types, you can download home and rental price data directly from Zillow Research

Property Taxes

Cities and counties collect property taxes to fund a range of services (i.e. education, health care, sanitation, and the like.) These property tax rates can vary significantly between markets, and those variations can significantly impact your returns.

For example, I enjoy a moderate property tax rate in Memphis – not the lowest, but not too high either. If my property taxes were just 30% higher, this would reduce the TOTAL cash flow of my portfolio over 10%! So these differences really matter.

Property tax rates are usually expressed as a percent of the home’s assessed value per year. For example, a 2% property tax rate means that a home assessed at $100,000 would pay $2,000 each year in property taxes.

When you look up property tax rates for a market, be sure you understand ALL the taxes owed. Depending on the market, taxes can be collected by multiple jurisdictions on the same property (i.e city taxes and county taxes), and/or they can be labeled differently (i.e. county taxes and school taxes). Many jurisdictions have consolidated tax collection to a single entity, who then disburses the funds to the correct recipients – but many have not. Still, all the information you need can be found online in various places, including on the websites of city and county governments.

Though property taxes are specific to counties and cities, this map gives a helpful overview of which states tend to have high and low property taxes:

State Taxes

Though much of your rental income will not be subject to taxation (read more about that here), it’s still nice to invest in a state that has no state income tax. There are currently 9 such states, but only three of them (Texas, Tennessee, and Florida) have markets that are generally considered prime targets for cash-flow investors:

In addition to income tax, states may also charge separate capital gains taxes. This would come into play if and when you decide to sell your properties. The same set of 9 states have no state capital gains tax; the balance of states generally tax capital gains at the same rate as they do ordinary income, ranging from 3% to 13%:

While these state taxes are worth considering, keep in mind that they are FAR less important to your profitability than the prevailing property tax rate in your chosen market.

2 Demographic Factors for Rental Property Markets

Market Size

Investors make money with rental properties in all kinds of markets, big and small. But most investors would do well to avoid markets that are too small – and I would argue that any city under 150K people, or a metro area under 500K people, is too small.

What are the risks with smaller markets? Primarily these:

Smaller availability of homes on the market that would make good rentals, making it harder to build and scale your portfolio.

Lower number of tenants looking to rent at any given time, which could mean longer vacancies between tenants.

Less mature marketing of rental properties (fewer brokers dealing with rentals, tendency for rental listings to be bare-bones with no pictures, etc.)

Less availability of contractor help for repairs, maintenance, turns, etc.

And the most important thing: markets that are too small will not have mature property management companies.

You simply cannot succeed in a remote market without a competent, professional property manager. Small markets tend to have mom-and-pop property managers, and that is absolutely not what you want. Consider this: my property manager has over 3,000 properties, which obviously requires sound processes, investments in technology, and teams devoted to specific functions (such as Collections, Leasing, Repairs, Owner Relations, etc.) If the market you’re considering has no property manager who handles at least 500 properties, that’s a good sign the market may be too small.

Renters vs. Owners

While the size of the market is a good litmus test, it’s really the size of the RENTAL market that matters. For that reason, it’s also good to know what percent of people in your market rent versus own. Markets with a higher penetration of renters are more attractive for investors.

Population Trends

Some experts will tell you to look at job growth in a market, or to understand what industries are driving the economy to ensure a diversified job base. It doesn’t hurt to know these things, but I would argue the simplest and best way to gauge the trajectory of a market is to look at population trends – because if the population is growing, it also generally means jobs are growing, industries are making investments, and so on.

Why does this matter? Markets that are growing are more likely to experience home price appreciation, AND more likely to see rents increase over time. Markets that are shrinking are less likely to experience price and rent growth.

In general, therefore, I recommend investing in markets whose population is stable or growing, and avoiding shrinking markets. Again, this data is readily available from many online sources — though my favorite is Wikipedia, which has in-depth pages devoted to nearly every American city, large and small, including a section on demographics. (Here’s the Wikipedia page for Memphis, for example.)

3 Other Factors for Rental Property Markets

State Tenant-Landlord Laws

State governments set the laws that govern landlord-tenant relations, particularly with respect to eviction. Some states are landlord-friendly, while others are more tenant-friendly. Whatever you think of this in your private life (I’m personally in favor of strong tenant protections), in your “investor life” you’re better off buying in a landlord-friendly state. This primarily comes into play with evictions, but there are also states that have rules governing rent increases, minimum living conditions in your homes, smoke detectors, and other things.

Climate & Natural Disasters

There are two reasons to avoid markets that are prone to natural disasters: first, insurance rates will generally be higher; and second, even with insurance, a major natural disaster that impacts your properties would still be a devastating and costly event for your portfolio.

I don’t see this factor discussed a lot among other investors, but I think it’s worth considering for those looking to buy & hold for the long term. For example, I would personally never choose a market that is prone to earthquakes or hurricanes – and luckily, those markets are reasonably easy to avoid.

Flooding, however, is a risk in many markets. Flooding is rarely covered by homeowner’s insurance — so if you need flood insurance, you have to buy it separately and it can be quite costly. While some markets are more prone to flooding than others, this is very much a hyper-local, property by property consideration. The Federal Emergency Management Agency (FEMA) publishes maps and online tools to help you determine whether your property is at risk of flooding.

Consolidation vs. Diversification

Once you’ve selected a few markets you like, should you buy all your properties in one market (consolidate), or spread your investments across several markets (diversify)?

This isn’t a factor that distinguishes markets from one another, but it is nonetheless an important strategic decision that you will have to make. The benefits of consolidation are operational – a single market to understand, one property manager, and so on. However, some diversification may be sensible to avoid putting all your money into a market that ends up not performing well in the long-run (i.e. low or no appreciation, falling rents, etc.)

Each investor will find their own place on the consolidation vs. diversification spectrum, based on their goals and comfort level. There are no right or wrong answers — though I will say that too much diversification can clearly be wrong. (For example, having 10 homes spread across 10 different markets would obviously be an operational nightmare.)

How Do 10 Popular Rental Markets Measure Up?

Using all these factors, let’s analyze and compare 10 popular markets for rental investors. I picked markets in 10 different states, and tried to include a variety of sizes, prices, and population trends to make the distinctions between markets clear.

This list is sorted by Price-to-Rent ratio, but that doesn’t necessarily mean it’s sorted from best to worst. There are various factors to consider, and there are pros and cons to each market. But based on my personal approach to investing, I would immediately REMOVE the following markets from consideration:

Austin, TX: With a price-to-rent of 19.1, prices have just gotten much too high for cash-flow investing to make any sense here. Texas also has very high property taxes.

Greensboro, NC: Price-to-rent is too high here.

Jacksonville, FL: Prices are too high here as well – and I don’t love the hurricane and flood risk either.

Dayton, OH: The market is a bit too small for my liking, and its population trend (like many cities in the Rust Belt) is not positive.

Detroit, MI: Though the price-to-rent is really attractive, property taxes are very high. Also, Detroit is a market that has struggled for decades with declining population and low investment. Given the low prices, I’m sure there are investors making good money there…but it’s not where I want to be for the long-term.

I think the remaining 5 markets are all good candidates for cash flow investors. But which is best?

Birmingham, AL is the best from a purely financial perspective: it has the best price-to-rent ratio and the lowest property taxes. On the downside, it’s by far the smallest of these 5 cities — but the larger metro area is reasonably-sized, with over 1 million residents. The percent of renters is high, and Alabama is a landlord-friendly state.

Memphis, TN is second-best financially, and also benefits from having no state income or capital gains taxes. The market is large with a lot of renters. Flooding is very rare in most of the area.

The other three markets – Kansas City MO, Indianapolis IN, and Oklahoma City OK – have many similarities. The primary consideration with these markets (vs. Birmingham and Memphis) is that you give up better cash flow in exchange for better population/demographic trends, and therefore a greater chance of future growth in home prices and rents. Oklahoma City has the lowest proportion of renters of any of these markets, but at 41% still exceeds the national average (currently 38%).

So there you have it! An in-depth discussion of the factors that actually matter most to cash-flow investors, and an application of those factors to 10 popular investment markets. You can and should apply the same set of criteria to any market you’re considering.

Now that understand these fundamentals, you can also check out my article on the 12 Best Cash Flow Markets, which does a deep dive on a 12 markets that I believe work best for cash-flow rental property investors.

Once you’ve chosen a good market, the next step is to locate the right neighborhoods WITHIN that market – I dive deep into that topic here.

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.