Single Family vs Multi Family: Pros and Cons for Rental Property Investors

Wherever you are in your real estate journey — just starting your research, making your first offers, or scaling your portfolio — one critical question you’ll need to answer is whether you’ll buy single family or multi family properties. Some investors are exclusively interested in multi family, while others swear by single family as the superior investment. Others build a portfolio with a mix of both styles.

So when it comes to single family vs mutli family properties, what kind of rental portfolio will YOU build — and why?

In this article, I will provide a detailed guide to the pros and cons of both single family and multi family rental properties. This should allow you to consider all the factors relevant to this decision, and build a portfolio that best suits your goals, temperament, and risk profile.

But first, a few definitions and caveats:

A single family home can be a freestanding structure on a lot, but it can also exist in other configurations (such as a townhouse that shares walls with neighbors.)

For the purposes of this article, multi family will refer only to small multi family — that is, properties with two, three, or four dwelling units. I will not consider large multifamily (five or more units), because this is considered a commercial property rather than a residential property. (This distinction changes everything for investors, most critically because conventional mortgages are not available for commercial properties.)

Throughout the article, I will frequently use qualifiers such as “generally”, “typically”, “on average”, and so on. I will describe the most typical features of these two classes of properties as you’ll most often encounter them, but keep in mind that there are always exceptions that prove these rules.

To organize the discussion, we’ll compare single family vs multi family across 11 factors. The sequence of these factors isn’t random — I’ll start with those factors that most heavily favor single family, and end with those that provide multi family the strongest advantage:

Availability

Neighborhood

Resale

Tenant Type

Turn Frequency

Expenses

Appreciation

Rent Potential

Capital Expenditures

Use of Leverage

Cash Flow

And of course, I’ve created a graphical summary of this topic in my patented one-pager format. (Okay, not patented, but still quite useful.) You can download it for free:

OK, let’s get into it!

Factors that Favor Single Family Rentals

1 Availability

Driving through American towns and suburbs, one thing is obvious: single family homes are everywhere. In fact, single family properties make up nearly 75 percent of all housing units in the United States.

But let’s break that down further. Out of the approximately 130M housing units in the country:

90M are single family

8.5M are in small multi family (2-4 unit properties)

31.5M are in large multi family (5 or more units)

Even if all those small multi family properties were duplexes, that’s at most 4.25M of those as compared to 90M single family homes. Said another way, single family homes are more than 20 times as ubiquitous as small multi family.

And in certain markets, it can be even more skewed. Generally speaking, newer markets — those primarily built since World War II — will have a greater percentage of single family homes than markets that were built out earlier. That’s why your decision about single family vs multi family can actually impact your choice of investment market: for example, Cleveland, a city that experienced rapid growth prior to the mid-20th century, has a much higher penetration of multi family properties than my investment market of Memphis, which had most of its growth more recently.

It’s a clear advantage to have more inventory available in your chosen class of property. And this isn’t just hypothetical, I see this in practice as well: among my private coaching clients who decide to focus exclusively on multi family, it’s common for them to struggle to find enough good buying opportunities to scale as quickly as they’d like. Those who are keen on quads (four-unit properties) have an even tougher time, because these are especially rare in most markets.

So based just on availability, single family is much preferable to small multi family, because there are a lot more deals available at any given time, and it’s much easier to scale with single family as a result.

Here’s that summary in graphic form, if you prefer:

2 Neighborhood

Because single family homes dominate the overall housing inventory, there are of course single family homes in all kinds of neighborhoods — A through D, luxury and not-so-luxury. (Here’s my article on rental property neighborhoods if you want further information on that topic.)

In general, multi family properties are clustered in middling to poor neighborhoods. (The notable exception to this rule is dense, expensive downtown areas in some markets that have high-priced condo buildings — but those aren’t the types of neighborhoods in which cash flow investors are buying anyway.) And even within the same neighborhoods, clusters of multi family properties will tend to make those blocks less desirable than nearby blocks with single family homes.

Based on this, we have to give the overall neighborhood advantage to single family:

3 Resale

Many cash flow investors aren’t too concerned about reselling their properties, because their strategy is to hold the properties for the long term — at least a decade, and in many cases much longer. I certainly intend to keep my rental portfolio for many decades. (Some investors take it all the way, and subscribe to the “buy ‘til you die” strategy, which lets them benefit from the cash flow during their lifetimes, and then pass the properties on their kids or heirs tax free. This is just one of the many tax advantages of rental properties.)

Nonetheless, since real estate is not a liquid asset, the need to resell them at some point in the future is a factor worth considering. And when it comes to reselling, a single family home is easier to offload. This is due to the pool of buyers: both owner occupants and investors are potential buyers of single family homes, but multi family properties will only draw investor interest. While investor activity in the housing market has been increasing over the past few decades, they still represent only ~15% of residential property purchases. Plus, those investors tend to be more analytical and patient, since they’re motivated by profit and will always negotiate hard to get a better deal.

Therefore, if you ever do have to resell your rental property, you’d rather have single family:

4 Tenant Type

Now let’s think about the types of tenants that these two classes of properties will attract. Here, as elsewhere in this conversation, I’ll be talking about averages and generalities — all types of tenants live in all types of properties, but it’s good to understand the types of tenants your rental property is more likely to attract.

Compared to multi family properties, single family homes tend to be larger, have more bedrooms, have significantly more yard space, and of course have more privacy. Picture a tenant who wants more living space , more bedrooms, a bigger yard, and more privacy — who do you think of? Probably you thought of a family.

And you’d be right. Those who rent single family homes are more likely to be married, and more likely to have kids. As a landlord, you generally like it when your tenants are families. Families are more likely to treat a rental house as their home. They’ll also move less frequently, reducing your long-term costs to turn the property between tenants. Data also shows that single family renters have higher incomes on average than multi family renters.

When it comes to finding the best tenants, then, you are (on average) better off with single family properties:

5 Turn Frequency

Because tenants in single family homes are more likely to be families, and more likely to have kids, they also tend to plant deeper roots in their communities — through schools, sports, religious organizations, and more. That means longer average tenancy.

This is a big deal when it comes to controlling costs associated with your rental properties over time. As detailed in my annual portfolio reports, turns are extremely costly, so avoiding them will save you a lot of money in the long run. Over the last several years, I have been turning less than 20% of my single family properties per year, which implies an average tenancy of over 5 years — which is excellent.

Single family has the advantage over multi family in this facet as well:

6 Expenses

All rental properties, whether single family or multi family, share a common set of expenses, including:

Maintenance & repairs

Property taxes

Home insurance

Property management fees

In single family homes, all other expenses are borne by the tenant, including utilities, lawn care, snow removal, pest control, and more. So it’s relatively easy to estimate your expense structure and build a financial pro forma for a single family home.

Multi family properties, by contrast, may come with other liabilities for the owner. What costs the owner is responsible for will vary by market and by individual property, but might include:

Utilities for common areas

All utilities, if units are not separately metered

Heating oil

Lawn care

Snow removal

Government/legal fees, registrations, and/or inspections

To correctly estimate these costs, it’s critical to get a full profit & loss statement from the previous owner, so that you’re not surprised down the road by expenses that you didn’t realize were your responsibility.

(BTW, I have an awesome free Rental Property Analyzer that makes it easy to build financial pro formas for your target properties. It’s available as a free download, or you can watch the demo video.)

So — when it comes to overall expenses, single family homes are simpler and cheaper (on average) than multi family properties:

Factors Where Single Family and Multi Family Are Equal

7 Appreciation

Both single and multi family properties can experience “forced appreciation”, wherein you improve the property in order to increase its resale value. Forced appreciation is what drives profits for a house flipper, and explains why turnkey properties are more expensive than ones in poorer condition. Of course, if a given property is already in fairly good shape, there won’t be much forced appreciation to capture, so this is highly property-dependent.

When it comes to market appreciation, though — the increase in home prices over time based on inflation, supply & demand, etc. — these property categories behave differently. Single family homes generally ride the wave of broader market appreciation, which can be good or bad depending on external circumstances and market conditions. On the other hand, multi family valuations aren’t necessarily subject to the same market forces; instead, the value of these properties is largely dependent on rent potential and profit potential, since these strongly influence what an investor is willing to pay for the property. Again, this can be good or bad as compared to single family homes, depending on timing and market conditions.

Appreciation is therefore a draw between the two property categories:

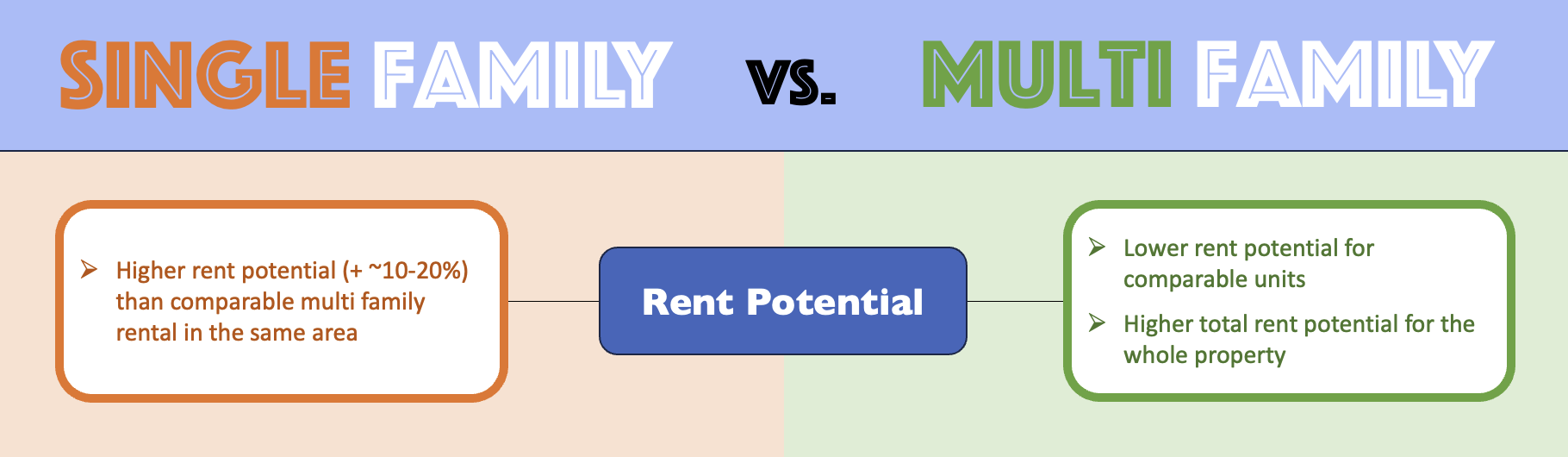

8 Rent Potential

Let’s say you owned a 3 bedroom, 2 bathroom home that could fetch $1200 in monthly rent. Then you found a duplex a block away with the same 3 bed/2 bath configuration in each unit, the same finishes, the same square footage, etc. Would you be able to get $1200 in rent for each side of the duplex?

You would not. You’d probably only be able to get ~$1000 in rent for each side. This is because units in multi family properties are less desirable, and therefore have lower rent potential, than comparable single family homes in the same area. (Further reading: Estimating Rental Property Income.)

However, the overall rent potential for that duplex would still be $2,000 per month, which means that it could have a big advantage over the single family home — depending, of course, on the relative purchase prices and expense structures between the two properties.

Rent potential cuts both ways, then, so we’ll call this one a draw as well:

Factors that Favor Multi Family Rentals

9 Capital Expenditures

The last few factors I’ll discuss are those that favor multi family properties. Let’s start with capital expenditures (CapEx, for short).

CapEx refers to large-ticket replacement items that improve the value of the home, such as a new roof, new HVAC unit, new kitchen cabinets, new flooring, and more. Both types of properties will incur these capital expenditures over time, but multi family properties have a slight advantage if those CapEx items are shared between units. For example, if you have to replace a roof for $10K, it’s more cost-efficient if that $10K is split across multiple units that generate higher overall rents than a comparable single family home.

Unfortunately, the savings usually end there, because most multi family properties do not share any other CapEx items except for the roof. For example, each unit will usually have its own HVAC unit, furnace, and water heater, and of course its own interior finishes.

Still, multi family properties have a slight advantage here:

10 Use of Leverage

The ability to use mortgages is one of the most important advantages that rental property investing has when compared to other types of investing. The power of leverage is hugely consequential to your overall returns — so much so that I wrote an in-depth article (The Magic of Mortgages) on that topic.

However, due to Fannie Mae/Freddie Mac rules, individual investors can only get TEN conventional mortgages (or twenty for married couples if both spouses can individually qualify.) While there are other ways to use leverage after those ten loans are used up, conventional mortgages are still investors’ “golden tickets”, as they provide the most favorable rates and terms of any loans.

Therefore, any strategy that increases the impact of those conventional mortgages is bound to be pretty valuable. Multi family properties do just that: you still get a single mortgage for a small multi-family property, which allows you to scale your portfolio to a larger number of units before exhausting your ten “golden tickets”. Instead of ten single family properties, for example, you could theoretically have up to 40 units using those ten mortgages (if you can find ten quadplexes, which as I discussed earlier would probably be a huge challenge.)

Multi family properties offer another advantage when it comes to leverage: the ability to get a low money-down loan, such as an FHA loan. Unlike a typical investment property loan that requires at least a 20% down payment, an FHA loan has a minimum of 3.5% down. However, this loan is only available if you’re going to live in the subject property, so it doesn’t offer much help for single family rental investors. But if you’re willing to live in one unit of a multi-family property and rent out the other units — a strategy called “house hacking” — then the FHA loan is available to you, and can be a big advantage especially to investors who are just starting out and don’t have a lot of cash saved.

In summarizing the important topic of use of leverage, multi family properties have some distinct advantages:

11 Cash Flow

Last — but CERTAINLY not least — is cash flow. In truth, cash flow might be the most important of all the factors discussed in this article. A high rate of cash return is the primary motivator for many real estate investors, since it is the engine of the increased freedom and flexibility that they often crave. For example, it’s what allowed me to leave my corporate career at age 39 and begin a new phase as a writer and real estate coach.

So cash flow is a big deal. And when it comes to cash flow, multi family properties can have a huge advantage. Of course, this depends on the specifics — for example, the price of the property, its rent potential, and the expense structure as discussed above. But it’s fair to say that multi family properties have greater cash flow potential on average when compared to single family.

My portfolio supports this idea. At the time of writing, I have 24 single family homes and only one multi family property — a duplex I purchased in 2020. (It’s Property #18, if you want to check out all the details.) That duplex is by far the biggest cash cow in my portfolio, producing over $12K in net cash flow the last two years, and it has the highest current cap rate (9.9%) of any of my homes.

While not all multi family properties will be cash cows, they certainly have better potential for huge cash flow:

Conclusion

After considering ALL these factors, does single family or multi family come out on top? Which one is better?

My belief is that they’re both very good, and both provide access to the enormous financial benefits of rental property investing — namely cash flow, mortgages, and tax advantages. Each has distinct pros and cons. So the real question is which one is better for YOU. Hopefully this article provides a useful structure for you to consider that decision in your own portfolio. (Want more help from me with rental property investing decisions? Schedule a free coaching consultation.)

As for me: my portfolio consists mostly of single family homes. I do like the advantages of single family, but actually this is mostly the result of inventory and availability: particularly in Memphis where I invest, multi family properties are quite scarce, and I wanted to scale my portfolio quickly out of the gates. This meant that single family homes were the easiest path, but I certainly wouldn’t mind if I had more multi family in my portfolio. They’re both great!

Finally, here is that one-pager graphic one more time, and the link to download it for free:

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.

Free Rental Property Analyzer

To evaluate single family vs multi family properties, you need to be able to run numbers like a pro. That’s why a well-designed rental property calculator is the most important tool an investor has. It allows you to quickly calculate key metrics and understand your cash returns on a target property. You can also answer questions like:

How much do your cash-on-cash returns improve if you use a mortgage vs. paying in cash?

What will your average monthly cash flow be?

How will your returns change in future years?

Those questions can be easily answered with side-by-side comparisons in the RIA Property Analyzer. I guarantee this is the best free rental property calculator out there today, and many of my readers have told me the same. It’s both powerful and very simple and intuitive to use. Check it out!