Monthly Portfolio Report: November 2020

One of my goals with Rental Income Advisors is to be as transparent and data-driven as possible with my readers and my coaching clients. I think the best way to build confidence in a new investor is to actually show the numbers, to prove that rental property investing really does work as advertised.

For those reasons, I publish a monthly report on my portfolio’s performance. I hope that this chronological history paints a clear picture of what it’s like to be a remote landlord. It’s also a great exercise for me to be sure I’m staying plugged in to all my numbers.

Here is the update for November 2020.

Property Overview

I continue to be fully occupied this month — nice!

However, I did have one tenant (at Property #13) unexpectedly break their lease at the beginning of December. He came into my property manager’s office with his keys and said he had to break the lease for personal reasons. I appreciate that he was upfront about this, and I hope he left the property in decent shape (I am waiting for the turnover Scope of Work from my PM). Due to the lease break, the tenant forfeits his security deposit, which in this case was 1.5x monthly rent — so I have 6 weeks to re-rent the property before any effective income from the property is lost. I will probably also be able to raise monthly rent by ~$100, because the previous tenant was below current market rent. I’ll provide an update on this situation in next month’s report.

Also, I successfully closed on Property #18 (indicated by the red pin on this post’s thumbnail image). This is my first duplex! One side is occupied, and the other side needed a rehab, which is now underway. I’ll include this property’s monthly numbers starting in next month’s report, and I’ll also write a future post diving into the detailed financials on this property (similar to what I did for Memphis Property #17.)

Rents

Fully collected this month, with one tenant a few dollars short.

As I mentioned in last month’s report, I had a few more tenants than normal pay late in November, but all tenants eventually paid by mid-month. The same trend continued in December. I’m hoping that Congress agrees on an additional aid package to help people who may be struggling due to the economic disruptions of the pandemic, which has surged to scary record levels all over the country, including in Tennessee.

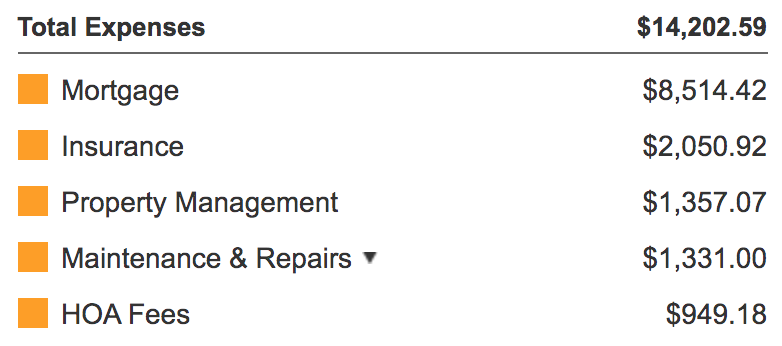

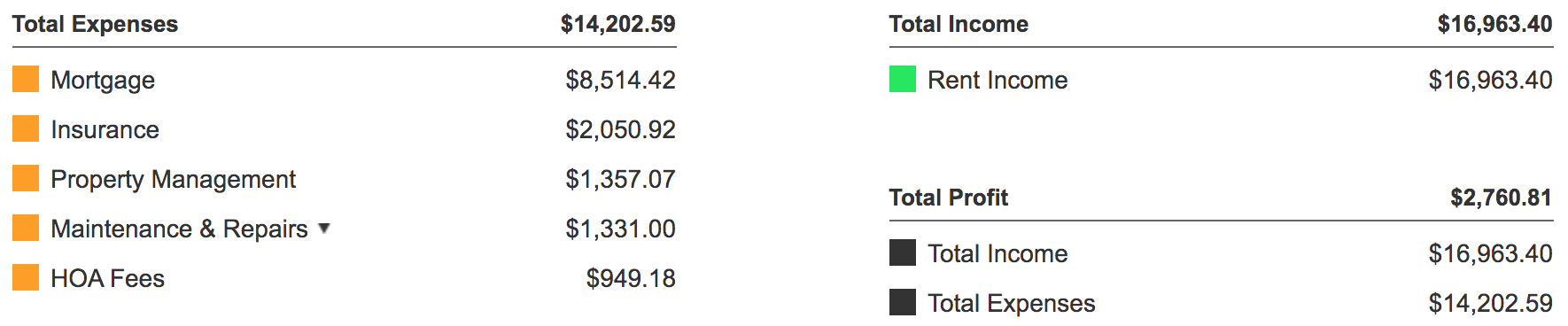

Expenses

After a remarkably good month in October, the month of November had a few special expenses:

Insurance: For my mortgaged properties, insurance and property taxes are paid out of escrow, so those costs are baked into the “Mortgage” category. But for the three properties I own outright, I have to pay those bills directly. The $2,050 here represents the annual insurance premium on those three properties, plus the first annual insurance premium on Memphis Property #17, which for complicated reasons was not collected at closing a few months ago. (In the future, that will be paid out of escrow as well.)

HOA Fees: There is one house in my portfolio that has a neighborhood Homeowners Association. (This is rare in Memphis, but some of the nicer neighborhoods have them, primarily to pay for parks and beautification.) Over a year ago, I tried and failed to locate the HOA online so I could pay my bill. I gave up, and figured they would find me eventually — which they recently did, in the form of a not-so-friendly collections letter. (I had never even received a bill!) Anyway, I talked to them and negotiated down the late fees, but I still owed $949, which covered two full years of the HOA charge plus those fees.

Maintenance & Repairs: My financial model budgets over $1,400 per month in maintenance & repair costs, so $1,331 is about on target. The biggest expense was replacing a wooden fence at one property, but I also had to replace a kitchen sink, fix a toilet, and repair an electrical breaker box. One interesting note: two charges worth nearly $200 were categorized by my property manager as “tenant chargebacks”, which means the tenant will be responsible for the charge, and I will eventually be refunded those amounts. In once case, this happened because the tenant was not home at the time of a scheduled maintenance visit; in the other case, it was the cost to fix a clogged drain, which according to my PM’s lease is the tenant’s responsibility. I’ll book these as “negative maintenance charges” when they are eventually credited to my account, which will happen when the tenants actually make their payments.

Mortgage: This is the first month that includes the regular mortgage payment for Memphis Property #17, so this month’s mortgage total will be the new regular amount.

The Bottom Line

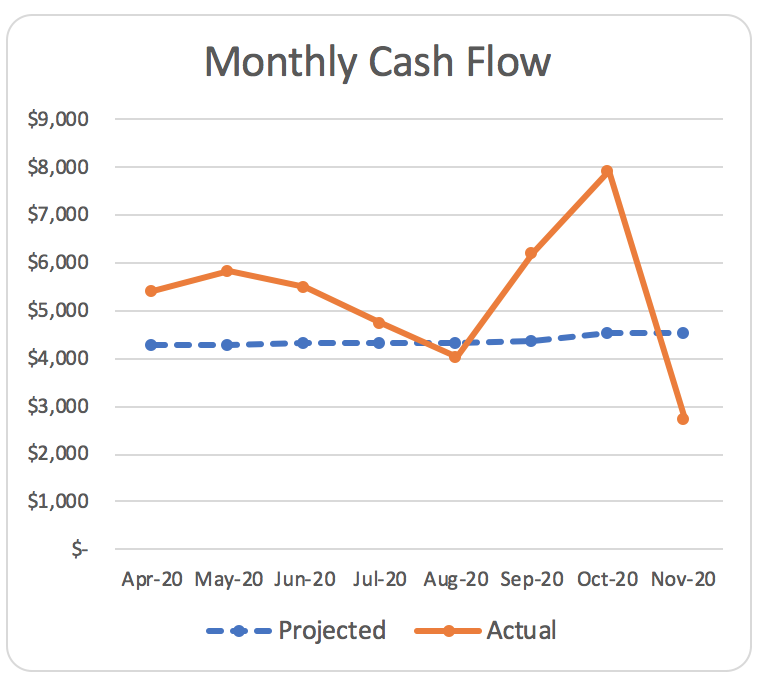

My financial model projects my Memphis portfolio to generate $4,542 positive cash flow in an average month. In November, the positive cash flow was only $2,760, nearly $2K below that average. This was primarily the result of those one-time charges for insurance and HOA, which totaled $3K — though this was offset somewhat by my 100% occupancy and collections. (Recall that in any good expense model, there is a budget line item for vacancies, so any month with zero vacancy results in a “bonus” vs. those projections.)

Finally, here’s the running tally and graph I update each month. You can see that this month fell well below my projected average monthly cash flow, as indicated by the dotted blue line. But there have been many months this year above the projected average, so statistically you would expect there to be some lower months as well.

Free RIA Property Analyzer

Need help running the numbers on rental properties? Check out the FREE RIA Property Analyzer. I guarantee this is the most intuitive, elegant, and powerful free tool you’ll find to run the financials on rental properties.

Here’s what the Property Analyzer looks like:

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.