Monthly Portfolio Report: July 2020

One of my goals with Rental Income Advisors is to be as transparent and data-driven as possible with my readers and my coaching clients. I think the best way to build confidence in a new investor is to actually show the numbers, to prove that rental property investing really does work as advertised.

For those reasons, I publish a monthly report on my portfolio’s performance. I hope that this chronological history paints a clear picture of what it’s like to be a remote landlord. It’s also a great exercise for me to be sure I’m staying plugged in to all my numbers.

Here is the update for July 2020.

Property Overview

Back to full occupancy this month, and no vacancies on the horizon. Huzzah!

Rents

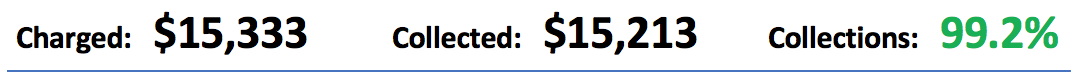

First, my rent charged is a bit lower this month. This is because of the partial month collected from my new tenant who signed a lease as of mid-June.

Of the rent charged, I was more than 99% collected — just one tenant was a bit short.

As for the Covid-19 pandemic, the story continues to be the same this month: the pandemic has so far not had any noticeable impact on my tenants’ rent payments. This has been something of a relief, as I was concerned earlier in the spring that the impact would be greater.

Expenses

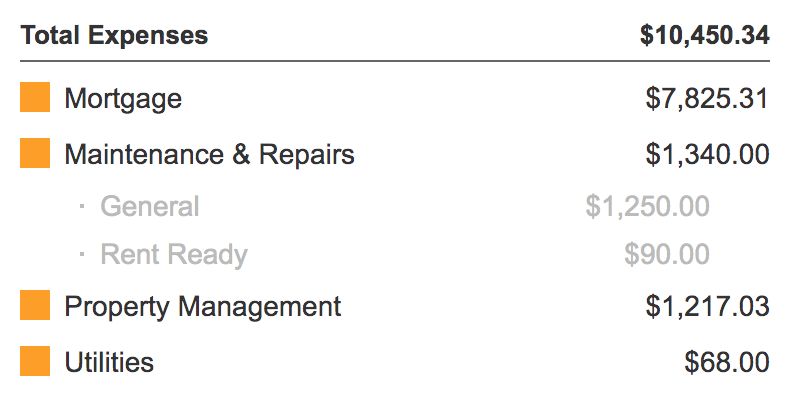

A few explanations for expenses this month:

Mortgage: This monthly amount is still settling out as a number of my loans go through their annual escrow re-evaluation. I had a few more escrow refund checks this month, which lowered the amount a bit. I expect next month’s mortgage amount to be back to the “new normal”.

Maintenance & Repairs: Typical amount of maintenance work this month, including a few HVAC service visits (which is typical in mid-summer). I also replaced a toilet. The $90 in “rent ready” expenses were two $45 charges for lawn-cutting from my most recent vacant property. As I discussed in my article on what a property manager does, this is a service PMs commonly provide for vacant properties.

Utilities: The $68 charge was the final utility charge from that same vacancy. My property manager similarly takes care of those utility account transitions during a vacancy, and passes the bills on to me.

The Bottom Line

My financial model projects my Memphis portfolio to generate $4,329 per month in positive cash flow. In July, the positive cash flow was $4,762, which is $400+ more than expected. I was helped out my the mortgage escrow refund checks, as well as by having no vacancy. (Recall that in any good expense model, you have a budget line item for vacancies, so any month with zero vacancy results in a “bonus” vs. your projections.)

Finally, here’s the running tally and graph I update each month. I’ve had four good months in a row, but I’m not fooled: below-average months will inevitably come. But the picture looks very nice right now!

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.